The financial scam of the century – In 2010 we added 600,000 millionaires while 5,000,000 people were added to the food stamp program. Wealthy derive profits from stocks while middle class hold most of their net worth in housing.

- 2 Comment

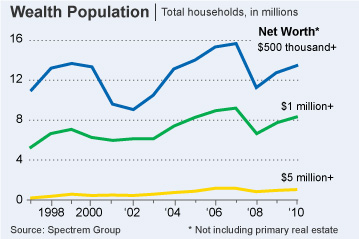

Part of the discontent roaming across America is that the economic recovery is targeted to a small portion of the population. This part of the population controls most of the mainstream media channels so the working and middle class are wondering why isn’t the fact that food, college, health care, or many other day to day items with price increases fails to grace the media agenda? Have you ever heard the words “median household income†or “average income†grace the daily news tube? The problem of course is that some are doing extremely well in our economy. In fact the number of millionaires in the United States soared once again last year. The number of millionaire households jumped to 8.4 million in 2010 increasing by 600,000 last year. Now to contrast this rise in millionaires in 2010 we added 5,000,000 Americans to the national food stamp program. The income inequality gap is only getting more pronounced here. A rising sea is not lifting all ships because many of the reasons for wealth building (i.e., corporations cutting costs to boost profits) directly impacts the working and middle class who own very little in stock. Yet the stock market going up over 100 percent from the March 2009 lows has helped the top 1 percent that control 42 percent of all financial wealth.

Millionaires grow with stock market

Source:Â Wall Street Journal

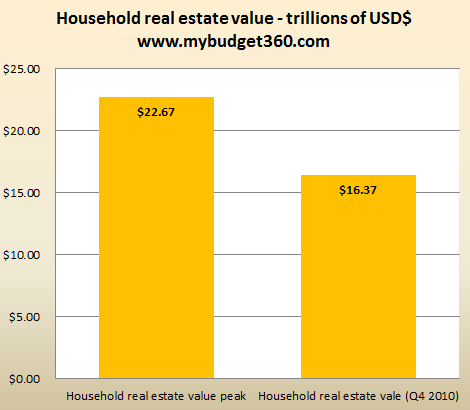

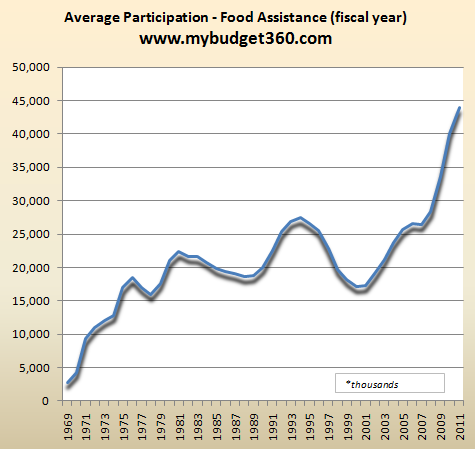

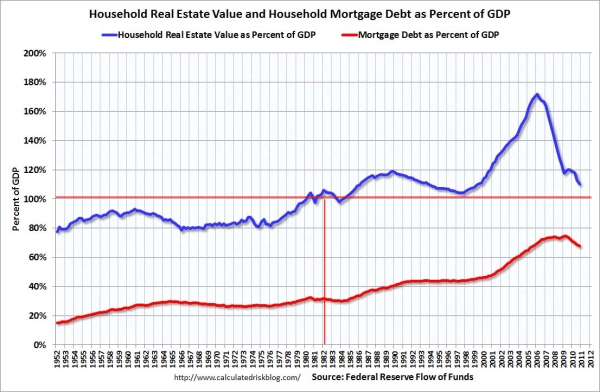

This is an interesting chart. The number of U.S. millionaires is back near its 2007 peak. At the same time we have an underemployment rate near 20 percent according to Gallup and 45,000,000 Americans on food assistance. You will also notice that the above chart excludes the primary residence for the household. Why is that? Well most middle class Americans derive their household wealth from real estate, and not the stock market. The real estate market continues to be crushed and prices continue to move lower:

Source:Â Federal Reserve

While the primary source of wealth for the top 1 percent is stocks and this sector continues to improve thanks to bailouts and the Federal Reserve pumping easy money into investment banks, millions of other Americans are being kicked out of their homes that are losing value. Americans have lost $6.3 trillion in household real estate wealth. If your primary asset for your net worth is collapsing is it any wonder why the majority of the population does not feel this as any sort of economic recovery even though the stock market is now up over 100 percent in a relatively short timeframe?

Growing inequality

Source:Â Marginal Revolution

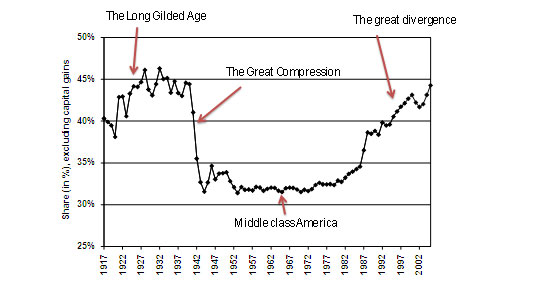

There is nothing wrong with having a system that rewards wealth building. In fact this is encouraged and should be supported.   Yet the system in place actually encourages short term graft at the expensive of long term growth. Many investment banks knew and helped create the housing bubble by setting up a system that took a stable investment in homes and turned it into another commodity for global speculation. Since investment banks knew this would go bust, many lobbied politicians early on for a preparation in bailouts to save them from their massive graft once it imploded. Many investors including giant investment banks made money on the misery of millions of Americans. How is this a good system? In the end the Federal Reserve and U.S. Treasury rolled out trillions of dollars of bailouts to the financial sector. This is why one tiny part of our economy is booming at the expense of others.

The chart above shows the growing income inequality in the country. A strong middle class can only thrive when productivity is rewarded and graft is punished. You cannot have a CEO making 500 times what the average worker makes especially when that CEO was instrumental in the financial products that crushed our nation. Yet that is the current system we are in. The media tries to brainwash the public that these captains of industry are somehow doing a good deed for the country. They are not. They are selling out the economy via plutocracy and not even capitalism. If this were truly capitalism most of the investment banks on Wall Street would be gone only to be replaced by other banks that actually take a fiduciary responsibility of their clients.

Incomes stagnant

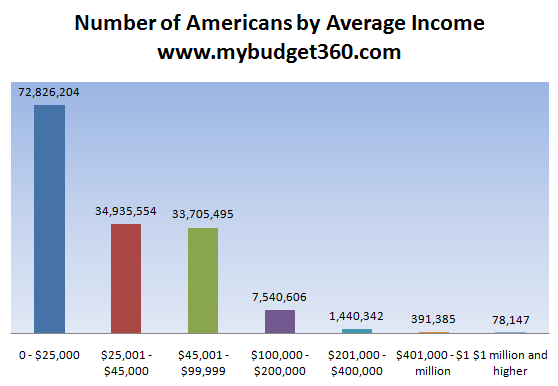

Source:Â Social Security

The average working American pulls in $25,000 for the year. Given the rise of two income households this coincides with Census data that shows the median household income of $50,000. Yet the cost of many items is eating away at their incomes; food, health care, college costs, and energy keep going up while income remains stagnant or declines. Public college systems, the typical route toward a middle class lifestyle are becoming more and more expensive as states lose revenues. The wealthy class in this country does not care since this can create a system where the public is uneducated about their methods of robbing from the productive class.

Does this look like a recovery to you?

More and more Americans keep getting added to the food stamp program. All the while those in the millionaire ranks continue to grow. With an abundance of labor, companies can keep wages low or threaten to take companies overseas (which they are doing anyway). Ironically many of the bailed out investment banks are funneling money to emerging markets because of better gains. These same investment banks were on bended knee in Congress asking for trillions of dollars for the American people. That was a lie and a Trojan Horse. It was the swindle of the century.

The rise of alternative media is merely a reflection of how disconnected our country has become. People don’t need a doctorate in finance to figure out their incomes are declining and the quality of life for the middle class is shrinking. All they need to do is look at their bank account. Much of the last decade of income losses was plastered over with massive debt growth:

Source:Â Calculated Risk

The only reason many in the middle class felt richer in the last decade is because of the housing bubble. But that was all a giant lie built by Wall Street investment banks with products like CDOs, CDSs, and the entire mortgage backed securities industry. When the entire casino went bust, Wall Street received their government welfare handout while the public is now confronted with higher taxes, less public goods, and is now being asked to live with austerity to pay for their graft. We don’t want to stop that millionaire train while more and more Americans depend on food assistance. What about the investment banks? What austerity measures are they taking? To the contrary their profits are even higher since they have unlimited access to the Federal Reserve at virtually zero percent interest rates. Expect income disparity to continue since we have a Wall Street run government and much of this will not be broadcast on national television.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Chuck said:

The way I figure, 600,000 went on food stamps and became millionaires because they no longer had to pay for the high price of food.

March 24th, 2011 at 6:11 pm -

peter said:

The American people are in desperate need of a leader that will lay out the following objectives clearly and precisely.

1-How do we get back to a balance budget?

2-A true definition of our foreign policy?

Until a leader steps forth and provides America with the details of the above questions we will never resolve our problems.

March 25th, 2011 at 9:12 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!