The End of the Peak Credit Era: 3 Quarters of Contracting Consumer Debt. Credit Card debt Contracts on a Year over Year Basis for First Time Ever.

- 2 Comment

There is a small silver lining in the unemployment report released on Friday. The positive side was the amount of people being fired slowed down in July (if you can call an annual rate of 3 million layoffs positive). However, there is still a major reluctance for firms to hire. We still have 26,000,000 unemployed and underemployed Americans in the country. Many have been relying on the plastic support of credit cards to ease the pain of the deep recession. Yet many are finding out that they are unable to have access to the once abundant lines of credit. It may be the case that we have witnessed peak consumer debt.

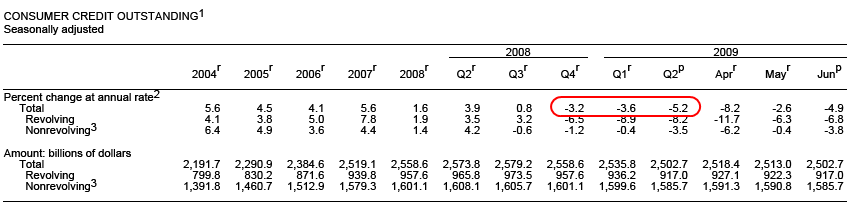

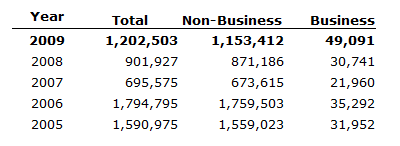

Even though some 8 million credit cards were yanked earlier in the year, many consumers are simply embracing a more frugal lifestyle. The contraction is occurring from both sides in that consumers are being more watchful on what they spend while lenders are actually vetting more carefully who they give credit to. The latest consumer credit report from the Federal Reserve shows that the trend in less consumption is still going strong:

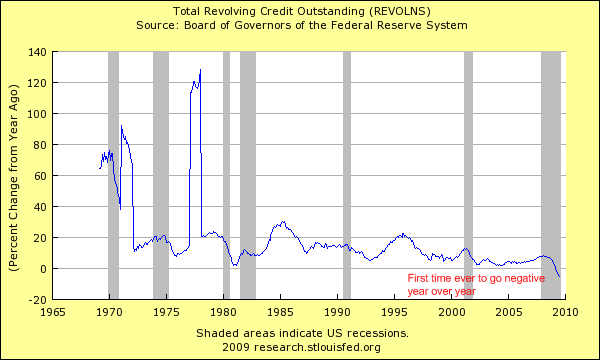

This is now the third consecutive quarter of credit contracting. Keep in mind this is debt that is already used up. These were purchases of flat screen televisions, food, vacations, and many items that have already been used up. The lines of credit are being pulled back at the same time. Credit card companies are hiking up minimum payments and charging higher rates to make up for the rising amount of defaults occurring in the country and they are also squeezing their prime credit borrowers. The last option may be counterproductive in the long-term. Now you might look at this contraction and think that it is no big deal. It is an enormous deal. This is the first time on record that consumer debt has contracted on a year over year basis:

Some 40 years of data and not once has consumer debt pulled back on an annual basis. It is a rather fascinating phenomenon when you pause to contemplate the massive unrelenting growth in debt over the past four decades. Americans are now having to deal with less access to cheap debt. And that is probably an important caveat to note. The days of 0 percent credit cards and no money down loans for homes are probably long gone. We see that Fannie Mae has posted a loss of over $10 billion for the second quarter and these are the more “safer” loans in the market. With unemployment this high, many people were using their credit card as a bridge loan to get through this tough patch of time.

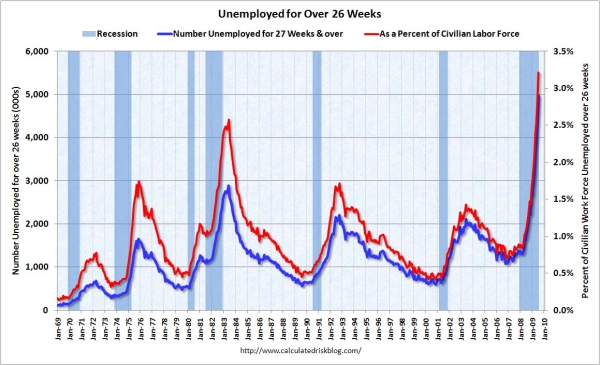

Much of the drain that is occurring is also because we have never seen so many people unemployed for such a longtime:

*Source:Â Calculated Risk

This is a troubling sign and has also increased the amount of bankruptcies that we are seeing. Peak debt was bound to happen at some point in time. The massive 30 year housing bubble was simply unsustainable. Spending more than you earn will eventually catch up with you. The U.S. Treasury and Federal Reserve are focused on saving the banks and Wall Street and the rest of Americans will need to fend for themselves. You would think with all this new found liquidity that banks would somehow pass it on to the average consumer. Unfortunately that is the line they sold to the public to get the bailouts passed. Remember all that talk about credit being the lifeblood of the economy? Apparently not since companies are chopping back credit for regular consumers. What was pushed through was essentially last minute expensive measures to ensure the banking syndicate remained in place. The bailouts were to fix their balance sheets. Now with taxpayer money in hand, they are squeezing the vice around the actual taxpayer that has saved them from failing. It is really a perverse system when you think about.

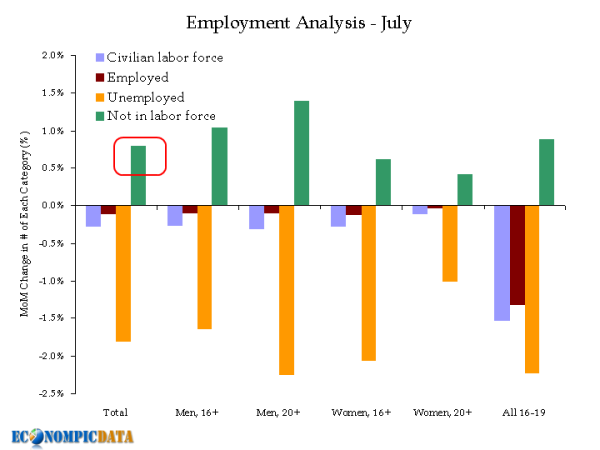

The average credit card rate has all shot up during this time when liquidity was being made abundant to 14.43 percent. With rising unemployment, this is still a major problem. You might be asking why did the unemployment rate drop to 9.4% when 247,000 people lost their job last month. Simply put, people left the labor force:

*Source:Â Econompicdata

And with this combined, it shouldn’t come as a surprise that even with tougher bankruptcy regulations, more people are filing for bankruptcy:

Although it is better news that the layoff number wasn’t so grim, the fact that many left the labor force and companies are not hiring should cause you to pause as to what really constitutes a recovery. The peak credit era is over and we will need to remake our economy into a completely different machine.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Gordon's Credit Report said:

Credit Card debt Contracts on a Year over Year Basis gives insights into the fate of the credit card consumers.

August 8th, 2009 at 2:07 am -

JP Merzetti said:

Contracting credit due to lack of payback resources….I would imagine that a lot of people would still grab more credit if they could get it…..

– reminds me of a junkie’s dilemma. Sad.

Sadder still: banks don’t need to invest in anything that creates healthy and sustainable job markets.

Corporate business can court rising middle classes elsewhere (China, India?)

When the American consumer machine becomes expendable, will they just let the thing fall apart and junk it, rather than fix it?

If it wasn’t so tragic, it would be funny, sifting through the rhetoric that passes for official explanations as to how this all came about.

It’s really been unravelling like a slow motion “instant” playback…40 years’ worth.

When American don’t have their “dream” anymore, does that mean they finally wake up?

It’s a hungry world out there – a lot hungrier than it’s been here since the dust bowl days. Did we fatten up our resource base, or just grow soft in the middle?March 27th, 2010 at 8:13 pm