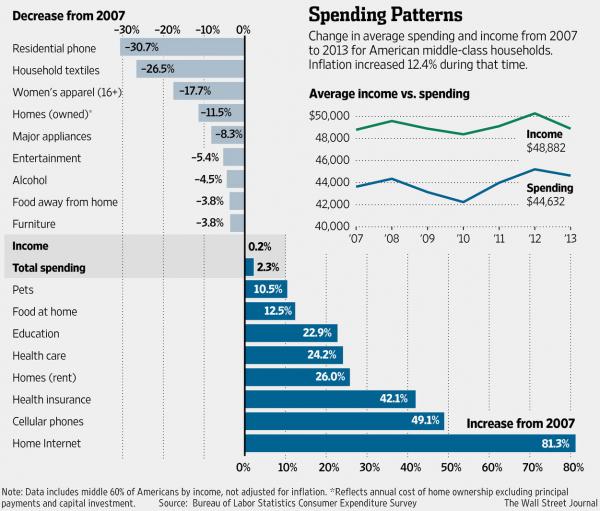

No inflation they say: Increases from 2007 include rent going up by 27 percent, food increasing 12 percent, health insurance 42 percent.

- 5 Comment

Inflation has a slow methodical pattern of crushing every little dollar you have in your wallet. Even a moderate level of inflation is an enormous change when incomes go stagnant. There is talk about how spending this year isn’t all that great. This is a big deal considering that our economy runs on non-stop spending and a large part of spending happens during the holiday months. But Americans are still constrained from the Great Recession’s echo impact. The lingering financial problems remain and many Americans have swapped good paying jobs with many in low wage service jobs. The end result should not be a surprise but there is less to spend even with credit card access and more debt being thrown on cash strapped households. We keep hearing about how controlled inflation is but in reality, we are seeing price increases in many important segments of our society. No inflation they say. Let us look at some key items.

Inflation is definitely here

As long as wage inflation is happening at a similar pace to the overall rate of inflation in the economy, then things do tend to stabilize since your standard of living doesn’t really change. Most people don’t pay attention to inflation or the Fed but definitely feel the pinch. Yet when incomes are stagnant and costs go up, this is the recipe for problems down the road. We have seen massive inflation in the cost of education. This has happened to a group that is already struggling with finding better paying work, young Americans.

Let us take a look at cost changes since 2007:

This is a really interesting chart. First, residential phones have dropped in price because of course most are now fully reliant on cell phones and the internet. Plus phones are a trivial cost of your monthly budget. But look at where costs have gone up. Food at home is up 12 percent. Health care is up 24 percent. Rent is up 26 percent largely because of the flood of big banks and hedge funds buying up single family homes and thus pushing many regular buyers off to the sidelines. In the end housing is your biggest expenses and rents have soared because of this action. More money into big investors hands via you spending more for a roof over your head. Cell phones and internet costs have also jumped up.

Inflation is here. Health care is also important since a large part of our country is now at an age where health spending jumps up. Many older Americans are fully reliant on Social Security and Medicare in old age. Social Security payments are largely fixed yet health care costs are soaring. This is a math problem that is heading to a bad outcome.

Food at home is also a big issue and ties in with our national obesity problem. Many families struggle to get by and many of the lower cost foods are the least healthy. Take a trip to the dollar store and see what the isles are full with. Empty calories. Some have started adding fresh fruits and vegetables which is great. Of course poor eating habits will lead to bigger health care costs in the future. This all ties in.

If you look at the budget for most Americans housing, food, health care, and for college students tuition tend to be the biggest expenses. How often do you need household textiles? Major appliances? Furniture? These are largely luxury goods when you have a tight budget. But food at home, shelter, and health care are basic needs and there is definitely inflation going on here.

I think the above chart highlights why spending has cut back and we could look deeper:

Incomes have not recovered for the middle class so there is no surprise in the down tick on spending. Of course we keep hearing from central banks that inflation is muted so to continue on this easy course of allowing big banks to do what they want and gamble with unlimited government backstops. We are living in the era of wealth defined by access to debt. The big banks had access to the Fed and are thriving now. Middle class households? They didn’t have this luxury and millions lost their homes to foreclosure and many others are burned via bankruptcy. Yet for big financial institutions, they have an unlimited lifeline and it should be no surprise that inflation is popping up in all corners of the economy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Ray White said:

I don’t think anyone’s claiming inflation isn’t happening. The Gov is just saying it isn’t occurring at the rate most of us are experiencing it. How that doesn’t translate as lying I don’t know.

And if your health insurance cost only went up 42% you got off lucky. Ours almost doubled.

December 3rd, 2014 at 5:44 am -

Bruce said:

Please consider:

2) Huge Keynesian stimulus since 2008.

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” – Milton Friedman

and

2) US national debt (ex. unfunded liabilities) just reached $18T.

http://www.newsmax.com/Finance/US-Government-debt-18-trillion/2014/12/02/id/610591/

It is no surprise that there is inflation. Real interest rates are negative, real wages are down and so the economic reality is that the real standard of living is declining for most. Current solution: increasing consumer debt. Not viable long-term. Potemkin economy.

“You cannot spend your way out of recession or borrow your way out of debt.†– Daniel Hannan, Member of the European Parliament

“There is no means of avoiding the final collapse of a boom brought about by credit (debt) expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit (debt) expansion, or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises

The next down-leg in the economy will likely start next year as sub-prime auto loans and new and old HELOCs become a problem again. Rinse and repeat.

http://www.zerohedge.com/news/2014-11-27/thankful-inflation-turkey-day-dinner-6000-1909

http://finance.yahoo.com/news/middle-class-is-dealing-with-12–inflation–wsj-study-175947204.html

http://www.zerohedge.com/news/2014-12-02/middle-class-spending-crash-explained

December 3rd, 2014 at 11:02 am -

Slvrizgold said:

Silver. Stack real money. Fiat currency is just worthless paper backed by lying, thieving, criminal govts and the banksters who run it. It’s NOT money, which by definition must act as a STORE OF VALUE.

December 6th, 2014 at 1:03 am -

Ame said:

Has anyone else noticed that the hardest hit by inflation are things the wealthy don’t need? The wealthy don’t use health insurance, they are “self-insured” and so don’t pay a monthly premium…they just pay doctors as bills come due.

Also, they don’t rent. They own.

Food has gone up, but how many of them are really affected by only 12%? With the stock market up by !!!!%, do you really think a measly 12% is felt?This current economy is designed to drain everyone below the 1%.

December 9th, 2014 at 6:42 pm -

Ame said:

Oh, and I forgot to add that the wealthy “write-off” most expenses with help of their personal accountant.

They truly live on a different planet than most.

December 9th, 2014 at 6:59 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â