A lesson in college debt – Student loan debt increasing at a rate of $170,000 per minute. Student loan debt will hit $1 trillion in 2012. For-profit schools take the place of subprime mortgages.

- 3 Comment

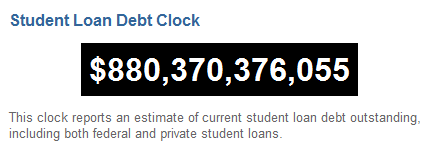

College loosely defined is an educational institution or as we are now seeing in the US a place where young people go to dive into a pool of debt. A college education was never a guarantee to a lucrative and well paying career. In a time when the middle class was more robust college was a major bonus for those who had the desire to attend. Affordable state colleges and non-impacted community colleges allowed virtually anyone with a desire to learn an avenue to educational growth. If your desire was to transfer to a four year university the path was easily accessible. Vocational programs did not require multiple year waiting lists like many nursing programs do today for example. A college degree certainly offered a solid advantage and more importantly did not put students into life altering debt. That is the major difference in this modern era of mega debt. In the past college cost more in time than it did in money. Today you have it costing more with student loan debt passing the $880 billion mark and far outpacing the $796 billion in outstanding revolving debt that includes credit card debt. Many parts of higher education are now in a bubble similar to the housing market.

The growing student loan debt

Source:Â FinAid.org

According to FinAid.org a site that tracks student financial aid student loan debt is increasing at an alarming rate of $2,853.88 per second. This is a stunning rate of $171,180 per minute. At the current rate we will hit $1 trillion in student loan debt in 2012 since we are adding $89,972,208,000 in student loan debt per year.

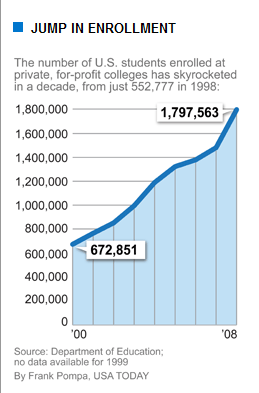

The staggering amount of red debt is putting many students into financial despair even before they see their first paycheck. Many for-profit colleges have capitalized on the allure of higher education and easy access to federal financial aid and have become largely the subprime lenders of the college arena. For-profit college growth has exploded even during the Great Recession:

Source:Â US News

The for-profit system has been under scrutiny recently:

“(US News) Recent lawsuits, and a probe by the Government Accountability Office, suggest that some nationally accredited colleges may be exploiting confusion about accreditation by omitting or glossing over relevant details.

The GAO report, for example, said a representative for the nationally accredited Kaplan College in Florida told an undercover government investigator who was pursuing an associate’s degree in criminal justice that the college was accredited by “the top accrediting agency — Harvard, the University of Florida, they all use that accrediting agency.” But that was not true.

A class-action lawsuit filed in August against the for-profit Westwood College in California noted that the college’s website said the school was a candidate for regional accreditation but failed “to disclose that it has been a candidate for two years and was passed over for accreditation during its first evaluation.”

Yet for-profits are one slice of the bigger pie. Much of higher education has seen giant spikes in tuition and additional fees all the while students are coming from families with stagnant incomes. Stagnant incomes means many that want to attend college will have to go into some form of student debt. There is a big difference between going to a state school and leaving with $10,000 in debt and attending a for-profit with a degree that is largely not as recognized by employers and leaving with $50,000 in debt.

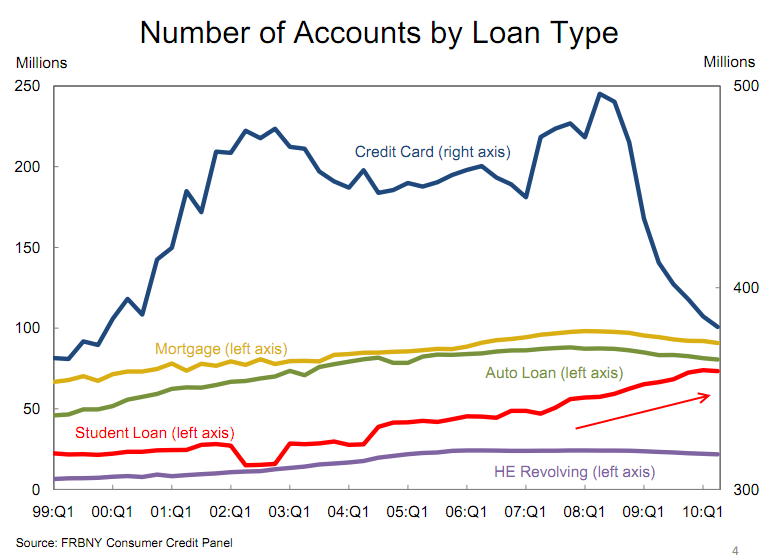

It is a telling story of the state of higher education when every other loan category has contracted while student loan accounts are spiking:

I find it amazing that student loan accounts hit a spike right when the recession hit. It is also interesting that in 2002 student loan accounts dipped as it is likely many people with high school degrees entered the housing industry in mortgage lending, as real estate agents, construction, or other ancillary employment fields. The above chart shows clearly that student loan demand has shot up and the less money one has the more money you qualify for to attend college. It would be one thing if the market was closely scrutinized and tracked but we know that for-profit schools that operate for money are better able to market and suck unsuspecting students into their web. Currently financial aid is designed to help those that need it most which is admirable. Yet public schools being caught up in massive state budget deficits are seeing larger cutbacks and face the inability to meet current demand. This allows for-profit schools to target lower income students with deceptive ads and hyperbole. They snare students and use them as a method of siphoning off federal financial aid.

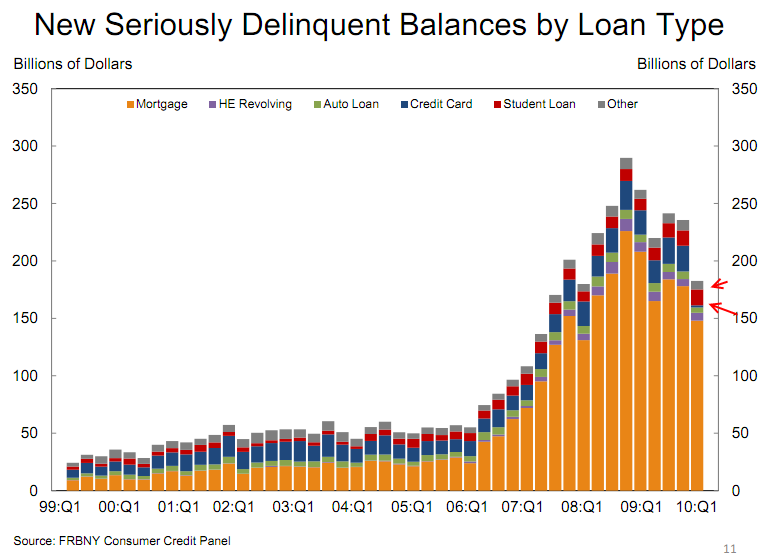

Of the total outstanding debt the largest line item is federal. The government backs $665 billion in student loan debt. And guess what area of loans is seeing growing delinquencies?

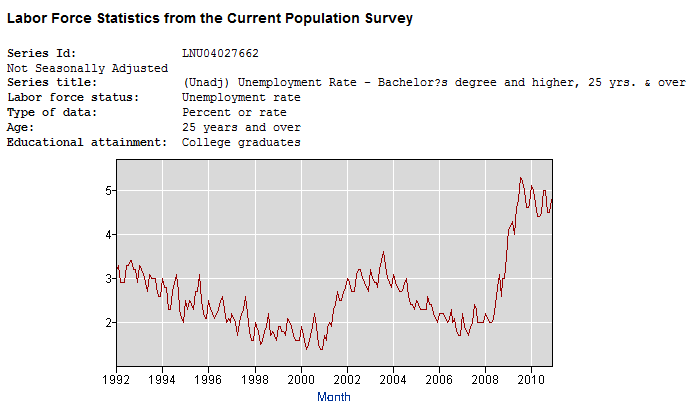

Student loan problems are spiking across the country as many with college degrees are unable to find jobs. The unemployment rate for those with a bachelor’s degree or higher is the highest in record keeping history:

This brings up a very important question. If many colleges do not prepare students for stable futures then why is the cost outpacing inflation? The middle class certainly cannot afford to pay more when their incomes are declining. The government and Wall Street are all the more happy to loot and sucker people into paper mill “colleges†just like they were all the willing to stick people into subprime loans. The for-profits take in over 90 percent of their “revenues†from federal financial aid. The government keeps on dolling the money out even though results are lacking. It is a symbiotic relationship between the new plutocracy and working and middle class Americans are seen by these organizations as pawns.

If the government were concerned about getting people educated why not fund public state universities and cut out the aid to middlemen? Instead, we have this subprime arbitrage and we will likely see another bailout in this arena while another group of educational robber barons make way with taxpayer money. With so many people coming away with college degrees and limited job prospects we will be seeing more student loan delinquencies. Student loan debt is one of the hardest forms of debt to erase so it is likely if things stay the same that we will have a nation of students with underwater degrees. Unlike a mortgage it is not so easy to walk away from a student loan.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

3 Comments on this post

Trackbacks

-

Gwen Marie said:

I suggest getting a marketable skill and leave this country. Let the banks try to collect that…..

January 9th, 2011 at 8:36 pm -

Ephraim said:

The only way to “bankruptcy” from a student loan is to leave the country. As I, and many other middle-class Americans become former Americans, I wonder what effect that will have on this country’s long-term prospects.

January 12th, 2011 at 4:43 pm -

Mikjall said:

You can leave the country first and – in many places – get a fine university education without piling up the debt in the first place.

January 21st, 2011 at 11:37 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!