Monthly Foreclosures and the Dreaded Road Ahead: On Path to another 3,000,000+ Foreclosures for 2009. 1 out of Every 173 Homes Received a Foreclosure Filing in California. 8,800 Foreclosure Filings a Day in the United States.

- 3 Comment

Foreclosures filings in past economic downturns were usually driven by job losses or contractions in the economy. In our current recession we had an interesting dynamic in that many foreclosures were caused by the actual mortgages given to borrowers. This of course spurred the housing bubble but more importantly, positioned a double whammy for our nation. First, problems started showing up in subprime mortgages followed by Alt-A and Option ARMs and now prime mortgages which then fed into an economy highly built on the real estate and finance sectors and now we are seeing foreclosures for more typical reasons like job losses.

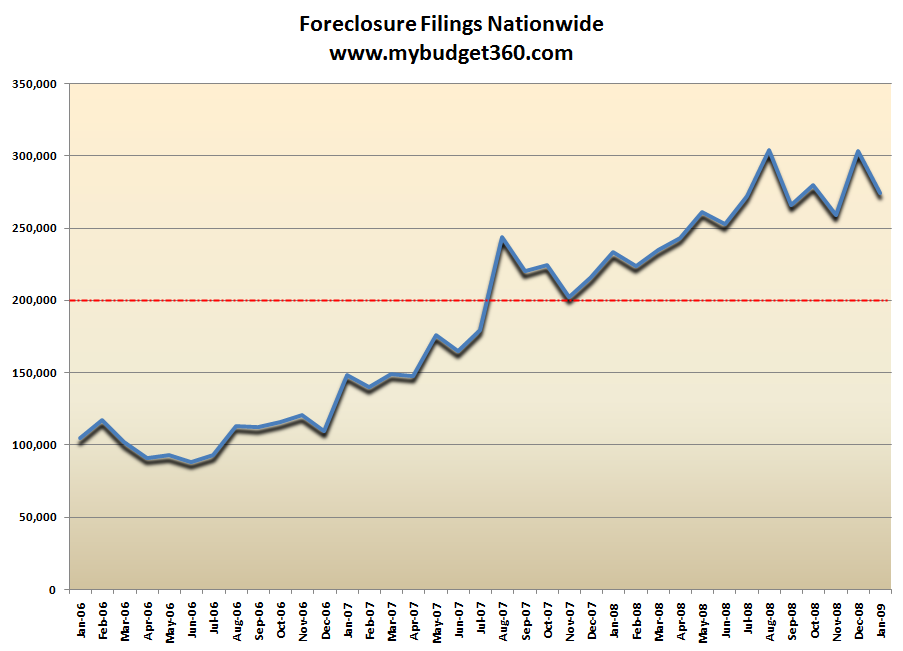

Until this situation is stabilized, there is little hope in seeing a bottom anytime soon. We just got the foreclosure filings for January of 2009 and we are already on pace, once again for a 3 million plus foreclosure year. First, let us look at the chart:

The troubling detail in the numbers above is we are still seeing sky high foreclosure rates and we have committed trillions of dollars to stabilizing the banking and real estate sectors. So was that money all a waste? It was unless you were part of the group receiving the actual bailout funds. In that case, you made out like a bandit.

Foreclosures are running at record numbers and this of course depresses the market value of homes in every area. The chart above is rather telling. What we see is that we have been running over 200,000 foreclosure filings per month since July of 2007. Remember that the stock markets did not peak until August of 2007. So this confluence of multiple distress signals is another reason why this is now the worst recession since World War II. It is hard to argue otherwise. Many will say that we are still not as deep as the 1980s recession but we really are if you factor in part-time employment and the amount of debt Americans carry.

The troubling detail is that 50 percent of all nationwide sales are distressed properties. This is troubling because it virtually ensures us lower and lower prices in the months ahead. Think of it this way. Anyone wanting to sell a home now has to compete with those 270,000+ homes that will be back on the market at fire sale prices. How can you compete when banks have a litany of homes on their balance sheet and are now liquidating these homes through various channels including foreclosure auctions?

In California, 1 out of every 173 homes in the state has received a foreclosure filing. Yet this is nothing compared to Nevada where 1 out of every 76 homes received a foreclosure notice! The data is even more startling when you break it down:

January 2009:Â 2,476 foreclosure filings a day in California

January 2009:Â 8,851 foreclosure filings a day nationwide

And if we parse the data even further, we see that the REO and Notice of Trustee Sales are outpacing Notice of Defaults. Essentially a home receiving an NOD is more likely than not to go into foreclosure.  And this would be expected in a down economy with unemployment rising. After all, what is the use of doing a loan modification if someone just lost their job and has no income? We start realizing that the housing market has profound and structural problems.

One fascinating point that I want to show is that in January 37,693 NODs were filed in California. Nationwide there were 46,681 filed. That means, 80% of the NODs filed were from California alone! Why the big number? Well this has to do with legislation passed last year, SB 1137 which required lenders to work with borrowers and delay the foreclosure process. Well that of course didn’t work so now, lenders are quickly sending out those NODs and California will be seeing an enormous amount of foreclosures in 2009. The Option ARM fiasco waiting to happen assures us that. In a state where homes are down 50%, why would anyone be making any payments especially if they went zero down? On top of this, the state is going to raise taxes to balance the budget. So now, you are raising taxes, incomes are dropping, and home prices are lower. A recipe for years of problems.

There was also legislation on the table regarding tax breaks for homebuilders which looks to be going nowhere as it should. This was a total waste of money and in fact, some of these companies were going to receive tax refunds! While the country suffers with a glut of housing these lenders basked in the sun when times were good and now that times are bad, they want the tax code rewritten so they can get money from the taxpayers.

So why will we see another 3 million foreclosures this year? Well if we take California alone, 76,000 foreclosure filings occurred in January. That means at this rate we will see 912,000 foreclosure filings in one state alone. Keep in mind that we have yet to see the most toxic loans come to fruition yet and they will be hitting at full force this year.

By no means we are not out of the woods. This will take a very long time to work through.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

saipeople said:

The survey of 71 CEOs released on Thursday found that none expected an economic recovery to begin early this year. Almost 40 percent said they expected the recession to stretch into 2010.

February 12th, 2009 at 3:01 pm -

TeddyBearNeil said:

As the government is already hell bent on subsidizing the stupid and greedy, we might as well try to make it the right way.

I would say, the most simple and straight forward solution would be to write down the principal to the current market value (CMV) and create an IOU to the bank for the difference between the CMV and the Mortgage balance in favor of the Lender/s, which would be payable with interest if and when the home sells above the CMV and will be extinguished on the sale of the home.

If the home sells for less than the CMV, the IOU will be a total loss for the Lender. If the home sells for more than CMV+IOU, the Homeowner keeps the balance above the CMV+IOU. If the home sells for more than CMV but less than CMV+IOU, then the value above CMV will go towards paying off the IOU.

These IOU’s can be securitized and traded providing liquidity to the Lenders, although I am not aware if anyone would be willing to buy these crappy ‘Assets’ for anything more than 5% of their value, unless the government comes out with another scheme to re-inflate home values!!

February 13th, 2009 at 4:15 am -

John said:

Well I saw that foreclosures went down from December. However, what I need though is mortgage help now as can’t wait. This site http://www.needhelppayingbills.com mentioned gov’t programs and Hope Now, but it was basic and I need info on the government programs and how to get help. Do you have any info on mortgage help? Thanks

February 13th, 2009 at 5:17 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!