Federal Reserve and the opaque banking syndicate – If the economy were booming why does the Fed still hold over $2.5 trillion in securities? $640 billion current fiscal year budget deficit.

- 2 Comment

The Federal Reserve is one giant black box of financial mysticism in our economy. At least that is what the Fed wants the public to think so it can remain shrouded in mystery. Since the crisis slammed our economy and the bailouts started in mass, calls for greater Federal Reserve transparency have been echoed in a non-partisan voice. The protectors of the Fed are largely part of the banking syndicate that have used this institution as one giant washer machine to recycle taxpayer money and convoluted the true intent of the original bailouts. Some in the public seem to think that the bailouts have all been repaid and suddenly the economy is back on even footing. Nothing can be further from the truth. To the contrary, the digital printing press is humming at a feverish pitch but the mainstream media has failed to convey the biggest financial story in any meaningful way. How can a multi-trillion dollar swindle occur with very little media scrutiny? The media would rather focus on Dancing with the Stars or some other flavor of the day reality show instead of confronting the financial system that runs our economy.

Federal Reserve still holding onto crisis like position

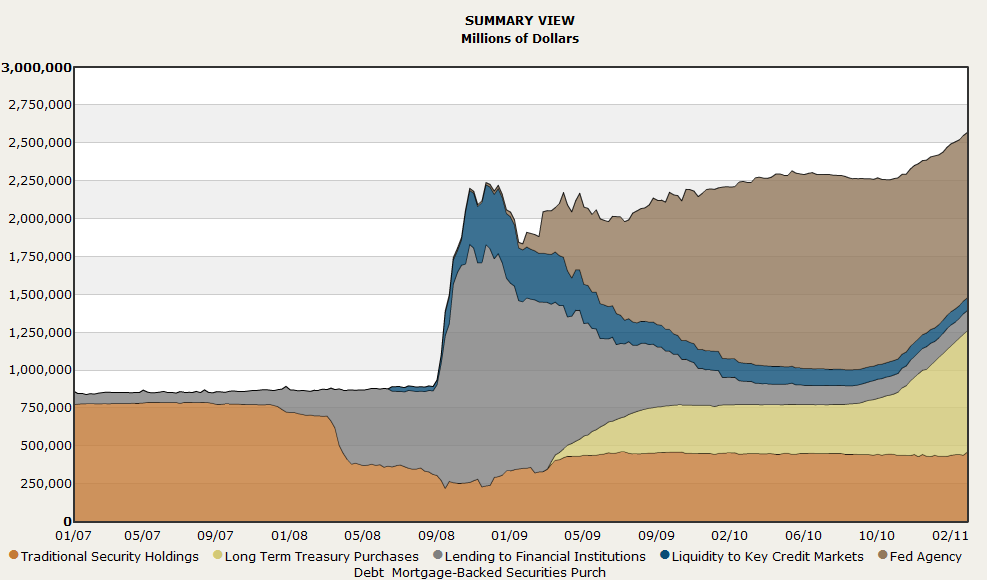

In more stable times, the Federal Reserve held roughly $750 billion of traditional security holdings like U.S. Treasuries. This is largely a role of a central bank until in late 2007 the Fed started breaking its historical mandate and venturing into uncharted territory purchasing whatever the banks flung its way. Today the Fed holds over $2.5 trillion in a grab bag of securities. We really don’t know the quality of what is being held but if structures like Maiden Lane are any indication the Fed is holding onto toxic debt waste of the bubble days.

Yet Bloomberg has won a first in the 98 year history of the Fed to actually have a court order release the details of the Fed’s bailout actions:

“(Bloomberg) The order marks the first time a court has forced the Fed to reveal the names of banks that borrowed from its oldest lending program, the 98-year-old discount window. The disclosures, together with details of six bailout programs released by the central bank in December under a congressional mandate, would give taxpayers insight into the Fed’s unprecedented $3.5 trillion effort to stem the 2008 financial panic.

“I can’t recall that the Fed was ever sued and forced to release information†in its 98-year history, said Allan H. Meltzer, the author of three books on the U.S central bank and a professor at Carnegie Mellon University in Pittsburgh.â€

Keep in mind this is occurring contrary to the Federal Reserve’s initial desires. If it were in their hands you would not even have a clue what was going on in their black box. $3.5 trillion in bailout actions to stop the 2008 financial panic yet taxpayers have no access to the crucial information as to how all this occurred. We already know from the way the stock market and banks are ripping through profits where the bailouts were geared. In the meantime the middle class contracts even further.

Spending tomorrow’s money

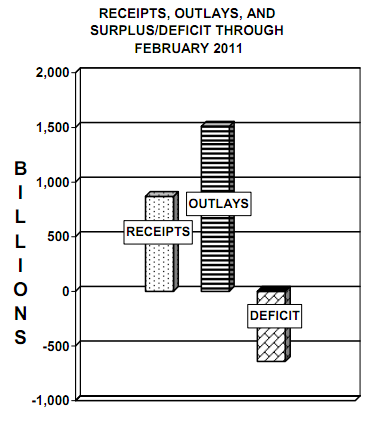

Part of the reason the Fed is still holding onto a record amount of securities is that we are spending more than we earn as a nation. For the fiscal year, we are in the hole to the tune of $640 billion. In the last fiscal year we ran a $1.2 trillion deficit so this year we are on track either to tie or pass that mark. This of course is completely unsustainable. Part of the reason we ended up in this financial crisis in the first place is because we were spending more than we were earning. So the solution is to spend more than we earn yet again?

This is a very big problem and given the rising costs of items like Medicare it is likely to continue even with a growing economy because of our aging population and rapidly rising healthcare costs. The only way to address these issues is to either curb healthcare costs or find other sources of revenue or to expand the economy. Last month we spent $47 billion on the Department of Defense. How long can we simply continue to spend money that we don’t have? Is it any wonder that over the last decade the U.S. dollar has taken a massive beating?

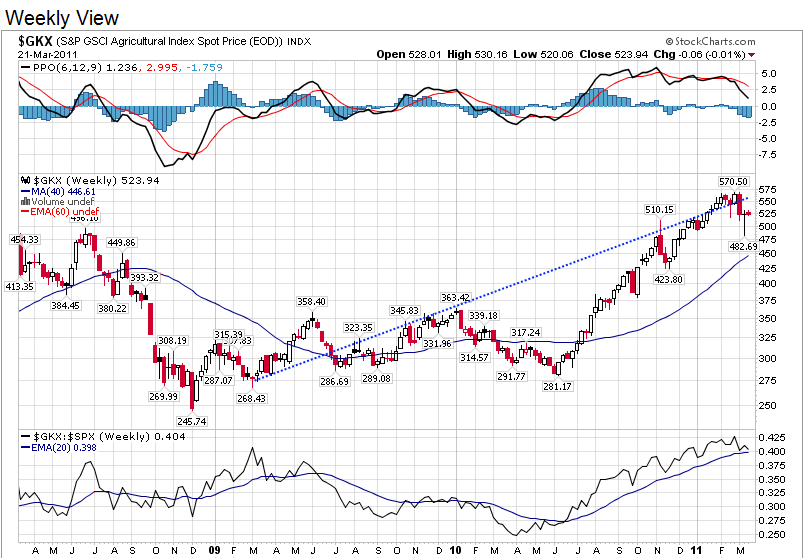

People may not see the direct correlation to their daily lives but the fact that we now have a higher structural unemployment rate with lower wages and increasing costs of daily goods should tell you that Americans are paying for all of the above by a slowly decreasing quality of life. Take a look at the agricultural index over the last few years:

The agricultural index is up 96 percent from the low reached in late 2008. This translates into higher food costs and many are feeling it even though the CPI with the heavy weighting on housing does not reflect this change.

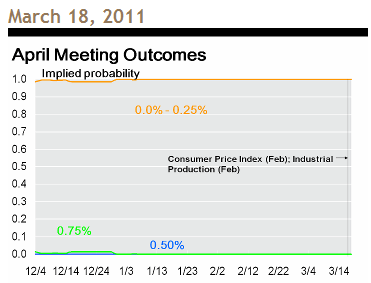

The banking system is inundated with toxic loans. Many sit in the balance sheet of the Federal Reserve since no one in the open market wants to touch this junk. Anyone really looking to buy a strip mall in the middle of the desert? Because of this, the Fed wants to lure in more and more home buyers with artificially low interest rates and hopes to unload some of these homes at a time when inflation can eat away some of the bubble mania. Yet prices rose so high and so quick that the Fed is still at their peak in terms of their holdings. That is why the Fed is still keeping rates near zero percent:

So what is the banking and government solution to our predicament? Keep deficit spending and allow the banks to use the Fed as their corporate mark to market suspension account for all the bad loans of the last decade. Slowly over time the cost will be shifted to working and middle class Americans in a process designed to strip and destroy the middle class. All of this is intentional and calculated. If the Fed had the best interest of the public they would have been open and transparent about their bailouts from day one. So here we are, a very long time into the crisis of 2007/2008 when the Fed ushered in unprecedented bailouts and we are only now about to find out who really got what. Will this even be covered in the media?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

tyler said:

Well written and good article. The fed has acted like the big banks, venturing out of what they are supposed to do. The big banks aren’t making enough just being banks so now they are “investment” banks. I don’t know if I would call jp morgan or goldman sachs investors considering they didn’t have a losing trading day all last year. The game is rigged and the fed is the rigger.

I’m glad you continue to write really good articles. Part of being a writer involves getting feed back and I don’t know why no one ever leaves a comment on your site, myself included.

March 22nd, 2011 at 2:56 pm -

kimboslice said:

I think that the Fed may like secrecy to avoid public panic and distrust, which may have negative financial consequences. I also believe the Fed, like all other organizations, likes to be independent and hide what it does from those who would perhaps control it. The wealth that Americans have lost was fake home equity that was a bubble. This is gone forever. The only way for Americans to create true wealth is by innovation, increased productivity, investment, and saving. We need increased productivity of everything, especially energy. We need to encourage jobs for Americans, products made by Americans, and American investment and saving must be rewarded, not punished by our government.

March 23rd, 2011 at 1:59 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!