The Unemployment and Jobless Recovery Myth – California Average Underemployment Rate for 2009 at 21 Percent. The Middle Class Destruction through Unemployment Corporate Jargon.

- 1 Comment

It is amazing how many financial analysts usually from the too big to fail banks have gone onto the media circuit to claim that employment is always a lagging indicator in economic recoveries. They preach this belief as if it were a law like thermodynamics. These same people who never envisioned a stock market collapse rivaling the Great Depression now want the public to believe their flawed doctrine of economic prosperity. Yet the question is prosperity for who? How are we supposed to trust an industry filled of self-labeled experts that missed the biggest financial crisis in modern times? This is like a pharmacist who doesn’t know what drug to give you or a baseball player who can’t swing a bat. We can’t trust Wall Street for a variety of reasons including they are part of the nucleus for this economic calamity.

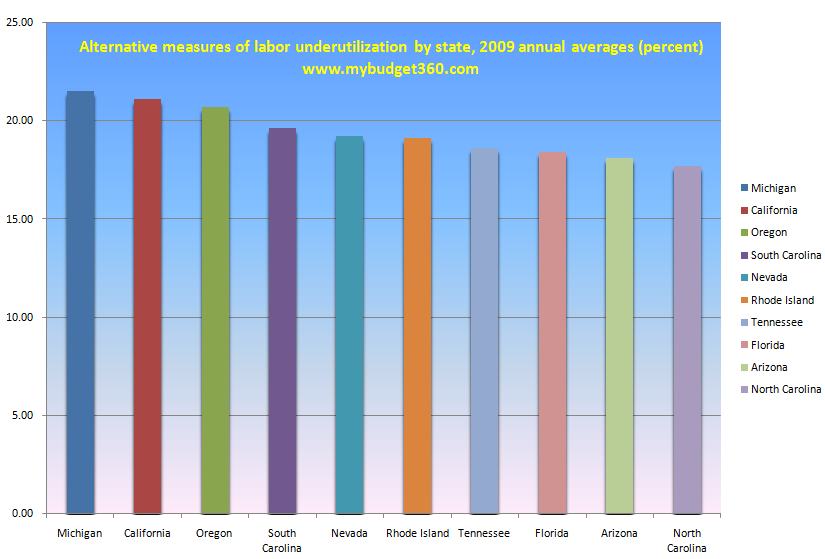

It is amazing that we even have to debate the issue of employment. Our economy cannot function and provide the middle class a thriving environment without jobs. This should be obvious yet the Wall Street crowd is feeling comfortable even though the public is still dealing with double-digit unemployment (we’ve lost jobs for 24 straight months and would have to go back to the Great Depression to find a similar streak). In fact, the largest state economy in our nation that of California with an economy of over $1.8 trillion managed to average out an underemployment rate of 21.1 percent for all of 2009:

Source:Â BLS

This chart is downright troubling. Who would have thought that Michigan and California would lead the way in 2009 with underemployment rates over 21 percent? Michigan has had issues for many years and their economy pulls in a GDP of $380 billion. But California being the biggest economic state in our country with a GDP of $1.8 trillion should make you pause before you think we are somehow in recovery mode. And from the looks of it, California with their historical housing bubble looks to have years of financial trouble to work through. These issues are large and we haven’t even begun examining their state budget issues that are projected to come in at $21 billion.

Having a job is the cornerstone of our economy and also our vibrant middle class. This has been the case for multiple decades and actually has been part of our identity since the disastrous years of the Great Depression. Having a job is a pact with our country and Wall Street has taken this for granted in the last thirty years. Slowly we moved from an economy that valued work to a casino like economy that funneled money into Wall Street and whatever demand came after the spending of the corporatocracy was given as crumbs to the public.

This notion of “jobless recovery†is such an oxymoron. How can we have a recovery while losing 8 million jobs? Just because bank bonuses are back to record breaking levels does not mean a recovery is in place. Statistically we can massage the numbers however we like. And what else would you expect? We pumped $14 trillion in bailouts, backstops, and gifts to bankers so of course something was bound to happen. Even a mountain can move with enough force. Yet where are the jobs?

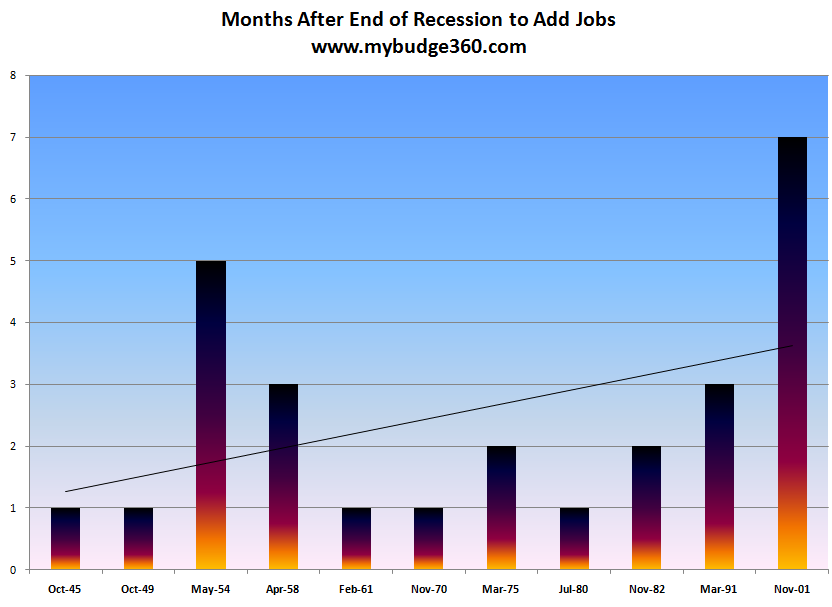

We should examine job gains after previous recessions to see the erosion of our middle class base:

Source:Â NBER

The above chart marks the month ending of all recessions since 1945 and how long it took to have a net positive month in job gains. For the most part, jobs were added fairly quickly and in many cases the month right after the official end of the recession. But starting in 2001 we start noticing this shift to the jobless recovery era. Now why did this occur? Well for previous recessions the business cycle was easy to follow and track. The economy pulled back and so did employment. But once the economy got back on track demand followed and so did employment.  But since the banking oligarchs have taken over our economy, a gain in the economic indicators does not mean additional employment. Since we now are largely importers we can buy cheap goods but have dismantled our goods producing base.   Ask yourself this, where did banks make their profits in 2009? It definitely wasn’t because employment boomed. Demand has been mute. So where did it come from? The profits came from gambling on exotic financial instruments all over the world with taxpayer money. In other words, the recent stock market rally is artificial and no longer represents the economic reality for most Americans.

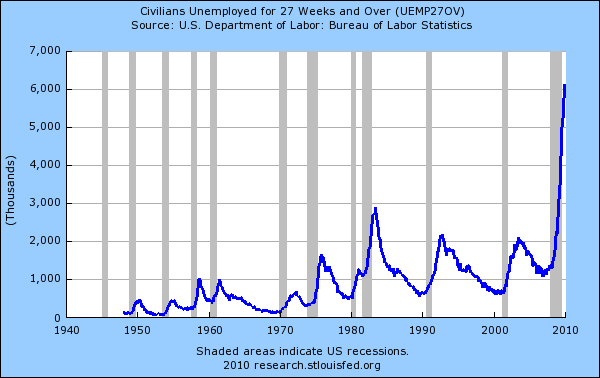

Another key indicator to look at is long-term unemployment:

It is amazing that the largest group of unemployed Americans falls under the long-term unemployed category. Over 6,130,000 Americans fall in this group. These are people that have been out of work for at least 27 weeks and will most likely, need to find a job in a different industry. We’ve discussed this in previous posts that the groups that took the biggest hits in this recession are manufacturing and construction. The financial industry has contracted as well but nothing compared to what other sectors have. The above chart should be indicative of where we are. This recession may be over in terms of GDP increasing but remove the bailouts and the stimulus and you get a deep economic mess. Plus, we have yet to add any net jobs. Think about this, we’ve added some $14 trillion in bailouts and backstops and we have yet to add a net job in the economy. Is this really the reflection of a healthy economy?

The middle class since the 1970s has seen their savings dwindle, their work week increase while their pay lags, and the cost of necessities like housing and healthcare zoom past any income gains. Even with two income households many Americans are simply trying to make ends meet. Even those who are doing well, those making enough to be hit with the Alternative Minimum Tax (AMT) are feeling the pinch as well. Because in reality, the last decade has been a gift to the top 1 percent of the nation. Think about how taxes play out. Many of these people live off capital gains that are taxed at 15 percent while even a physician working 70 hours a week will need to pay the top federal tax bracket of someone actually working. In other words, our system values people who put their money into the casino as opposed to working.

How else can we explain the cheerful smiles of Wall Street traders while the nationwide underemployment rate is up over 17 percent? How else can we explain the giddiness of bankers counting their bonuses while home values are still in the dumps for most Americans? The continuous chants of “jobs lag the stock market†are absolutely tiresome and in fact, wrong. The current system is only waiting like a beggar hoping Wall Street creates enough demand so most Americans can get a piece of the action. We already saw what this creates with the housing bubble. You can enjoy the ride for a few years but you’ll be kicked out once the fun is over. While the public gets kabuki theater programs like HAMP bankers get bailed out 100 cents on the dollar like Goldman Sachs did through the AIG gift exchange. In other words, this bailout isn’t for you and it certainly isn’t about creating jobs.

There is this argument about global bubbles. Gold bubbles, a China bubble, another stock market bubble. But take China for example. Even though they are spending enormous amounts of money they have pumped billions into infrastructure projects that are at least building up their economy and putting people to work. Engineering analysts for the U.S. estimate that we have about $2 trillion in infrastructure upgrade projects that we have delayed or simply ignored. Why not take some of that $14 trillion and put it to at least reinforcing that core of our economic structure? I’m not talking about building strip malls and dumping more money into the commercial real estate pit. How about reinforcing our highways, bridges, universities, and other key components that make our economy strong and envied around the world? If we are going to spend at least spend in the right place.

Yet the irony of this is the Wall Street system still believes in a “free market†world yet they’ve never even lived in anything resembling a free market. Their idea of financial innovation is setting up credit cards with 79.9 percent interest rates and creating mortgages that harm your financial health when you’re not looking.

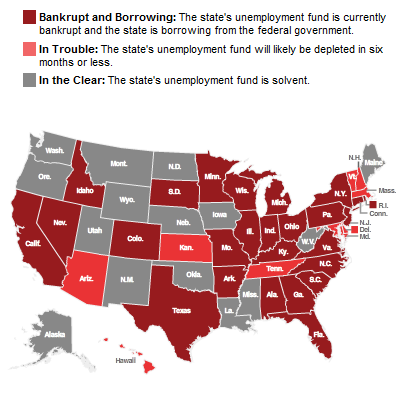

People are focusing on places like Greece, no doubt a big problem but California has an economy that is 13 percent of U.S. GDP! Michigan has a bigger GDP than Greece ($357 billion) yet so much attention is being given to this issue. Our nation’s number one GDP state has an underemployment rate of 21 percent and is on the precipice of financial insolvency. Not only California, but other states. In fact, many have been borrowing for their unemployment insurance funds trying to keep those long-term unemployed from going into despair:

Source: Propublica

Four enormous GDP states in California, Texas, Florida, and New York have bankrupt unemployment insurance funds and are now borrowing from the federal government who is also broke (not broke enough to bailout Wall Street however). How anyone can look at the above and claim we are in recovery is really beyond me.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

JP Merzetti said:

You’re right. The oxymoronic notion of the century has to be “jobless” recovery. There can be no “recovery” without jobs.

However, if one examines just who it is making those claims of recovery, I”m sure we find that the claimants themselves are indeed, not jobless. Not by a long shot. In fact, if they all, en mass…became jobless tomorrow for the rest of their lives, they would no doubt live high off the hog for eternity. (pass the pork, please)I think part of the problem here – goes back to all the plans laid for a jobless economy. Every way possible that could be conceived to create a model of economic activity that required less labor cost, was a boon to the ownership class, and doom for everyone else.

Actually having to hire people – is a toxic notion in most boardrooms.

Having to hire them and pay competitive American wage rates is the equivalent of high blood pressure and heart failure to the suits, it seems.It says a lot though, doesn’t it? That the notion of a “recovery” at all, could be so passionately embraced by the privileged few, while so very many are left out in the cold.

But there it is – they’ve recovered…no-one else has.What amazes me is not only the waste of workers…and their lives.

That is after all a moral issue.

Beyond that, is the bad management. Chronically unemployed people provide negative returns to the state. (they cost a bit, don’t they?)

Whereas gainfully employed people pay taxes! (imagine that)

Something to think about the next time Uncle shrugs and turns out empty pockets.March 13th, 2010 at 11:36 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!