Wells Fargo: $865 Billion in Loans. Time to Really Examine the Wells Fargo $3 Billion First Quarter Expected Bounce. $57 billion in Pick-a-Pay Loans Still Waiting.

- 6 Comment

It was rather stunning to see the market react so positively to a bank that has received $25 billion in taxpayer money turn a profit of $3 billion in the first quarter, which also included the FASB mark to market rule adjustment. What many people have seemed to forget in the last few weeks is that Wells Fargo in their infinite wisdom took over Wachovia. Wachovia for many of those who do not know swallowed uber toxic mortgage dealer Golden West that ultimately led to the demise of the bank because of mortgage indigestion. So Wachoiva was swallowed up by Wells Fargo in a shotgun marriage similar to JP Morgan Chase taking the entirety of Washington Mutual.

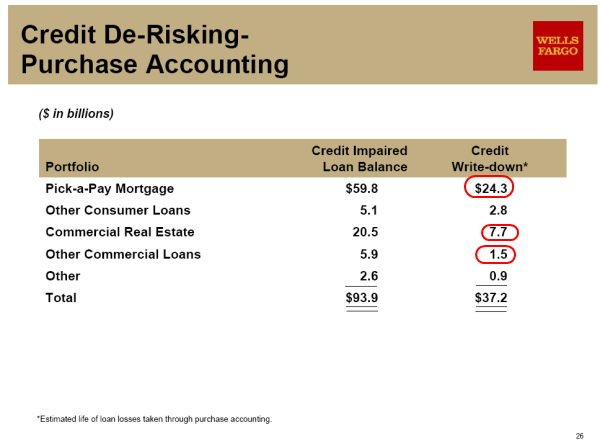

What brought down WaMu and Wachoiva were toxic liar loans. Sadly, many of these loans still sit in the massive $865 billion loan portfolio over at Wells Fargo. We will have to wait a couple of weeks before we get full details but take a look at where things were at in the Q4 of 2008:

Well look at that. Tons of pick-a-pay mortgages are still on the books. A large portion of commercial loans as well. Keep in mind Wachovia made tons of these loans in California and many of these are only hitting their stride recasting in a state with one of the highest unemployment rate in the country. It probably doesn’t help that home values have fallen by 50% but thanks to new accounting methods, we can forget about marking those assets to market. If you were to sell these homes, you might get $250,000 but let them keep it on their books for $500,000.

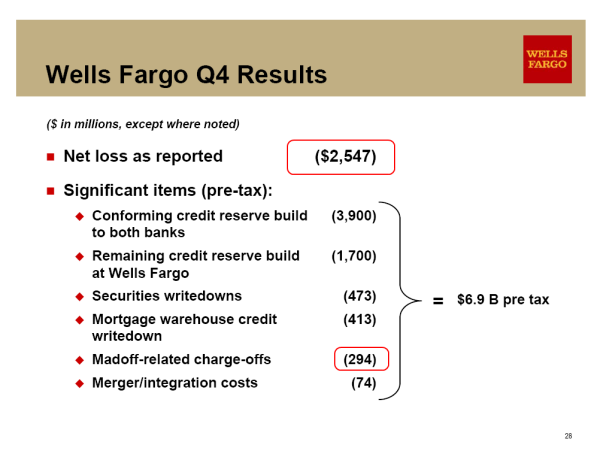

And for those of you with short term memories, Wells Fargo also took a hit by being intertwined with none other than Bernard Madoff:

So this supposed $3 billion earnings quarter is on the back of a $2.5 billion loss last quarter. $25 billion in taxpayer money, changing accounting rules, having the Fed sacrifice the dollar for cheap mortgage rates, and all you get is a $3 billion quarter?

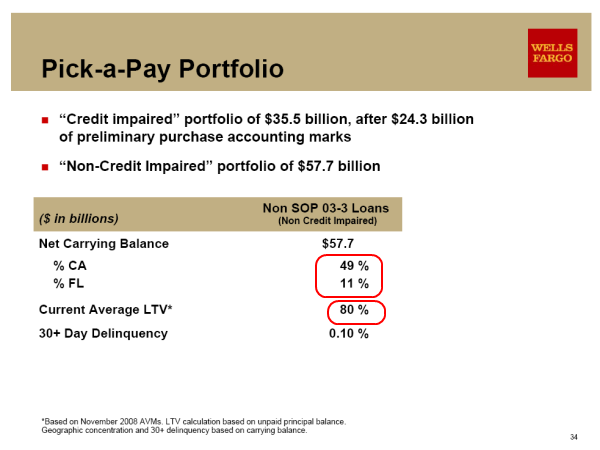

Of the pick-a-pay portfolio $57.7 billion is still sitting in “non-impaired status” which is insane. How much exposure do they have to the most toxic states?

Rest assured if these homes were put on the market, you would easily have a $3 billion loss. California has a 10.5% unemployment rate, but more like a 16 to 19 percent rate if we do a better calculation. These pick-a-pay loans are the most toxic of mortgages. To think these are not going to have further losses is insane.

So how did Wells Fargo pull it off?

-$175 billion in loan commitments, mortgage originations, and mortgage securities purchases.

-$190 billion in mortgage applications for over 800,000 homeowners

-Funded $100 billion in mortgage loans, helping over 450,000 homeowners either purchase a home or lower their payment through refinancing.

We aren’t told the value of those refinancing versus those who are purchasing. This is a key factor. It is very likely the majority of these loans are refinances with the record low rates. Once we get results, we’ll be better able to see what is occurring.

Bottom line, this is a one hit wonder because of mark to market freezes, TARP funds, lower interest rate hitting a trough, and a pause before those pick-a-pays start recasting in mass. Keep in mind, this is the lowest mortgage rates are going to get. We have only one way to go from here and that is up. There is a reason why the government decided to hold on releasing those stress test results until all banks reported earnings.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

jay said:

I will not be surprised to see that once this financial and econmic crisis changes the landscape of America within next a year or two, the Wells Fargo executives, Borad members and accountants will be heading to prison for their criminal activities and swindling of American home owners, shareholders and taxpayers. They don’t know what they are doing would destroy their lives and families. It is sad.

April 10th, 2009 at 8:02 am -

RICHARD RALPH ROEHL. Los Angeles, CA. said:

And how will all this translate into a stable and viable economy in the United $tates of consumer Amerika… when the retail price of gasoline goes back to $4.50 a gallon in 2010? And then $hoots the moon after the collapse of the petro-dollar in 2011 (or before that)?

Peak oil is still out there! Old Coyote Knose… there are too many consumers on Earth, a host organism of finite space and finite resources. This means that the Doctrine of Perpetual Growth in a $ociety that consumes 36% of the world’s resources cannot be sustained.

You are seeing a ‘daed cat bounce’ here. Denial and deny-all won’t prevent the calamity that’s coming. Can ewe folks hear the whistle? It’s a freight train headed for your peace of mind… and it shall bring third world conditions to most of Amerika before 2012.

April 10th, 2009 at 4:29 pm -

eattherich said:

I’ll tell you what, if these Banks coming crying for money in the next month or two, I’ll be pissed. Especially in light of all this “positive” news being proclaimed which has skyrocketed the stock market. Howard Atkins (CFO) was on CNBC on Friday telling us all how wonderful things are for Wells.

http://www.cnbc.com/id/30133484

I hope he is telling the truth, and being forthright with the investing public, and the taxpayer that is funding some of his operations.

I think he is slime. Sorry to say. I think there is much more to this story. And I will personally hold Mr. Atkins responsible for his actions and words, if deceptive.

April 10th, 2009 at 5:26 pm -

Wyatt Perk said:

True#sforBofA,JPM,C,FreddieMac,&FannieMae=Loanswith Late PaymentsvsForeclosure-See Links

Bill Moreland

Sent: Friday, April 10, 2009 4:26 PM

Subject:

Re: What are the true #s for BofA , JPM, C , FreddieMac , & Fannie Mae? = in Loans with Late payment vs in

Foreclosure/Default?

How many Divatitives in volume & dollar amt ., $$$ Amt ., of Toxi Loans

I’m pulling strictly the reported delinquency numbers for the top 11 lending portfolios. The elements are

30-89 days past due & 90+ past due. I also get Charge Offs, Recoveries & Non-Accrual numbers for

each of the 11 loan portfolios.

The Call Reports do not break down Foreclosures for each of the portfolios. That number MAY be reported

in the Call Reports, but I’m not familiar with it. If it is there I’m not currently pulling it down.

Derivatives are in the Call Reports, but I am not pulling it down. The following link takes you to the SDI

Definitions & Download section:

www2.fdic.gov/sdi/main.asp

Enter the Definitions section and then you call scroll through the available data on the left hand side. The Derivatives

section is half way down on the left. It will explain what is captured and available. To get to it for a bank either do a search

on a call report: https://cdr.ffiec.gov/public/

Or you can get it from the SDI download. I hope this helps. Let me know if you have any more questions.

April 10th, 2009 at 6:13 pm -

Holocaust Gaza said:

@jay

Nobody will be ever held accountable.

April 11th, 2009 at 1:09 am -

Tim Burnett said:

Wells Fargo is another Madoff in the making. Too sad, Wells Fargo Vice-Presidents ( it seems that most everyone at Wells Fargo is a Vice-President of a department or another) have no idea that they may end up in jail one day for their wrong doings, for ruining hard working American people. So be it .

October 13th, 2009 at 6:30 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!