The Only Certain Bet in this Market is paying Down Debt. Credit Card Rates Rise as Other Interest Rates Drop. $866 Billion in Revolving Debt Still Remains.

- 2 Comment

The global economy remains on unstable footing as we see debt problems slam the European markets with Greece in the current spotlight. Yet the problem of debt is not unique to Greece itself and it is fascinating that the world is only focusing on one country. The average American over the past four decades has taken on so much debt that household debt outstanding is now equivalent to the U.S. annual GDP. The biggest amount of debt is with mortgage debt. Yet with mortgage debt you are securing the mortgage to ideally a property that will reflect the amount of debt linked to the home. Part of the housing bubble problem stems from the hyper inflated values of homes and now we are seeing the ramifications of this with millions of homes being foreclosed on. But another large part of this bubble was around the usage of credit cards that hit their apex during this crisis:

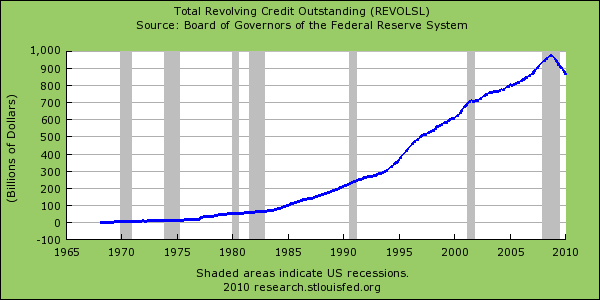

For nearly four decades Americans’ love affair with credit cards grew unabated. The amount of credit card debt outstanding hit an apex in 2007 at the height of the bubble reaching $975 billion in debt (to put this in perspective Greece’s GDP is $367 billion and their current deficit is 12.7 percent of economic output). Unlike mortgage debt or even auto debt, there is nothing securing credit card debt. This can be someone going to a club and buying $300 in drinks for friends or taking a trip to Antigua and spending thousands and charging it up on easy plastic. It can also be in the form of consumer goods consumption like buying a new television set or additional appliances. Yet for the first time since data on revolving debt has been kept we have now seen it contract on a yearly basis. And part of this contraction stems from the Great Recession but also more people are paying down extremely expensive debt:

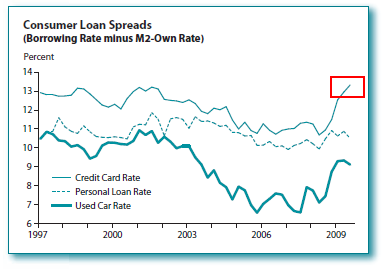

The above data comes from an interesting article from the St. Louis Federal Reserve. The author William T. Gavin examines the low interest rate and its impact on consumers. As his chart above highlights, even with the Federal Reserve lowering funds to record lows the average interest rate on credit cards has crept up even higher than in 2000 when the Fed funds rate was at 6.5 percent. With interest rates on savings accounts so low, it is definitely appealing for many consumers to pay down high interest rate credit cards down since this is a guaranteed return of 13, 15, 20, and even 79 percent on some credit cards. This low interest rate environment is creating some asymmetrical dynamics in the market. While the above shows interest rates on credit cards as being high, rates on savings accounts are extremely low:

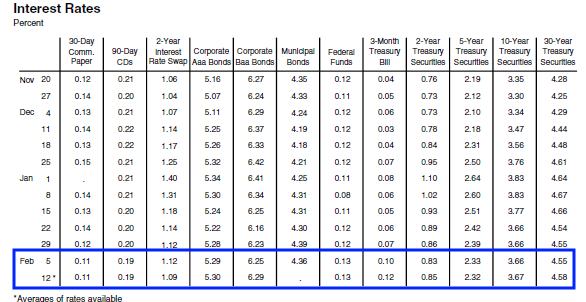

A 90 day certificate of deposit is currently yielding 0.19 percent, or slightly above the rate you would get by sticking your paycheck in the mattress of your bedroom. So even as we see the amount of revolving debt outstanding decline, there is still $866 billion in credit card debt outstanding. Credit card companies are losing money on charging off accounts as bankruptcies across the country rise. Many times credit card companies are hiking up the fees whether they are annual payments or jacking up interest rates on even good paying customers. In this environment it is rather clear that if you have high interest credit card debt, forget about the stock market and focus all your energy on paying down that high debt.

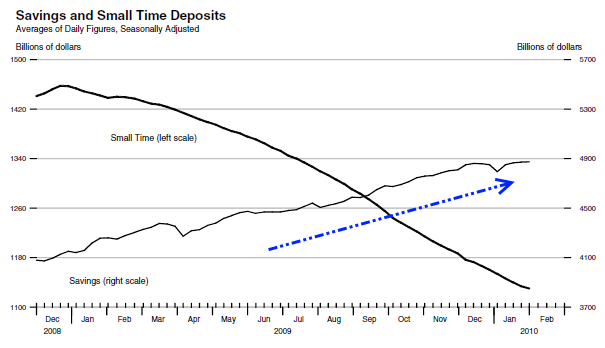

This interest rate spread on debt and savings is enormous. And as average Americans move their money to safer deposits as the stock market now reflects a speculative casino, many are wondering how they will do with such low rates:

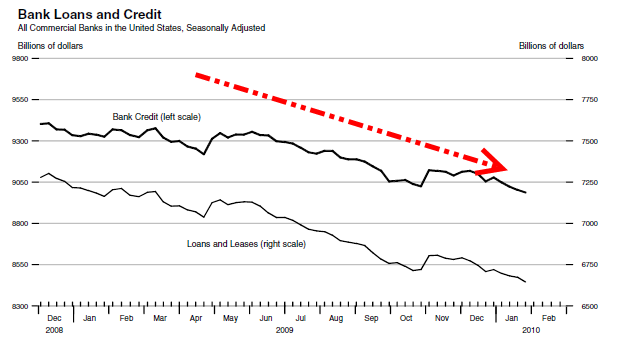

In this current environment it would seem that the best course of action is paying down high interest debt and more importantly, not spending beyond what you can reasonably afford. Unfortunately many Americans are now realizing that they do not have access to the same lending window banks have with their central bank. The bailouts were largely a method of shoring up the troubled assets within banks, not a bailout to help the balance sheet of average Americans. If banks had any faith in their customers you would see lending pick up once again. But this Great Recession has created a smaller number of quality borrowers. Or to be more accurate, there weren’t many quality borrowers to begin with over the past decade but that didn’t stop banks from making loans earlier in the decade. Once banks gained consciousness they slammed shut the door and they went into survival mode primarily by focusing on government support to keep them solvent.

Banks have very little desire to loan money when they are dealing with large imbalances on their internal accounts:

You don’t need the above chart to tell you that credit has contracted massively during this grand economic calamity. Just look at the amount of credit card solicitation you now receive in the mail. Long gone are those zero percent offers for 12 months. You might get a six month balance transfer offer at zero percent but you will find out in the small print the enormous 5 percent fee for moving any amount over. Or you might soon come to realize that your annual fee free card now has a service fee. These are the ways banks are trying to go after additional revenue streams from their customers (or if you like, taxpayers that saved them from extinction).

Until our system is reformed, these are the rules we have been given. If you have outstanding credit card debt ($866 billion tells us many do) start paying it down. Forget about the stock market for the moment. The stock market is highly volatile and with no real reforms yet, we are in for another crisis in the short-term since the same games that got us here are once again being played out. By paying down your credit card debt you are assured a fixed return for a defined set of time. In this current market, that is as close as you will get to any sort of guarantee.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Figaro said:

And what about the senior who has no debt but is still faced with getting along on 1/3 the interest CDs used to generate? He’s not part of the problem but he still has to suffer the consequences of all those debt abusers.

February 16th, 2010 at 7:09 pm -

Forty2 said:

What I don’t get are the weekly credit card apps and “convenience” checks, esp. the latter from Shitibank and BofA. It all goes right into the shredder.

I have zero debt. Apparently, the fix is to load us up with more. Sorry, dirtbags, you can’t force me to borrow.

February 16th, 2010 at 8:19 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!