Real estate is a bad investment does not show up in Google News and other interesting housing trends – Strategic default searches went viral in 2010. Banks betting against American homeowners.

- 0 Comments

82 percent of American households have internet access. Of those with internet access, a large number are homeowners. The vast majority use Google to search for many things including foreclosure advice or investigating the real estate market. The online trends give of a sense of what is happening in the collective psyche of our country that really isn’t revealed through the conventional press. The housing market seems to be entering a second leg down and many are now predicting nationwide home prices to fall by 5 to 10 percent in the upcoming year. With that being said, very few articles have made their way to the popular press regarding real estate as a bad investment. Even today, there is still a sense that no matter the price, real estate will always be a good financial choice. Let us examine the online trends and market behavior that surround the current real estate digital psychology.

Strategic default the rage in 2010

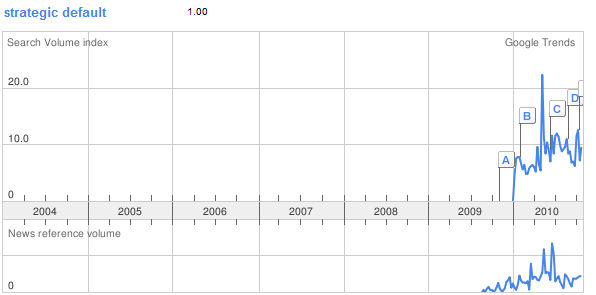

Google Trends offers a view into the machinery of the internet and what people are searching for. In 2010 strategic defaults went viral:

You can see that in 2009 the momentum was growing but in 2010 it has spiked off the charts as many Americans debate whether walking away from their underwater home is a good choice. Yet this isn’t a nationwide trend necessarily. It seems to be concentrated in the large bubble markets:

Las Vegas by far has the most searches for strategic defaults given over 6 out of 10 mortgage holders are underwater. The other familiar states of Arizona, Florida, and California show up as well. It is also interesting that Seattle shows up as the fifth city with the most queries for “strategic default†yet is rarely clustered with the typical foreclosure areas.

Is real estate a good investment?

You would think that by now, some news source would have put together an article showing real estate is a bad investment under certain circumstances but not only does this not show up, those exact words don’t even pop up in Google News:

Now it is obvious that some articles have talked down real estate but out of the millions of articles online, this string doesn’t pop up in any news article. Again I tend to believe that there is still this strange primordial fixation with housing and this is largely why the bailouts have focused completely on banks and housing. In fact, the focus has been so narrow that the government coupled with Wall Street has missed what is going on in the real economy:

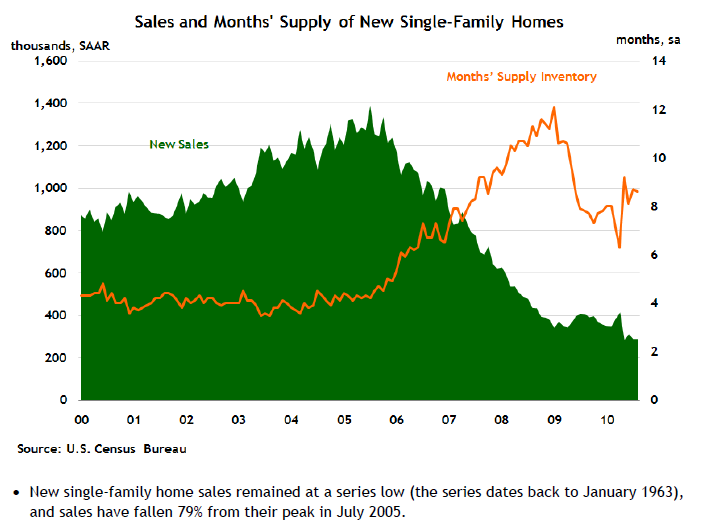

The headline unemployment rate has hardly improved and the underemployment rate is over 17 percent. Combine this with the massive glut in housing:

It is obvious that Americans are shifting priorities here. The low sales rate of new homes is troubling for two reasons. New family sales and construction serve a double purpose. First, they put people to work building homes and second, new home sales do well in a good economic climate. The above chart hasn’t responded at all to all the trillions of dollars in bailouts. The bulk of home sales in the last two years have been foreclosure re-sales and these have moved because of lower prices. The consumer is completely price conscious when it comes to housing.

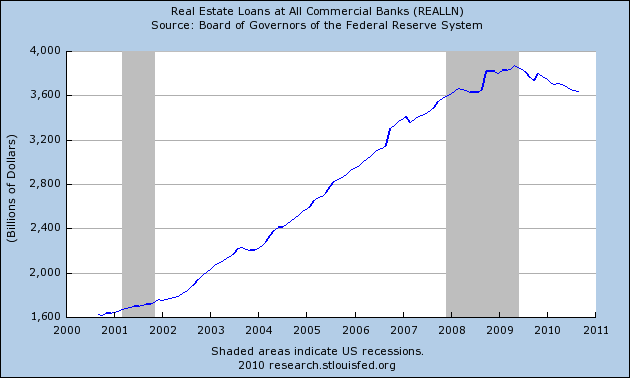

All the bravado coming from banks shows us a very different trend when it comes to them putting their money where their mouth is:

While the banks are all the willing to lend out government backed mortgages, they have pulled back putting their money into play in the mortgage market. In other words, banks have no faith in working and middle class Americans. They are willing to take handouts through bailouts but their actions speak louder than words. Just follow the trend and you’ll see where the money is going.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!