The status of the working and middle class American worker for fall 2010 – 42 percent of unemployed persons had been jobless for 27 weeks or more. Young workers have the highest unemployment rate on record at 19.1 percent.

- 0 Comments

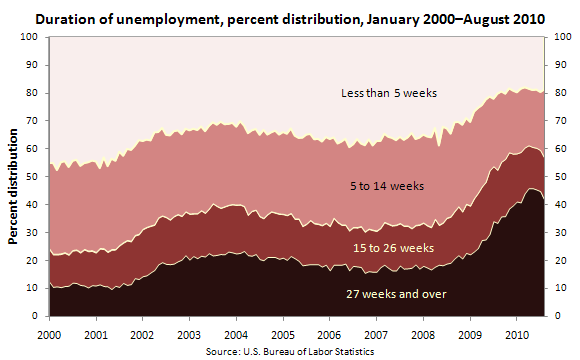

There can be no sustained recovery without putting Americans back to work. We live in an odd time where GDP can be going up while middle class America is slowly dismantled. Let us be clear that the employment situation hasn’t improved. The recent job gains are largely part of the Census hiring that is now coming to an end. The housing market is still seeing record amount of foreclosures, bankruptcies are on the rise, yet banks are somehow turning profits. If we look at the length of unemployment for displaced workers we realize that our economy is undergoing a fundamental shift. Working and middle class Americans will have a harder time achieving and staying in the middle class than only one generation ago. Let us first examine the persistent issue of long-term unemployment:

Source:Â BLS

42 percent of unemployed Americans have seen 27 weeks of being jobless or more. This is a modern record as a percentage. The little uptick on the chart above is largely based on people dropping out of the labor force completely. The private sector is having a tough time providing new jobs for these workers. The manufacturing industry that once was the backbone of our economy has been replaced by lower paying service sector work:

The top four industries that employ Americans barely pay a living wage. It is a commentary on our economic engine that manufacturing does not show up as one of the 10 largest occupations in the United States. The first big industry is retail sales followed by cashiers. When we look at our spending habits over the past decade, it is clear why Americans relied so heavily on debt to keep the illusion of a middle class lifestyle going. The charade had to come to an end and now many Americans are wondering what avenues are available to them if they ever wish to obtain a comfortable middle class lifestyle. If the recent Census report is any indication, it will become even more elusive for most Americans to even maintain what they currently have.

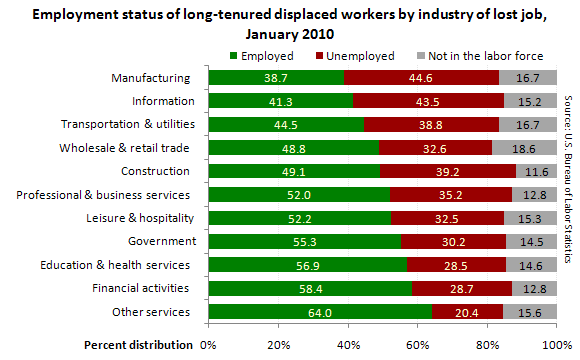

The chart below shows an interesting shift of the long-term unemployed:

It should be no surprise that the two biggest sectors with long-term displaced workers are manufacturing and information. The displacement of American manufacturing is no new thing and has been occurring since the 1970s. The shift in the information sector ramped up after the technology bubble popped. So what two industries seem to be doing better in terms of long-term unemployed workers? Education/health services and financial activities. It is interesting that financial services, an industry that one would expect to have permanently contracted with the collapse with the credit bubble seems to be doing better here. A large part of this success of course has to do with the very generous bailouts that protected the Wall Street financial industry. The health service category should be no surprise given the aging demographics of our country.

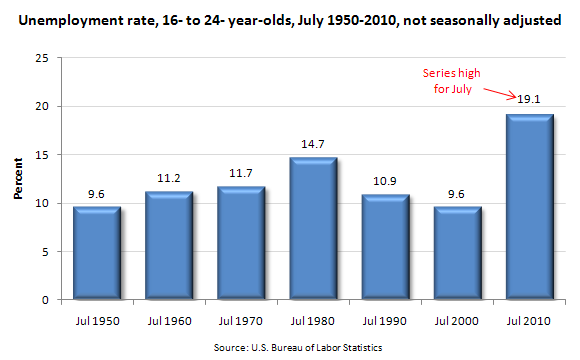

The youth of America rarely have a voice in the country yet their unemployment rate is now at a historical high:

The current unemployment rate for 16 to 24 year olds in America is 19.1 percent. You can only imagine what the underemployment rate is (30+ percent). This is a disturbing trend because research has shown that young workers that lag in terms of starting their career will never catch up financially to other cohorts. The fact that the unemployment rate is twice the rate of that in July of 2000 should be startling. The unemployment rate trend hasn’t really shifted even though the headlines state the economy stepped out of recession in the summer of 2009:

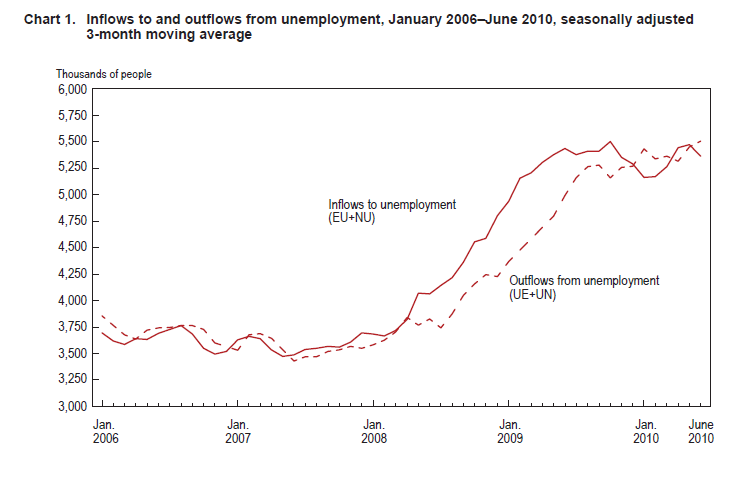

This is a troubling chart because what it shows is that Americans that become unemployed tend to stay unemployed for a longer duration than in past recessions. The chart hasn’t trended lower and until we see significant changes here, many Americans will feel as if they are deep in a recession. The stock market does not offer comfort to the millions out of work pondering how they will pay their bills. They are more concerned about finding a job instead of a too big to fail bank posting billion dollar profits on their speculative bets.

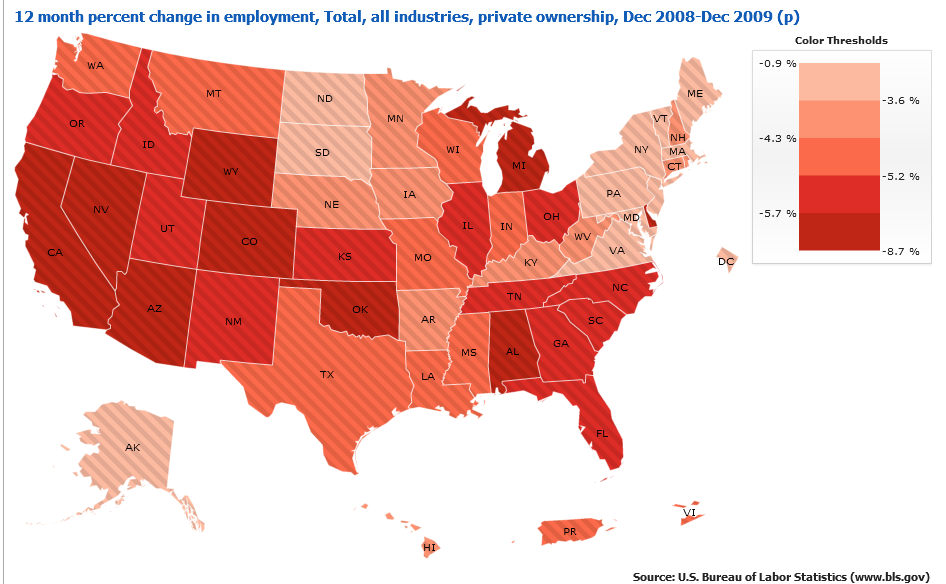

This crisis has hit across the country. Every state from December of 2008 to December of 2009 saw private sector job losses:

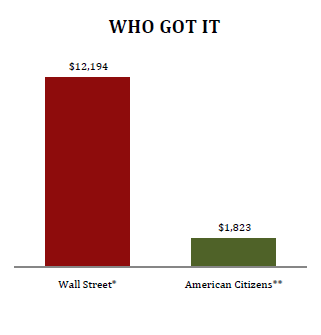

The current trend hasn’t reversed this. Most states are still near their troughs. We are in a holding pattern because of the trillions of dollars that went to the banks, some crumbs are falling to working and middle class Americans. Yet the bailouts were not evenly distributed:

Source:Â It Takes a Pillage, Billions of USD$

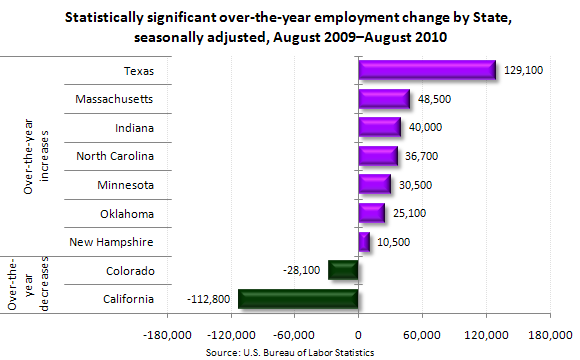

And some states seem to be doing better than others as well:

Until we can maintain steady employment growth across the country talk of a recovery rings hollow. Recent data showed that the median household income fell to $50,000 (a drop of $2000 from 2008 data). That won’t feel like a recovery to most. And with banks hoarding money and cutting access to credit for Americans there is no ability to pretend to be middle class anymore. Yet the dismantling of the middle class started in the 1970s and accelerated in 2000. The current unemployment rate doesn’t tell the entire story. 4 out of 10 Americans work in low paid service sector jobs. These people are counted as employed. In fact, many are part of the new class of “working poor†in America. 43 million Americans are in poverty as well. These are profound problems that we need to confront.

It was a big mistake focusing on the financial sector first as a method of getting the economy back on track. Three years later and the proof is in the job market. There is little point on trying to get jobs back on track with Wall Street banks still operating as they once did. What is the use of not systematically changing the system and adding jobs just so they can be lost in a few years when the next big bet fails and the taxpayer needs to bailout the banks again?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!