Stimulus Check Gone with Price of Oil: Running the Actual Numbers Behind the Non-Issue Stimulus Checks.

- 0 Comments

You may be wondering why the $150 billion stimulus package has had such a minimal impact on the markets and the general economy. The problem is, the entire stimulus package was spent merely keeping up with rising oil prices. Since the start of the year, oil has gone from $95 to $145 to the current $136. Yet we have remained in the high area for sometime. So let us take some rough estimates from the last month to see how many days it took to wipe out that stimulus.For the month of June, oil per barrel averaged $130. This is 36 percent higher than the $95 point we started at in the beginning of the year. So let us look at some data:

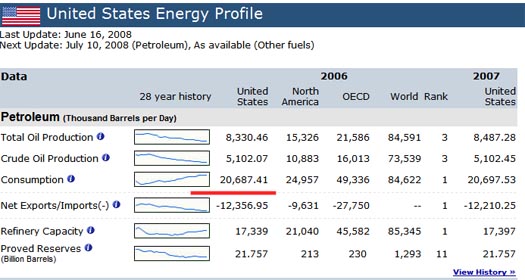

We consume 20.687 million barrels of oil a day. So let us run some quick math here:

January starting price $95/bbl = $1.965 billion per day spent on oil (30 day total = $58.95 billion)

June average price of $130/bbl = $2.689 billion per day spent on oil (30 day total = $80.67 billion)

$80.76 – $58.95 = $21.81 billion more spent on fuel in one month alone

Now factor in that we’ve been spending more for fuel in January, February, March, and every other month up until now and you’ll quickly realize why the stimulus check is essentially wiped out simply because of fuel prices.

This isn’t even factoring in the amount of equity lost in housing. The Case-Shiller in this same timeframe went from a yearly loss in the lower single digit to the current point of being down 15% on a year over year basis. So now Americans have lost a significant portion of their equity in their primary asset.

In addition, all 3 major stock indexes are now in firm Bear Market territory. There goes the 401k or the IRA account.

Throw in the declining dollar and you know why Americans are feeling the pinch. The U.S. Dollar index has already lost an additional 5% since the year began:

And inflation is running at an annualized rate above 4% while wages remain stagnant. That is why even throwing $150 billion of stimulus into the market has done nothing. A second stimulus check will face the same fate because it will only cause more inflationary pressure down the road. This will force the dollar into a further decline thus increasing oil and finally making the entire stimulus point moot.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!