China’s ghost cities and shopping malls – 14 million empty housing units in the U.S. while China may have up to 64 million empty apartments. GDP is only as good as the quality behind the financial numbers. China real estate bubble.

- 1 Comment

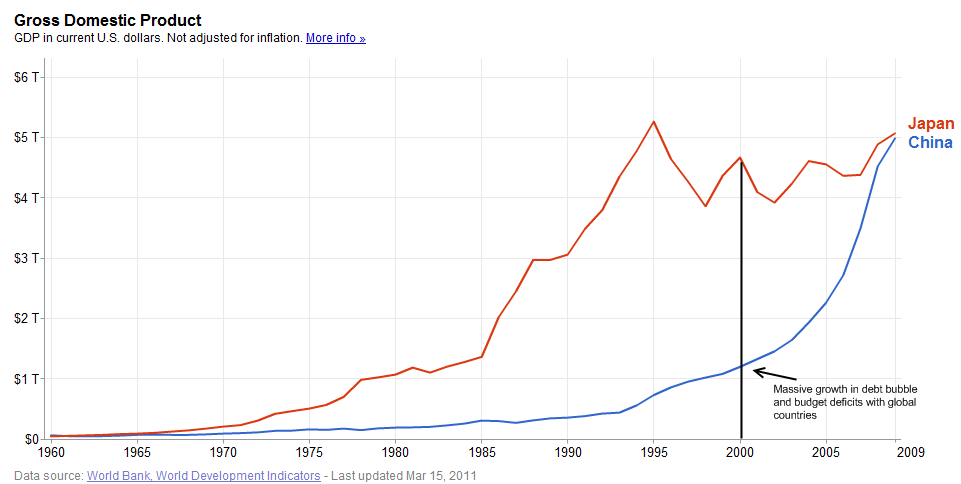

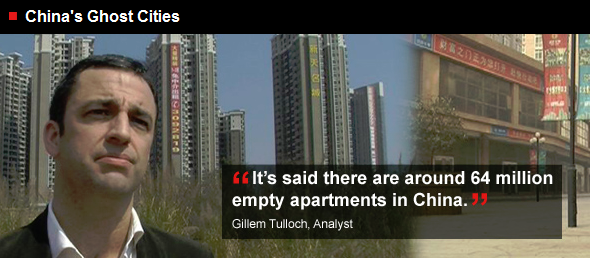

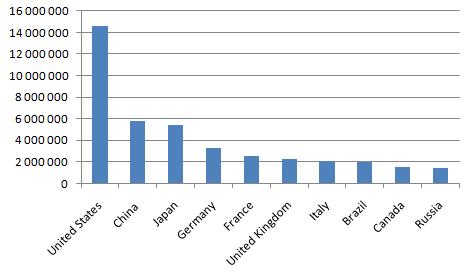

The Census released data showing that 14 million housing units in the U.S. are categorized as being vacant. As startling as this figure appears on the surface, China has an estimated 64 million empty apartment units. As we enter a perpetual cycle of global financial bubbles, the largest ongoing bubble in the world at the moment is likely to be in Chinese real estate. China has grown from having a GDP of $1 trillion in 1999 to well over $5 trillion today making it the second largest economy in the world. Yet as we will examine in this article simply having a large GDP does not necessarily mean a robust economy. Many Americans thought home values would remain elevated but once reality took over prices came crashing down in dramatic fashion putting household balance sheets into a tailspin that we have yet to recover from. China in order to keep up with growth demands from their central government and investment demand is building at a pace where many areas including entire cities remain largely empty.

Ghost cities of China

Without a doubt China has expanded at an amazing pace. There is real and dramatic growth occurring in the economy but when growth occurs at this pace you also have speculation.  Much of the investment capital in China is going into fixed investments including real estate. How well will this investment perform? Right now the government is focused on targeting GDP growth even if it means building real estate projects with no actual real world demand:

A great piece of investigative journalism by Australian Dateline inspects this property speculation in China. An analyst in China estimates that some 64 million apartment units sit empty on the market. You should watch the video and see the eerie silence of an entire city in the middle of the week with no people and no traffic like some apocalyptic Hollywood movie. These projects are added to the bottom line of GDP but is this actual healthy growth? Or is this merely another real estate bubble like the one we experienced here in the U.S.? It is likely that China’s real estate bubble is even more troubling than the one in the U.S. for a variety of reasons.

First, in the U.S. in many markets housing units do have a market as long as prices come down. For example in Florida and Nevada we have seen investors creep in to buy low priced units. It is also the case that in many of these areas there are population centers already established like Fort Lauderdale or Las Vegas. These population centers have taken decades to grow and establish roots. Many of the Chinese real estate projects were built without gauging actual market demand at a feverish pace.

The metrics are also off and many of the units being sold are being pushed by speculators who largely will not live in the units.  Some of the places examined in the Dateline piece are selling for $70,000 to $100,000 but local working family incomes are only $6,000 per year. In the U.S. even on a nationwide basis the housing bubble (which was insanely high) pulled the median price of a home to over 5 times the annual household income when historically it had hovered between 2.5 and 3. In China it ranges from 15 to 20 depending on the market. This is a massive bubble and the only thing that keeps it going is the central government’s desire to keep GDP going and investor speculation:

“(Business Insider) The first is that a large chunk of China’s GDP is coming from investment in fixed assets such as factories, real estate projects, and infrastructure (in 2009, fixed asset investment accounted for 90% of China’s net GDP growth). GDP only measures how much is being invested, but not the return on those investments, i.e., whether they are good or bad. Given how much has been invested so quickly, there’s a lot of concern that many of these investments will prove to be poor ones, the cost of which could come back to haunt China’s economy. This is similar to a point I made in post last year on China’s â€quality of GDPâ€.

Massive bubbles are something we have in common and the working class in China faces similar issues when it comes to real estate:

Source:Â SBS

Many working and middle class Americans can relate to the above story. This couple works in Beijing and earns a combined $900 a month and 25% of their income goes to rent. The empty units near their residence sits empty but has a price tag of $100,000. Much of the push upwards in price has come from property speculation. Hot money is seeking a home and fixed investments like real estate still pull in money even in the overheated market.

Another reason why the real estate market in China is even more over priced than the U.S. is that accurate data is hard to track. Here in the U.S. virtually every major metro area has monthly data that is easily tracked by the public. The mechanism isn’t as clean in China so the flow of information isn’t as smooth. There is a shopping center that has been virtually empty for six years yet a U.S. media piece announced when it opened that this was an example of China’s growing consumer class. Of course it would help if people actually went in person to see the actual foot traffic.

In 2009 nearly 90% of China’s net growth came from fixed asset investments. This includes factories and real estate projects. Again GDP is only one measure of a country’s economic prowess. What use is it having entire cities that sit empty merely to boost GDP numbers? Of course the government in China seeks to keep GDP going because this is one of the main reasons investment is flowing into the country. Money seeks growth areas so keeping GDP moving forward even with building empty cities and shopping centers is part of the mission. Yet the pain will come once the bubble bursts just like it did in the U.S.

The China banking sector may be in better shape since many of these places require 50 percent down payments. Yet hot money is hot money. A bust is a bust. It only means that those who are purchasing the places will face the repercussions instead of those holding the notes. Investments are only as good as what they can return. If a place sits empty without any market demand then eventually the price will have to be paid.

The growth of China over the last decade is nothing short of amazing. Again we have to ask how much of this is coming from say manufacturing goods and real estate projects like those above?

Internally the central government has tried to throw a bucket of water onto real estate speculation. Yet so far the game continues. Eventually like all bubbles, it will burst and a correction will be in place. What happens then?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

nevket240 said:

G’day.

Have just returned from 4th trip through China. I wrote about the huge over build in property early 08. Take the fast train from Wuhan to GuangZhou and marvel at the empty sky scrapers in the evening light with not one light on.

People are missing a huge point here with Chinese construction.

Their shopping malls are not targeted at the lower class but mainly upper middle class buyers. The new malls are being built in places where middle class living is non-existent. The malls are huge, over- staffed, and stacked to the roof with expensive brand names.

No one is buying. The stock is NOT moving. My girlfriend works in a big name mens wear store. She does nothing all day. No customers.

This will end badly for the Western brand names as well as the developers.

regardsMarch 28th, 2011 at 3:44 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!