The Federal Reserve plans on exporting the U.S. middle class abroad with Quantitative Easing II. QE1 cost $1.7 trillion and took the underemployment rate from 10 percent to 17 percent.

- 1 Comment

The Federal Reserve is entering uncharted territory with this second phase of quantitative easing. The public may or may not be aware that the Fed has already embarked on quantitative easing (QE1) and has grown their balance sheet by $1.7 trillion (that’s $1,700,000,000,000) by exchanging U.S. Treasuries for questionable assets including a shopping mall in Oklahoma. It is obvious that the Fed is betting on the public being unaware of this action to continue on their unabashed shadow bailout of the banking industry. Some think that this will somehow cause residential real estate prices to boom. Yet this flies directly in the face of a middle class that is quickly seeing their nominal income decrease. How will they support higher home prices? It doesn’t compute but what is certain is the demise of the U.S. dollar is already happening.

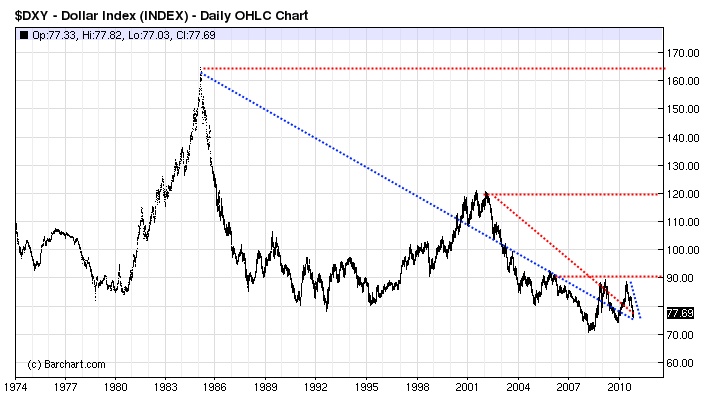

The U.S. dollar has been on a multi-decade swing to the bottom:

The Fed is doing all it can to induce inflation but there is a troubling back story. The middle class is growing, just not in the U.S. Global companies are now forcing the labor pool to take lower wages or perish and many S&P 500 companies now make a large portion of their revenues overseas. So a lower dollar is not a big deal for them. In fact, it allows their foreign assets to appreciate in dollar terms and that is largely one reason why the stock market is doing so well while the actual real economy in this country is faltering. Look at the above chart. The U.S. dollar has lost 50 percent of its value since 1986. In fact, since June of this year the dollar has shed 11 percent of its value. The trend is obvious and it is clear. If the Federal Reserve can print money at will, why should people have faith in the currency at the hands of a few central bankers?

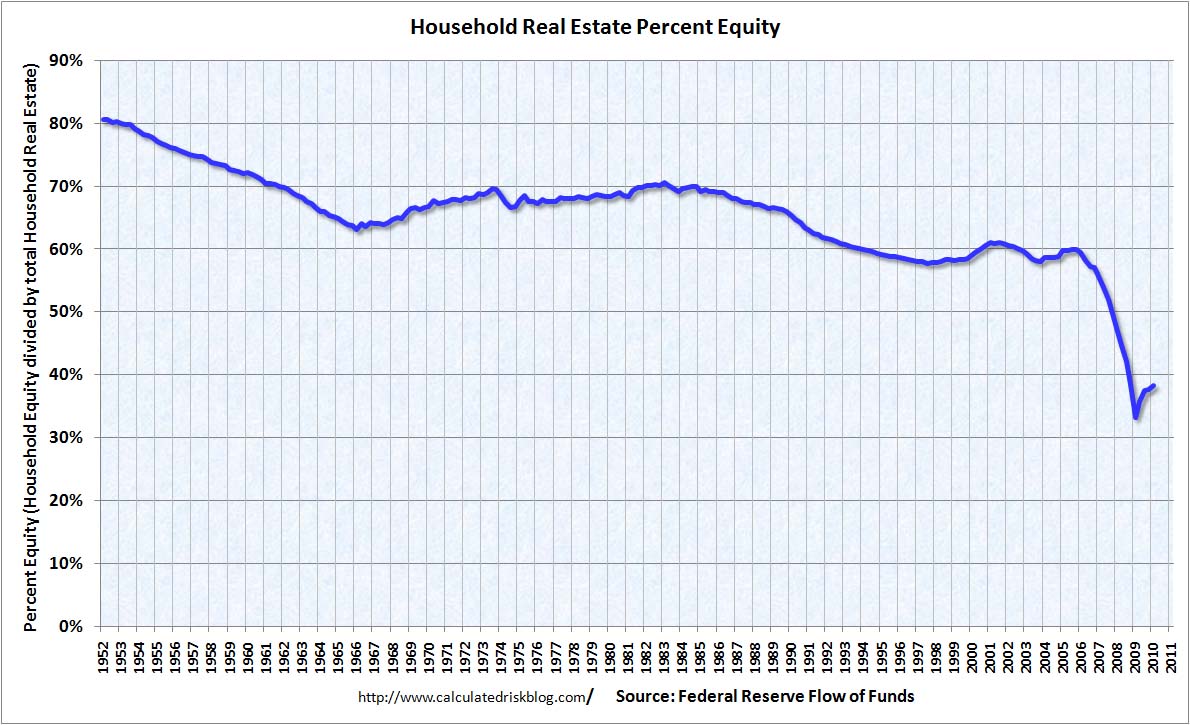

People tend to believe that quantitative easing will boost housing values. If $1.7 trillion didn’t boost values why would $600 billion?

Source:Â Calculated Risk

Homeowner’s equity is still trending lower. The only reason the actual figure has jumped a bit recently is because of all the foreclosures. After all, once someone loses their home you can’t use that in the figures above but the pain is still very real. The Fed is gambling large and the U.S. dollar is at the center here. They make it no secret that higher inflation is what they are seeking. But personal incomes are not going up. In fact, the income data is downright scary for the U.S.:

“(Sudden Debt) The largest group of wage earners – a massive 24 million or 16% of the total – made between 1 red cent and $4,999.99. On average they earned $2,016.

The average wage for everyone was $39,054, but the median was a mere $26,261. Two thirds of all workers made less than $40,000.â€

The median wage in the U.S. is $26,261 based on Social Security data. This makes sense given the median household income from Census data shows it at $50,000. How is the Fed going to juice incomes with quantitative easing just by keeping interest rates lower? The major risk we will now face is another bubble elsewhere as banks begin chasing profits elsewhere but how does this help the American economy? The Fed is essentially turning into the rating agencies of a few years ago. They are gambling with the seal of approval of the U.S. and allowing banks to use the American credit standard to speculate in a number of toxic items. We need to remember that brand needs to be protected and right now the banking system is stomping on the brand that is the U.S. dollar.

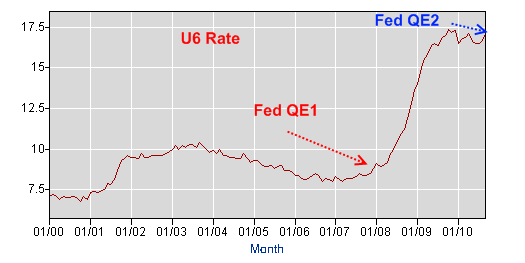

There is little evidence that the past intervention from the Fed has helped the American economy. Unemployment and underemployment is up to 17.1 percent. The Fed went into this dark abyss in 2008:

If we look at the unemployment and underemployment rate which is a better measure of the health of the economy, we’ll notice that QE1 did very little in stopping the underemployment rate from spiking by 70 percent in two years:

When the Fed embarked on QE1 the U6 rate was at 10 percent. Today after the $1.7 trillion balance sheet expansion the unemployment and underemployment rate is up to 17.1 percent. It is no wonder why home prices are not moving anywhere. The proof is above. Why should we expect any different course moving forward? The reality is, the middle class is being exported abroad and banks are having full access to the taxpayer wallet to gamble globally.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Iowa Farmer said:

Gonna climb me a mountain, chop it down with the edge of my hand.

November 7th, 2010 at 8:19 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!