The Big Change and Four Rules not learned from the Great Depression – Break up the Banks, Protect Workers, Use Stimulus Funds for Jobs and not Banks, and a Government Protecting the People.

- 2 Comment

As we drift further and further from the abyss of March of 2009, there is a slow acceptance that things are getting better even though average Americans need only look at their individual household balance sheet to know this isn’t the case. How can things not be better they ask? The S&P 500 is now up 74 percent in one year, the strongest run up since the Great Depression. Yet Wall Street gets it that the longer they can stall and water down reform the more chance they have at getting away with the biggest wealth transfer in American history. Even during the Great Depression, we actually learned lessons and enforced new rules to curb the gambling that led to the collapse. This has yet to occur. Let us look at some changes that occurred during the 1930s that certainly have not happened this time.

In the book by Frederick Lewis Allen the Big Change the author takes us through some of the important changes that occurred during that economic crisis:

Rule Change #1 – Breaking up the Banks

“In the first place it rewrote a good many of the rules of the economic game as played in America. For instance, in order to prevent any recurrence of the financial follies of the nineteen-twenties, it divorced commercial banks from the securities business, forbade the issue of securities without exhaustive disclosure of pertinent facts, circumscribed pool operations on the stock exchanges and set up a federal agency to police these exchanges, and dismantled the more illogical holding-company structures in the utilities business. Not only was there a new rule book, but at many points the federal government moved in as umpire to interpret and enforce rules.â€

We have actually done the opposite this time by making banks even larger:

At a time when it was obvious that too big to fail banks were causing major problems, instead of breaking them apart as we had done during the Great Depression we started merging these banks and creating the bond between investment banking and commercial banking even stronger. This conflict of interest has skewered Americans even more now that Wall Street can gamble in the stock market with taxpayer money. The Big Change was written in the early 1950s and the changes after the Great Depression must have seemed so obvious. Yet here, we have JP Morgan Chase eating up Bear Stearns and Washington Mutual, you have Wells Fargo digesting Wachovia, and Bank of America purchasing Merrill Lynch all during the crisis. Instead of breaking up the banks, we have made them even more powerful and most of their current profits come from their investment arms! They are pulling back credit to average Americans while gambling away in the stock market. They can borrow from the Federal Reserve at near zero percent and put that money to work in the casino. No wonder why the 74 percent rally doesn’t seem to make people feel better:

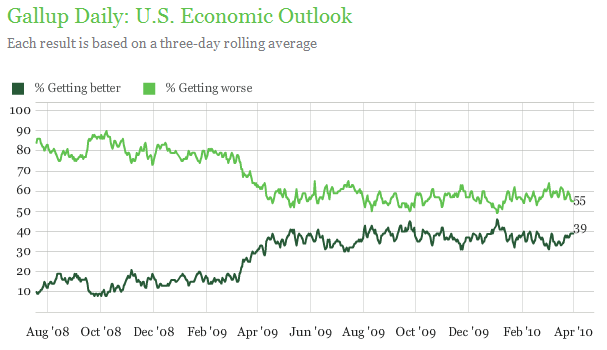

55 percent of Americans still feel that economic conditions are getting worse. Could this be because the banking system has created a new corporatocracy that serves only their tiny purpose? Wall Street wants the middle class to cheer on their mega profits as if this is the true symbol of recovery. The fact that we did not break up the banks, but merged and made them bigger tells us that we have failed to learn a primary lesson from the Great Depression.

Rule Change #2 – Protecting the Worker

In no other time in history has the middle class in America been so ripped off with no criminal investigations as what occurred during the last decade. During the Great Depression the government stepped in to protect workers; this time it has stepped in to protect the banks:

“In the second place, it intervened extensively in the economic game as protector of the underdog. For instance, because the operations of one of the old-time rules of the game, the law of supply and demand, appeared to be doing damage to the American farmer, it stepped in to jack up and then to guarantee the prices he got. (The anomalous result was that the farmers of the United States, as conservative a group temperamentally as were to be found in the land, became dependent for their very economic lives upon government decisions in their behalf!)â€

Now many of these policies did not work but it was clear on which side of the fence the government stood. Today, even after the massive transfer of wealth to Wall Street banks are still robbing people with the zest of a criminal knowing he is getting away:

“(NY Times) PHOENIX — When the bank sued Leann Weaver for not paying her credit card balance, her reaction was typical for someone in that situation. Personal and financial setbacks weighed her down, and she knew she owed the $2,470. So she never went to court to defend herself.

She was startled by what happened next. When she swiped her debit card at the grocery store, it was declined. It turned out Capital One Bank had taken $224.25 from her paycheck, a quarter of her wages for two weeks of work at a retail chain, and her bank account was overdrawn.

“They’re kicking somebody who’s already in the dirt,†she said.â€

Banks and collection agencies are acting like loan sharks and going after the poorest in our population. Not only are they going after the initial debt, but with such usury rates they are doubling and tripling and sometimes going after more from those least able afford it. The government is nowhere to be found. In the Great Depression we learned that the banking system can suck the life out of the working class and here we are allowing the same banking system cut from the same cloth to rip off our fellow neighbors and family members. Instead of calling foul and stepping in it seems that the government is encouraging this behavior from Wall Street and the financial industry.

Rule Change #3 – Fiscal Stimulus went to Building Things, not Banks

One major difference between today and the Great Depression was the first focus of many of the initiatives was getting people back to work. The fiscal stimulus went to building things. This time, we spent even more but it went into the pockets of banks which is the biggest crime of this fiscal disaster:

“In the third place, it went into the active business of stimulating employment, by building dams, bridges, parkways, and playgrounds of the grand scale, and by putting even the recipients of relief to work at all manner of enterprises carefully concocted so as not to interfere with private business: and it set up the Tennessee Valley Authority to do a combined job of competing with the private electric utilities, preventing floods, and teaching farmers some of the principles of conservation.â€

In this fiscal stimulus era we got the worse of both worlds:

-$700 billion TARP to banks

-$200 billion to nationalize Fannie Mae and Freddie Mac

-$29 billion to bail out Bear Stearns

-$150 billion for AIG

-$350 billion for Citigroup

-$87 billion to JP Morgan for bad Lehman Brothers trades

-$200 billion in loans to banks from TAF

-$50 billion for temporary IOUs for money market accounts

-$500 billion to rescue other credit markets

The list goes on but how are the above massive targeted employment creating activities? In the end we have given or backstopped some $13 trillion in bailouts for the banks. Then, we spend a few billion in job creation activities just to say we have. This is like the one token vegetable on a plate of massive prime rib banking funds. Is it any wonder that it has taken over two years to produce a month with 100,000+ job growth? And a large number of those jobs are low wage or include 40,000+ from Census hiring.

Rule Change #4 – The New Government

During the Great Depression, whatever you may think of the policies, the government stood much closer to the people than today:

“The result of all these interventions – the reform measures, the subsidies and guarantees, the public works, the encouragement of labor, and the attempt to steer the economy as a whole – was certainly not a socialist order, at least in the old sense of the government’s taking over the management of business and industry. For the management of the vast variety of concerns remained in private hands (though it was so often hedged in by regulations, bedeviled by taxes, and opposed by unions that many an executive felt himself a prisoner of government and labor). Nor was it a free economic order, at least in the old sense of an order in which everybody’s economic fortunes were determined by the action of buyers and sellers in the open market, with the government standing aside as Herbert Hoover had tried to stand aside in 1930-31. It was something between the two: one might call it a repaired and modified form of capitalism in which – to revert to our earlier figure of speech – the government umpires were forever blowing their whistles and rushing onto the field to penalize this player or that, or to pace off a fifteen-yard gain for a hard-pressed team.â€

The government today and for the last few decades has been bought by the corporatocracy. They are back to making their revenue in the same manner as they have always done! Nothing has changed. The only thing that has changed is the middle class is trillions poorer while banks somehow have trillions more in taxpayer funds. The transfer of wealth is so obvious and many Americans are waking up to this. We have not learned primary lessons from the Great Depression. We are now on path to another crisis because nothing has changed. After all, if nothing has changed then why should we expect a different result?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Kurt said:

I’m not particularly fond of labor unions, but I do think that the American worker has been unjustly overthrown, in favor of increased profits on Wall Street.

It’s shameful that companies would fire thousands, in pursuit of a nickel’s worth of profit per share.

April 8th, 2010 at 11:33 am -

CLARENCE SWINNEY said:

Excuse me. I am pissed off old man.

In past year I have copied thousands of artilces, read many books and WASTED HUNDREDS OF HOURS that, at my 85 , i cannot afford.Why? Every damned piece of information I sought for my book was in front of me on just a few hundred pages.

YOUR FORUM. It has all I needed.

The more I read of it the angrier I get.

My 35 years as a Business Executive, I thought, taught me how to seek information without wasting time.

I addressed it in my book—Lifeaholic-story of Workaholic to Lifeaholic.

I is jist a stoopidf ole man.

clarence swinney

old ugly stoopid–honest.April 19th, 2010 at 5:43 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!