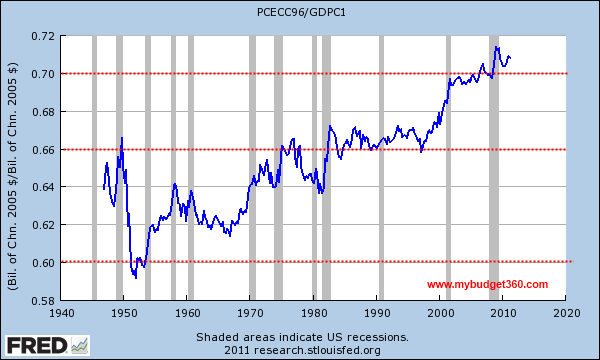

The wonder years – over 70 percent of GDP comes from personal consumption. For the past decade home equity and credit from other sources fueled growth because of falling household incomes. What happens when credit contracts and home equity evaporates?

- 3 Comment

In a debt based economy a credit crisis is similar to an uncontrollable virus spreading from house to house. The slow infection hibernated for decades until it went into a pandemic. It is troubling to see how the middle class is slowly being dismantled. However there is one silver lining of the home price correction. Americans spend most of their money on housing as we will highlight later in this article. The media never bothers showing a detailed budget to Americans since the average per capita income is $25,000 and they don’t want to scare off people from purchasing that new trinket. Over 70 percent of our annual GDP comes from personal consumption expenditures. We are a spending nation but for the last decade, much of that spending came from the phony equity brought on by the housing bubble. Inflated home values really only benefit the banks at this point in time. With smaller incomes Americans would receive an automatic boost if they spent less of their smaller paycheck on housing. With credit contracting and home prices moving lower, there is little reason to believe that we will suddenly see a resurgence of debt based spending.

Where the average American consumes

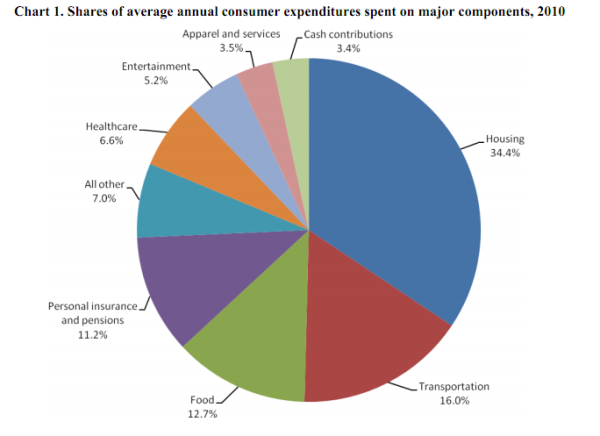

The Bureau of Labor and Statistics recently released a chart detailing where most Americans spend their money:

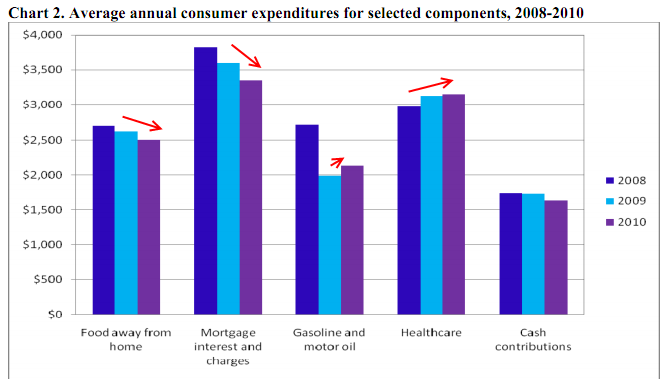

Housing by far is the largest line item. Yet with home prices moving lower, Americans can stretch their budgets further since the last decade they saw real incomes fall. Yet this is not entirely good news since education, transportation, and healthcare are largely consuming this new found money. If we look at a core item in housing, that of mortgage interest and charges, Americans are spending less and less since 2008:

Source:Â BLS

The above is like a short story of the recession. Americans are eating out less because they are largely poorer. However, because of the housing bubble popping, families are paying less on housing. The recession caused energy prices to crash from 2008 to 2009 but they are back up in 2010. Healthcare costs have moved steadily up. In the end the middle class is still feeling the extreme pinch of this recession.

The wealth effect of home equity

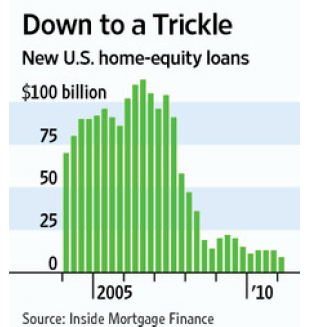

Many Americans must have thought they hit the housing lottery when every week, multiple offers in the mail were being sent to tap out home equity. Some companies were so brazen as to send checks only needing a signature and an instant $50,000 was given to you. Of course, this placed a second mortgage on your home but it must have felt like El Dorado was finally discovered and it turned out to be in your very own home. Many Americans were yanking hundreds of billions of dollars from their home to purchase cars, vacations, gadgets, and upgrades to their homes. Wall Street banks have convinced global investors that a toxic dump property was truly worth half a million dollars. Trust us they said, we are from Wall Street! The con was largely played by those addicted to debt and investment banks addicted to greed. Yet the prudent middle class was appalled and did not partake in this excess although they bailed out the investment banks. Many of those that largely gambled have lost their home or have had their luxury vehicles repossessed. Do you think those top investment bankers have had their yachts taken back?

Looking at home equity evaporating was like watching part of the fuel moving the economy run out:

Source:Â WSJ

Home equity loans are now like spotting a bald eagle in the wild. They are a small segment of the market. For over a decade the consumption machine, remember over 70 percent of GDP, was running on nitrous oxide home equity loans. Our GDP has stalled but consumption is still a large part of our economy:

This is a big problem. This is what happens when you spend money you don’t have and build an economy around that. Look at economies like Greece for example that are at the extreme end of spending with no adequate income generation. What is unsustainable will eventually face a stiff correction. The world is facing a peak debt crisis. Consumption is still over 70 percent of our economy. Some of the best growth and stability for the United States happened in the 1950s and 1960s. Why? The middle class was strong and we actually exported a large share of our goods. Since the 1980s we have pretty much put out the charge card, allowed Wall Street to turn our economy into a casino, and let the spendthrifts and investment bankers dictate where the nation went. The vast majority of people did not have a say in this mess yet here we are.

Where do we go from here?

China is experiencing some of the opposite problems. They suffer from low internal consumption. Their large growth has come from investments but as we have seen, you have some 60 million empty apartments. Building for the sake of boosting GDP is just as bad as spending money you don’t have. In this hyper financialized system some medium needs to be reached yet it is likely that we will have to have another meltdown before real changes occur.

First, there needs to be separation from investment and retail banking. There is no doubt that we need a well run financial system. However, comingling this with greedy graft prone investment bankers is like giving a Ferrari to a 16 year old kid. If a hedge fund manager wants to gamble all his capital let it be but no bailouts were ever be made. Period. With the too big to fail we have taught the banks that no risk is too big since the government (aka the taxpayers) will be there to back them up. While the media rants about a few billion here or there on lightning rod topics, the true robbery has occurred with the Federal Reserve bailing out the top banks with trillions of dollars. That is right, trillions of dollars.

Second, we need to assume that there is not going to be massive growth moving forward:

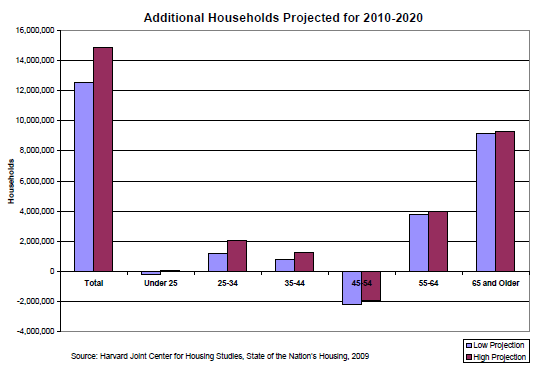

The above chart shows expected growth of households from 2010 to 2020. This projection was made in 2009 by the Harvard Joint Center for Housing Studies. The low projection was for roughly 12,000,000 households to be added over the next decade (a rate of 1.2 million per year). They are already off. The 2010 Census shows that only 500,000 households were added last year. So even the above low projection is off. In other words, housing values are likely to go lower in the next few years and that home equity spending machine is not likely to be back.

What the above chart also highlights is the rise of the older household. Those 55 and above. This segment is likely going to use much more of their budget for healthcare, a budget line item that is seeing prices rage out of control. The demand for their housing needs is not going to be that high. After all, an older couple or an older retiree doesn’t need a home built for four or five people. You do have some boomerang households were kids in the 25 to 34 age range are moving back home. I’m sure many in the middle class did not have this in mind when they read those nice investment bank brochures of retirement. Didn’t you read the fine print on those toxic mortgage backed securities or obscene derivatives?

In the end we are to have slow growth going forward. If Americans are having smaller household incomes and debt is contracting, it is likely that the consumption side of the economy will only grow slowly. The math is simple. Where will the extra dollars for spending come from? We have 45,000,000 Americans on food stamps. A per capita average income of $25,000 can only go so far. We also have an underemployment rate of 16.5 percent in this country. Millions are working part-time jobs but hoping for full-time employment. At the same time those in the financial sector continues to monopolize the lion share of the nation’s income largely on speculation and taking from taxpayer’s through bailouts. Is it any wonder why so many people are frustrated with the way things have been going for over a decade?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

MarkH said:

Thank you for that cogent explanation of our recent past and why it’s so difficult to pull out of this (mere) recession.

October 10th, 2011 at 2:02 pm -

Auntiegrav said:

Consider, also, that much of the consumer spending was TO FILL UP THE HOUSES which were being built. Stop building houses, and people stop buying refrigerators and Corian countertops. Now, they are buying iPads and laptops that will move as they go from one rental to another.

There is even a further bottom line that will be addressed, whether we want to or not: What are people FOR? In other words, what are we generating that adds more to our future (and the planet) than we consume in resources? A house is only valuable if it puts people where they can be useful to their own future. If it puts them at the end of a long gasoline-fueled commute, then it is actually a liability, not an asset, because someone has to tear it down to use the land.October 11th, 2011 at 7:03 am -

compass rose said:

Just love this blog, always.

One comment on “food stamps.” Please…understand that “food stamps” (food supplement programs) are NOT welfare for citizens. They are welfare for the agribusiness corporations that have increasingly found ways to redefine and formulate fractionated industrial byproducts of mega scale/factory farm commodities as “food,” which can then be marked up at vast profits that protect food speculators (both shareholders and commodities gamblers).

The farmer share of each consumer food dollar has plummeted to 11 to 12 cents–down from 20 cents just a couple years ago, and 30-40 cents in the 1990s. And of that 11-12 cents, 15% of it goes to corn alone!

The other 88-89 percent goes to processing, packaging, advertising, marketing, transportation, and energy. This is not food. This is the equivalent of financialization of the staffs of life.

When a very poor person has a dollar to spend on food, and buys a conventional mainstream food product, the vast majority is not going to her or his best nutrition–if there is even any nutrition at all in it. (Which leads to further costly health and behavioral problems, but that’s not my point.)

My point is that it has taken massive taxpayer subsidies on all sides of the agribusiness formula to prop up agribusiness profits. There are subsidies to grow monocrop soy and corn, subsidies not to grow it, and on the consumer end, subsidies to the shopper. Plus more subsidies at every step of the way.

If agribusiness had to compete in a real free market situation, it would implode. I’m not advocating that. I’m simply observing that any time someone talks about “Americans getting food stamps,” what is actually happening is that tax dollars are propping up the profit formulas of corporate agribusiness. They are the real welfare queens, while middle class and poorer Americans are increasingly finding their very bodily sustenance converted into yet another casino game.

October 20th, 2011 at 9:42 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!