Financial dismantling of the American middle class in 8 charts – Peak debt, credit card addiction withdrawal, banks hoarding cash, financial sector dominance in pay, Federal debt will never be paid off, and struggles of the middle class.

- 8 Comment

The American economy runs on high octane debt. Debt has been welcomed by many with open arms and things seemed to be going well until people realized they actually had to pay the debt back. Average Americans trying to keep up with the picket white fence image of Leave it to Beaver were largely relying on debt to keep up with this lifestyle that was unsustainable with current incomes. Paradigm shifts in economies the size of the United States happen gradually over time. They occur slowly and systematically with the patience of a person watching grass grow. The Federal Reserve has made a conscious effort to bailout the banks and use the crisis as an excuse to lower the standard of living of most Americans to pay for the bailouts. Federal debt is so large that only someone with blind optimism would have any hope that it would ever be paid off. When an average person cannot pay their mortgage they lose their home in foreclosure. If someone can’t pay their car they get it repossessed. When banks need bailouts they simply print away and devalue the currency of the domestic country shifting the burden to society. Have we in the United States reached a peak debt scenario? Is the Fed willing to sacrifice the middle class to keep the banking system intact? Let us look at 8 charts showing shifts in our economy that put the middle class at risk.

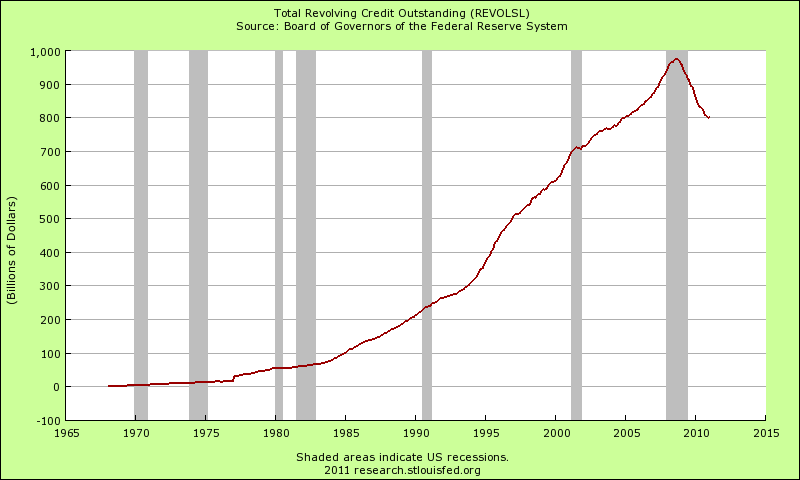

Chart 1 – Credit card debt

Americans love credit cards right along with apple pie. Since the 1970s the amount of credit card debt in the United States moved unrelentingly higher and higher. By 2007 close to $1 trillion in credit card debt was outstanding. During the crazy debt era of securitization we were hearing stories of cats being issued credit cards with $5,000 limits. It was a massive debt bubble. Many average American families have relied on credit cards to give them the impression that they were keeping up with a middle class lifestyle but instead were simply borrowing time on expensive shiny plastic. With stagnant incomes over a decade the piper is now calling. The above chart clearly shows the contraction in outstanding credit card debt in the U.S.  Much of this debt is being discharged in bankruptcy if you are wondering how the chart is moving lower so quickly.

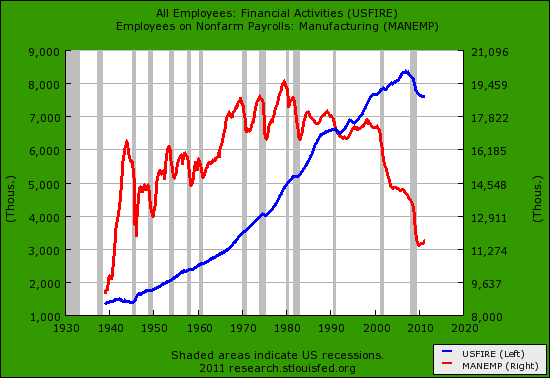

Chart 2 – Growing financial sector versus manufacturing

The above chart shows the financialization of the American economy. Since 1970s the U.S. manufacturing sector has contracted. Over 19 million workers were employed in manufacturing during the 1970s. Today we have slightly above 11 million workers with many more living in the country. Over 40 years later and our manufacturing workforce has been cut nearly in half. But look at the financial sector. This part of the economy has been adding jobs almost nonstop. It seems that the U.S. economy was largely built on debt production and collection; credit cards, mortgages, student loans, and auto debt. Someone needs to collect the interest right? Yet how useful is it to have giant parts of your economy developed to make nothing and suck away actual real wealth from the productive side of the market? That is what Wall Street investment banks have done for many decades and it coalesced with our current Great Recession.

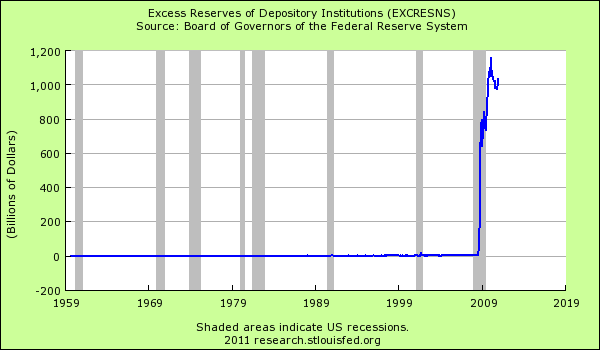

Chart 3 – Excess Reserves

Where is all that easy money going from the Federal Reserve? Clearly it isn’t going to average Americans in credit cards. Much of the taxpayer bailouts are being held as excess reserves and banks currently have over $1 trillion that they can easily deploy into the economy helping the middle class. Why don’t they? They don’t trust the economy because they only need to look at their internal shady practices. They are holding onto this money for the coming problems that will hit with more defaults across all levels of loans. The bailouts were simply a way to save the banks. Make no mistake, banks do not trust the middle class that is largely responsible for bailing them out.

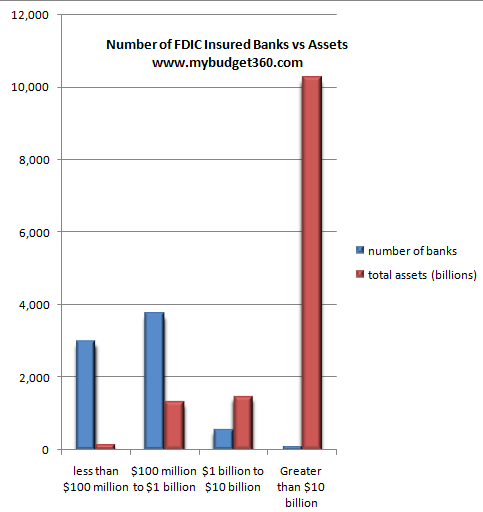

Chart 4 – Too big to fail banks

The too big to fail have gotten even bigger in the latest crisis. Over $10 trillion of all banking assets sit with a handful of the over 7,500 FDIC insured banks in the United States. Instead of using the crisis to make the too big to fail smaller the government in conjunction with Wall Street has made the big banks even bigger with more taxpayer protection. This has done little in making the financial lives of Americans any better. Most of these banks are now making a large portion of their profits via overseas investments and stock market speculation (all on your dime by the way). Little has been done to shore up the finances of the middle class here and many of these banks charge high interest and other hidden costs to scam Americans.

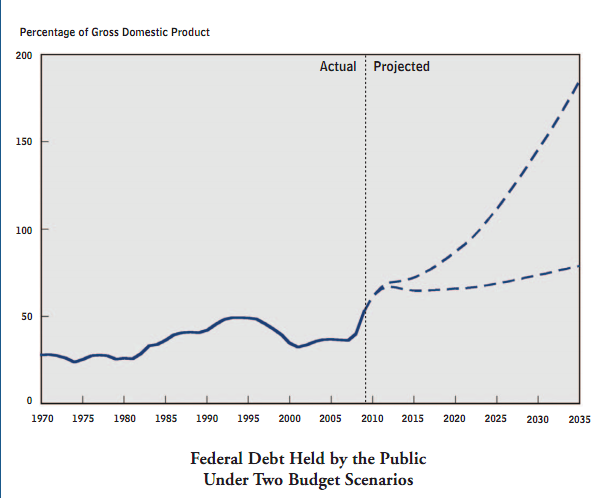

Chart 5 – Federal debt projections

Source:Â CBO

The above chart shows that we have no intention of paying back our Federal debt. The optimistic scenario would require massive spending cuts that would likely contract the economy. The more dire line is basically us going on the same path. We are on this path. Nothing dramatic has changed in the last few years. If we were adding jobs to the productive sector of the economy then we would have a better chance but instead the banking sector has sucked away all the taxpayer resources. There are giant expenses like Medicare that will eat a hole in our budget for years to come. It is likely that we will face cuts and tax hikes in the next decade which doesn’t add any support for the middle class.

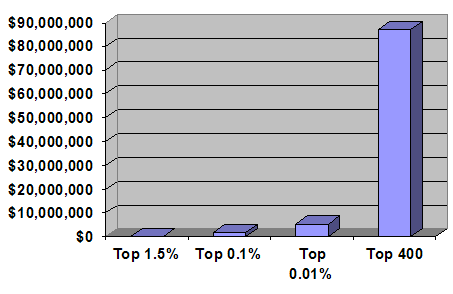

Chart 6 – Top 1 percent

Wealth inequality in the U.S. is at levels not seen since the 1920s. We all know what happened after that. In fact since the 1970s the top 1 percent have managed to control and take over 42 percent of all financial wealth in the United States. We have seen in various reports that many top companies through various tax loopholes pay zero or close to it in taxes while most Americans have to pay Social Security and other taxes on a daily basis. Real wealth gains have come for the top 10 percent while 90 percent of American household have gone into debt merely to stay on a middle class path. We are witnessing the effects of an economy that favors the entrenched plutocracy.

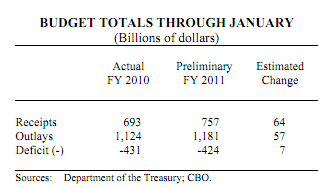

Chart 7 – Government spending

Just look at the above from the latest CBO report. We keep spending more than we earn as a nation. In the 2010 fiscal year we brought in $693 billion yet spent $1.1 trillion. This year it is expected to bring in $757 billion while spending $1.1 trillion again. How is this sustainable? It isn’t. The only reason we can do this is because the Federal Reserve can print away and devalue the U.S. dollar globally. On a more basic level this means the quality of life of Americans will go lower and lower. Notice how food prices are soaring? Notice how gas is $4 a gallon? Notice how college costs are soaring? The dollar isn’t going as far as it once did and this isn’t by accident. Yet bank profits are soaring and those that run these institutions keep getting more and more wealth in the top 1 percent bracket.

Chart 8 – Where do Americans work

Source:Â Wikipedia

What should stand out above is how few physical people work in finance but the share of their profits relative to all total sales and revenues is enormous. No other field has this kind of lopsided data. Wall Street banks continues to rob the public blind by devaluing the U.S. dollar through their shell organization in the Federal Reserve. These are institutions that are largely responsible for the Great Recession with their creation of the toxic junk financial instruments and other archaic system designed to surgically suck true wealth out of the economy and aggregate it into the hands of the few. What many are realizing is that we are in for a challenging decade ahead. Even with jobs being added these are happening in lower paying sectors. This is the last thing we need with half of Americans working at jobs making $25,000 a year or less. Unless things radically change the middle class will be gone within one decade.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!8 Comments on this post

Trackbacks

-

MarkJ said:

This article is another example of the great service you provide by telling the public just how misguided and costly government financial policy has been for working men and women over the past few decades.

I have followed your BLOG for a few years and I look forward to and enjoy the articles you create and appreciate how much work you put into substantiating your views and opinions. It is unfortunate that much of what passes for “news” today does not meet even minimal standards for fact based and objective reporting as your BLOG does. Mybudget360 is a shining example of why readers seek a much higher journalistic standard on the internet rather than legacy media sources.

Thanks for a great BLOG.

March 7th, 2011 at 8:31 am -

John said:

Great comments! This did’nt have to happen. Abolish the Federal Reserve, eliminate the income tax, bring back the woodruff tarrif, go back to the gold standard, reinforce the 10th amendment(abolish federalism),begin term limits for federal Senators,Congressman, Judges, stop all immigration (legal and illegal) and most of our nations problems would go away. We had all this and Woodrow Wilson did most of the damage(change). Otherwise it is civil war. Wars are nasty and destructive, so we need to elect the people to implement the old ways.

March 7th, 2011 at 10:00 am -

George said:

Yet the American workers and the populace will accept their fate and do nothing about it. Everyone knows that the Federal Reserve System Corporation Banks are owned by the ruling elite. Everyone knows that politicians are groomed and schooled before they are allowed to be in Congress or be President. Everyone knows that we use a worthless backed by nothing fiat currency.

Yet, nobody including those who have sworn in public with a hand raised and one on the bible to protect the Constitution from enemies foreign and domestic do nothing but continue to burn it to the ground.

Where are the military servicemen who took that oath and continue today to watch these foreign and domestic terrorists destroy their own country? They are following blindly their orders from their brainwashing by their masters.

We are a doomed nation.

All due to stupidity and brainwashing.

March 7th, 2011 at 1:56 pm -

Nate1 said:

Agree with LuLu..

I am in the top 1.5% (~$280K year) however I definitely don’t feel rich whatsoever. I drive a 6 year old Honda and live a “regular” life. I am not democrat nor republican but it is funny how the system is rigged to make me “richier”.. the republicans want me to keep more money for myself which I really don’t need, but hey, I don’t make the rules. On the other hand proportionally, I pay less taxes now than when I was in school. Go figure.March 8th, 2011 at 5:25 pm -

CLARENCE SWINNEY said:

WHY ARE NOT MEMBERS OF YOUR STAFF ON TV SUCH AS MSNBC?

olduglymeanhonest mad mad madMarch 9th, 2011 at 8:52 am -

mark joyner said:

George, I am one of those military veterans. I am neither brainwashed, nor blindly following anyone’s orders. My oath did not call me to take up arms against my government. It called me to defend the Constitution. I am doing that at the ballot box. I suspect most of us are. Don’t ask me what I’m doing about the problem! Get YOUR tail out there and do something YOURSELF! I did my service for my country… and I still continue to, in spite of people like you!

March 10th, 2011 at 7:22 am -

kimboslice said:

Many Americans do not care that illegal aliens work in the restaurants they frequent, nor that they replaced Americans in every other conceivable job. We need to have Americans producing, innovating, investing and saving. The government must not punish but encourage this. We need to produce energy, not windmill welfare schemes. We need to protect the American worker, not flood the USA with foreigner workers to replace him. Today almost no American teenager can find a part time job. He will grow up to be resentful and distrustful of our system, with good reason. I feel sorry for everyone who works today and must compete unfairly with the illegals and H1Bs for jobs. The only jobs that will be exclusively for Americans will be the government jobs. We are descending into becoming a third world country.

March 23rd, 2011 at 2:09 pm -

Dumbfounded said:

What?!? Where are the Emperor’s clothes? He was so immaculately dressed a second ago.

March 30th, 2011 at 6:56 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!