The Transfer of Risk from Wall Street to Main Street – How the Bailouts Shifted 3 Gigantic Risks from Wall Street in Housing, Banks, and Jobs to Average Americans.

- 3 Comment

There is a false security in our current economy. The belief that the current banking industry is now healthy simply because the government supports it is misguided in valuing the real risk inherent in back stopping Wall Street. Or the idea that deposits are safe up to $250,000 in commercial banks because the FDIC seal is on the door. Keep in mind the FDIC insurance fund is now insolvent. Or the notion that jobs are no longer needed for a recovery. This of course is all false. What has occurred under the veneer of stabilizing the banking sector is that the ultimate risk has now been transferred to the American taxpayer. It has already been made clear to Americans that no too big to fail bank will fail. Yet does this somehow fix the trillions in toxic assets that still remain? It doesn’t but what it does do is shifts the risk to the average American.

The banking industry and Wall Street is corroding the actual engine of our economy. GDP is growing but when you pull back the data, much of the profit comes from the banking sector and debt payments. Take for example the recent jobs report. A revision was made to the January jobs report last week that added over 1,200,000 more Americans who have lost their job in the last year. And this was somehow good news! The unemployment rate which comes from a separate survey dropped to 9.7 percent because a large number of people dropped off the employment radar. This is what goes for good news. Also, we have the troubling amount of commercial real estate loans with a value of $3.5 trillion now defaulting at record levels. Much of these loans are with too big to fail banks. To be blunt, it is now our problem. Let us go through the big risk transfers in this recession starting with jobs.

Risk One – Jobs

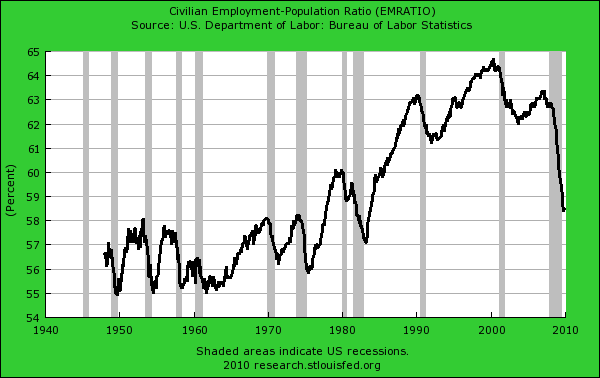

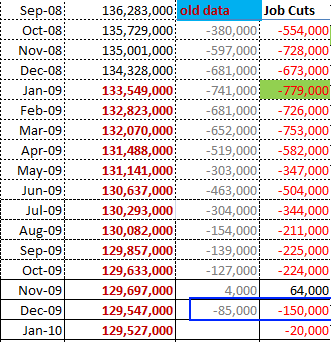

The above chart is one of the more important charts in measuring the actual unemployment problem. Average Americans are struggling to find work and those that do have jobs are finding it harder to maintain their wages. The unemployment rate is highly inaccurate in the short-term because of how it computes its rate. Think of last month were the unemployment rate dropped from 10 percent to 9.7 percent yet a revision on another survey showed an additional loss of 1.2 million jobs over the past year. This is straight out of 1984 economics. And the problem with this risk transfer is that we’ve been discounting headline job losses for over a year:

Instead of having one month with 700,000+ job cuts, the new revised data tells us we had 4 months at this rate! Even with the December data, instead of 85,000 jobs being lost we lost 150,000 jobs. Take a look at the above chart and you’ll see how much we were underrating the actual employment situation of Americans. This went on for over a year and here you have Wall Street betting stocks up on data that wasn’t even accurate. Who needs jobs when you have the taxpayer funding your casino that doesn’t even rely on accurate data? All you need to do is issue a revision a year later and say, “sorry, we just happened to find 1.2 million more actual jobs that were lost during this recession.â€

Risk Two – Banking

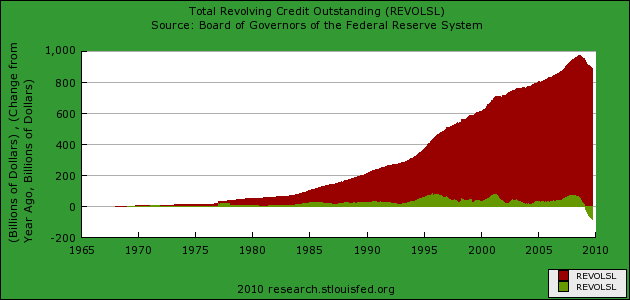

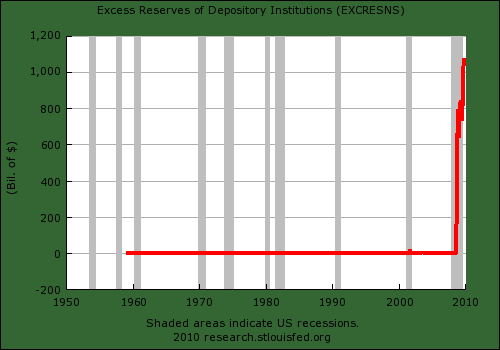

The banking sector by far has pushed the biggest risk onto the taxpayer. Wall Street and their new corporatacracy have created a system where gains are privatized and losses are socialized. It is the worst system possible for the American public. Have you noticed that since the massive bailouts, almost no kind of bad news phases the market? We have headlines that show commercial real estate showing losses of trillions in value and the stock market keeps going up. Foreclosures are occurring in the millions and people are losing their homes (foreclosures do cost banks money) but somehow banks keep turning profits. From where? They certainly aren’t lending the money to consumers:

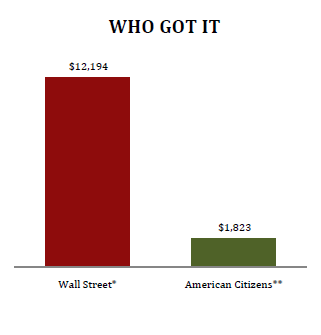

And banks are certainly not making mortgages with their own money. So where is the profit coming from? Simple. Any risk or loss has now been pushed to the taxpayer.  Why do you think banks are fine with people not paying their mortgage for months? Because they can still claim the asset at a peak value thanks to the suspension of mark to market and then make the bulk of their profits betting on the absurd stock market rally from March of 2009 that has shown no connection to reality based fundamentals. Here is the breakdown of the bailouts:

You would think that over $14 trillion in bailouts would create at least one net job but it hasn’t because much of the money has gone to transferring the wealth to Wall Street and the corporatacracy and shifting the risk to average Americans. Is that the deal we were looking for?

Risk Three – Housing

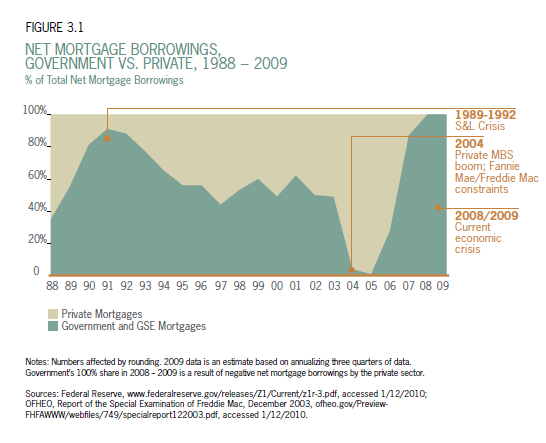

Yet at the core of this crisis, is the real estate market. Banks are now simply lending mortgages backed by the government serving as middlemen in the transaction:

The above chart should tell you everything you need to know about the current housing market. Banks have no faith in the average American. They are more than happy to lend out mortgages that are backed by the government (aka the taxpayers) and would rather hold onto their precious reserves to deal with the real problems in the market or make additional bets on Wall Street. That wasn’t really the initial deal since they pleaded for funds to keep lending going but have now decided it is more profitable to gamble against the American public with their own money. Take for example Goldman Sachs that created and bet against the same mortgage backed securities that it was pushing to clients. When things went kaboom, it simply decided to get the American government to bail it out. In other words, the market was trying to flush them out of the system because of their horrible structure yet their corporatacracy connections allowed them to survive and now thrive with the taxpayer as their funder.

Take a careful look at the chart above. Since 1988 we have never seen this much government backed loans in the housing market. Banks are not lending from their own money because they know what is going on:

Banks have held on tight to their excess (bailout) reserves. Even with a 0.25 interest rate they have more incentive to hold onto this money then lend it out to the public. The Federal Reserve can easily increase lending from member banks. All it would need to do is drop the interest rate or even better, charge banks a fee (heck, banks charge a fee for everything to average Americans) and banks would start lending some of that money. Yet referring back to risk #1 above, Americans are dealing with an economy with very few jobs and low hiring. So who are they going to lend to?

It should be abundantly clear that risk has been shifted to the average American with no upside or even change on how we do business. We are way beyond incremental change at this point. So what can we do? Break up the too big to fail banks. Enough with the government backing every mortgage being pumped out. How about we get better measures of employment? These would be a few things that would mitigate the risk now placed on the shoulders of an already struggling middle class America.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

TobyBo said:

Banks pay a fee for FDIC insurance.Perhaps another condition for insurance could be a minimum rate for savings.Let non FDIC banks advertise that they are free market deregulated without insurance paying 1%.

Banks can get capital from the Federal Reserve for less than me so I took my money out of savings and store it as cash in protest.Credit Unions do the same thing so I have no sympathy for them either.

Little banks put up posters of smiling customers that instruct us to be happy.The smiling bankers on Capitol Hill remind me of those posters and so will the smiling campaign ads.

February 9th, 2010 at 2:51 pm -

Jimbo said:

It’s time to punish the Wall Street mafia.

February 10th, 2010 at 6:11 am -

fran said:

All our policies are set up for us to lose and them to win, everything is a joke:

The Indymac Slap in our Face. 02.08.10

http://www.thinkbigworksmall.com/mypage/player/tbws/23088/1540466February 10th, 2010 at 9:46 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!