The Red Queen’s Race in pay raises: Record number of employed US workers report no change in wages or salary. Stagnant wages and inflation eating away at purchasing power.

- 0 Comments

A record number of Americans currently working are reporting no wage increases over the last year. What is important to note in this recent report from the Federal Reserve is that this is for those working and staying in their current job. As we know, we have a growing army of people in the “not in the labor force category†and we can assume, that they are not receiving any pay raises. If the economy were booming (assuming the stock market is a good barometer) we should see a healthy increase in wages as demand for labor increases. That is simply not the case and this report only adds more fuel to the fire that we are entering a phase of low wage America. Pricing power is in the hands of corporations and banks have created an entire nation fully dependent on debt to have any sort of middle class life. Only a generation ago, a careful saver putting away the earnings of their labor could enjoy a middle class lifestyle. That is out of the question today. You think you can pay $30,000 a year in tuition to go to college out of savings? Or what about buying the typical $200,000 house? Your average new car now costs $30,000. Good luck doing that when the per capita wage in the US is $26,000. The fact that a record number of currently employed workers are receiving no pay raises should give you a hint as to how healthy this recovery is.

No pay raises for you

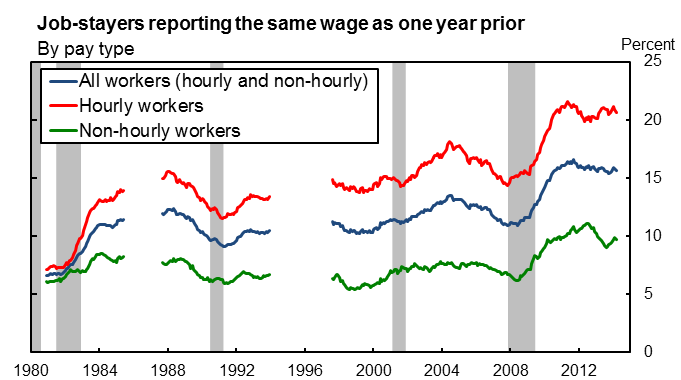

The Fed does an interesting study on wage rigidity. The latest data continues to find that pricing power is all in the hands of those writing the paychecks. Normally in a broad based recovery you will see wages rise as labor becomes scarce and employers actively need to increase wages to keep workers. That tends to be the normal course of things but what we are now seeing is a low wage recovery. This data simply adds more evidence to that case.

Take a look at this chart:

Source: Federal Reserve, San Francisco

A record number of workers are seeing no wage increases and this is for those actually employed. Combine this with real inflation hitting across all areas of the economy, and you begin to understand why Americans are feeling the pinch.

“Some argue that the CPI is a good measure but it simply isn’t. Housing eats up the biggest portion of income for Americans yet the CPI measures the owners’ equivalent of rent (OER) and this does a poor job of measuring true housing costs. Why? First, it assumes you will rent out your unit – most Americans own. Next, it doesn’t factor in the reality that mortgage debt allows for incredible leverage with low interest rates. This papers over the reality that the base cost of a home is much higher but because the monthly payment is lower, people tend to forget the true cost of the purchase over 30 years.â€

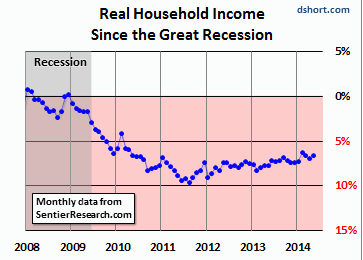

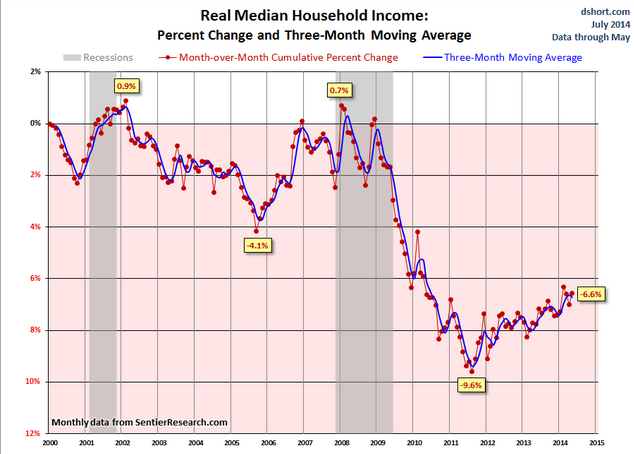

What is interesting is the OER missed the last housing bubble yet we continue to use this measure. The CPI also “adjusts†items like food and energy yet these also consume a big part of a household’s budget. What we are told is items like computers and TVs are going down so it all balances out. It doesn’t. This is why even using the CPI, we find that Americans are not keeping up:

Keep in mind the above data is adjusting out via the CPI which under reports inflation. There is a real reason why Americans feel poorer. They are. Inflation is being severely underreported in areas like housing and this is one of the biggest expense items for people. The fact that there are no pay raises coming for a record number of people simply means that more income is going to go for current expenses. People are running the Red Queen’s Race in the current economy: running faster and faster and working harder and harder just to stay in the same place.

People purchase goods as a household unit. This also has the added benefit of combing incomes for one housing payment be it rent or a mortgage payment. When we look at housing units in the US, we see that many are simply falling back:

In the end, these charts rarely hit the mainstream press and in reality, many simply feel the pinch via inflation on their pocketbooks. The underlying cultural assumption is that prices always rise and this is as natural as air, water, or fire. It isn’t however. This happens because too much debt is being issued and is chasing real goods: in this case you have big banks using very low rates and buying up real assets like real estate crowding out regular households that don’t have this debt leverage. This is why we have a record number of sustained buying by investors, not regular families looking for shelter.

Keep running faster and act as inflation is not happening. The fact that a record number of employed Americans are not receiving pay raises should tell you something.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â