Middle class do worse in current economic recovery – median household income falls faster during recovery than during recession. S&P 500 up 77 percent in recovery while home values are neutral or down in many areas.

- 1 Comment

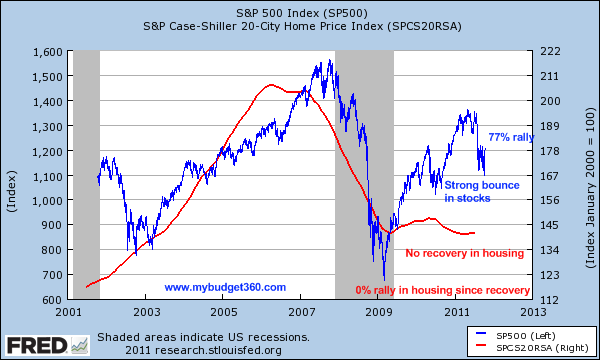

Some incredibly disturbing data was released this week showing the continuing crushing body blow to the American middle class. What was striking was that middle class incomes have fallen faster during the supposed recovery from June 2009 to June 2011 than they did in the actual recession from December 2007 to June 2009. Why? First, the recovery has largely occurred with the top one percent where much of their wealth is derived from the stock market. The market has rallied significantly from the lows in March of 2009. Yet the vast majority of Americans, those with any net worth, draw a large part of their true wealth from home equity. The housing market is still mired in problems and never experienced any sort of recovery and in fact, is aiming for a second leg down. Two charts highlight this dramatic predicament.

Middle class families take a larger hit during the economic recovery

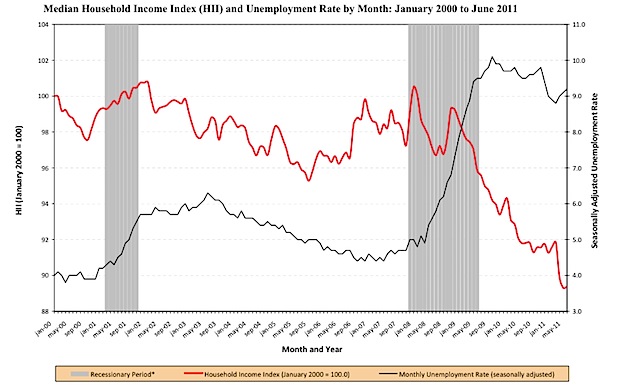

This chart is probably one of the more telling charts I have recently seen:

Source:Â Sentier Research

And then the jaw dropping data:

“Real median annual household income has fallen significantly more during the economic recovery period from June 2009 to June 2011 than during the recession lasting from December 2007 to June 2009.â€

The pressing question is why did this happen if we are supposedly in a recovery? Again, the answer is that most Americans do not derive their wealth from the stock market. The top one percent has largely benefitted from this economic bailout recovery. Ironically it is the middle class that is bailing out the financial system so profits can be redistributed back to the top. Do we need any more proof?

Some more information:

“During the recession, real median annual household income fell by 3.2 percent, from $55,309 in December 2007 to $53,518 in June 2009. During the economic recovery, real median annual household income fell by an additional 6.7 percent, from $53,518 in June 2009 to $49,909 in June 2011.â€

So overall household income has fallen by roughly 10 percent since the start of the recession in December of 2007. To reiterate the grim reality we have to look at the biggest line item for middle class wealth, housing and compare it to the largest line item for the top one percent, stocks:

Since the recovery hit the S&P 500 is up 77 percent while housing values are neutral or even down in many areas. Sort of puts the entire game in perspective.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Xavier said:

This is the reason for the “Occupy Wall Street” protests nowadays.Top 1 % have been provided bailout and every kind of possible support by Government.But it is the middle class which has to bear the burnt of this recession.The same thing is going on in most of the capitalistic countries.In Europe also it is the poor countries which are asked to bailout rich countries.

October 17th, 2011 at 3:59 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!