Credit card companies shut down 8 million credit card accounts in February while accepting more Bailout Credit Cards from the U.S. Treasury. 400 Million Credit Card Accounts still open.

- 0 Comments

Many American households have been strapped for money for many years. The benefit of having a debt bubble is the ability to cover up troubling economic trends and drown out any noise while people feed at the bubble. During this time, credit was easily accessible and many families used credit cards as a bridge loan to hold them over for another month. That lifeline is becoming more and more limited. That is why we are seeing bankruptcies jumping sky high in the latest filings with U.S. courts. In news that will make life harder for more on the edge, credit card companies pulled 8 million credit card accounts in February. The peak number of credit cards was reached in July of 2008 at 483 million. The current number of credit card accounts open is 400 million.

In addition, the amount of credit limits has also fallen. From the peak, credit lines have fallen by $320 billion. That is, American consumers no longer have access to that credit. And as a company, this is a smart move since many American families have been over spending for years but this couldn’t occur at a worse time. The irony here of course is while American households are getting their credit yanked, the government is extending various credit programs to banks and Wall Street. This double standard is infuriating to a public that is witnessing their money paying for massive bailouts while their access to funds is dwindling given that we now have 24 million Americans that are unemployed or underemployed.

Mortgage delinquencies are also rising at the same time. 39.8 percent of subprime borrowers are now 30 days behind their mortgage payment. This is up from 23.7 percent last year. Close to 1 out of 2 subprime borrowers are now late with their payment. This is an astonishing figure. A more disturbing number is now 7 percent of all homeowners with a mortgage are now 30 days late, a jump of 50 percent from a year ago.

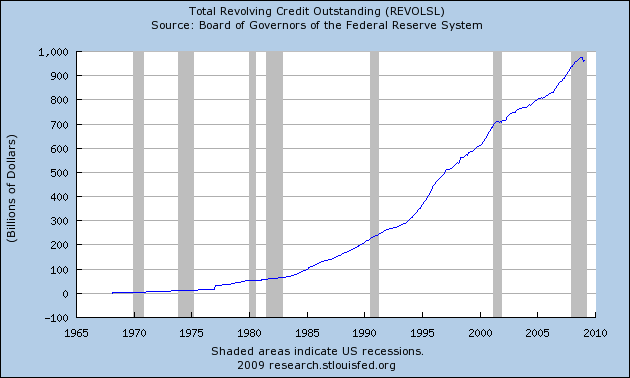

The growth of revolving credit has been exponential since the early 1980s:

In the most recent data $961 billion in outstanding revolving debt is out on the market. The credit limit out on the market is $3.27 trillion. So with the $320 billion drop in credit limits, many people are now at risk of getting slapped with a worse FICO score! How? Well one component of FICO is your debt to limit ratios. So if you had $800 on a $2,000 card, your ratio is 40 percent. But say your line got cut to $1,000, your ratio is now pushed up to 80 percent and you didn’t spend anymore. Such are the unintended consequences of our current debt crisis.

And you can expect many more people to start defaulting on loans as credit card companies try to squeeze even good card buyers for every penny they got. Many recent stories are popping up where a borrower with a good credit score took out $5,000 fixed for the life of the loan at 5% only to see that rate jump up to 19% because of some random reason. It is outrageous what these companies are doing especially when many are benefitting (in fact, owe their life) to the taxpayer. No wonder why there is so much anger floating out in the public.

Again looking at the chart, this is another ominous sign of the times. This explosion in debt is symptomatic of the problems in our economy. Stagnant wages have been here for a decade yet the expansion in the housing bubble and consumer debt gave the façade of an actual booming economy. The only thing that was booming was debt and now that it is crashing, the system is morphing into something utterly different.

Lenders are doing what they should have always done. Be more careful with lending money out. But consumers realizing the government is not going to help them are now saving more to protect their financial vitality. In the mind of the government, all we need to do is inject enough credit and we’ll be back to the good old days. That isn’t the case. This recession is deep enough and will be painful enough that you will have a generation that doesn’t view debt the same way. This is already the longest recession since the Great Depression. So many Americans from this point on, will never view debt in the same way. When do you think we’ll hear people say, “real estate never goes down” again in a steady chorus? Those are days long gone.

Many policies are under the impression that we’ll somehow be back to peak credit. I’m not sure we will be there. Just take a look at what the credit card companies are doing. The last thing they are doing is extending more lines of credit. So we are seeing an actual contraction in the availability of credit to borrowers. Many consumers now have to rely on saved money, a concept that is now taking hold on a wider scale.

It is impossible to spend yourself out of a recession especially if a large part of the recession was based on over spending. Cutting credit cards to consumers is smart. Cutting credit cards to banks and Wall Street is genius.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!