What Caused the Housing Crash? Two Words: Crushing Debt.

- 0 Comments

Many of you had the chance to catch a glimpse of the 60 Minutes episode this past weekend called, House of Cards. In a nutshell, what has occurred with the housing market is a glorified Ponzi Scheme. The housing market was fueled and pumped by perpetual housing speculation motion. That is, the idea that the home you buy today will be worth a lot more when you sell it in the future. The majority of those complicit in the charade never stopped and asked the inevitable question of how they would react should prices go down.We’ve all had those moments where we let our mind wander and think, where does money come from? Yet the answer is so obvious and disturbing that we erase the thought. The housing market was built on the margin of real asset wealth and speculative hedging. No one is going to dispute that housing has an inherent value to it. Unlike over-the-counter (OTC) stocks that can quickly vanish into thin air overnight, home values will not decline to zero. There is a fundamental and intrinsic value to real estate. And in most places this is determined by local area economics and the ability of people to afford a monthly payment.

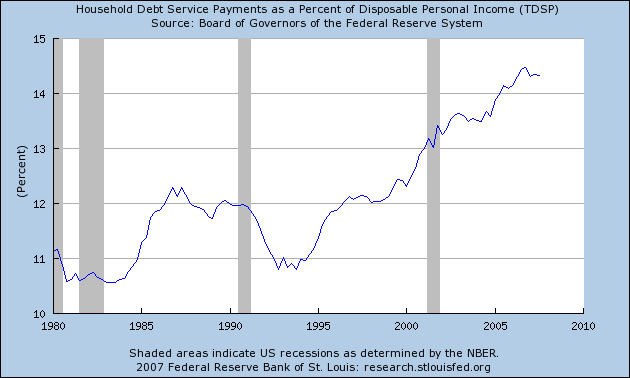

With all the talk of blaming lenders, agents, brokers, Wall Street, buyers, and everyone else for the collapse in the housing market, there does seem to be one true culprit in all this mess. Debt. We constantly hear the term “credit crisis” but what we really are facing is a “debt crisis.” I’m not sure when credit became debt but the fact of the matter is American households would have kept the Ponzi Scheme going longer if it wasn’t for the fact that the monthly servicing of their debt crushed them like a ton of bricks. Let us take a look at household debt service as a payment of disposable income:

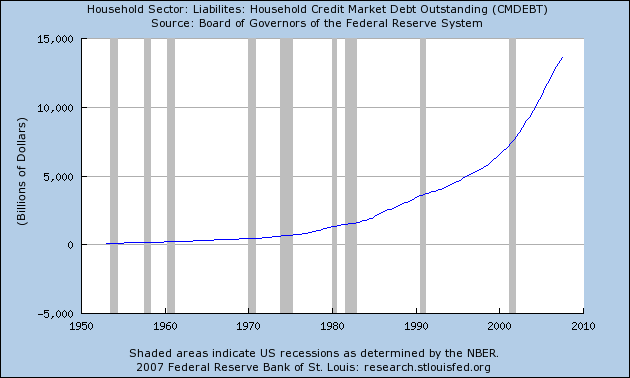

What you’ll notice is that in the previous 2 recessions debt actually declined during and shortly before the recession officially hit. What happened in 2001 with our brief recession was that former Fed Chairman Alan Greenspan decided to drop rates to an incredible 1 percent creating a negative rate and thus fueling the current debt bubble we are living through. Ben Bernanke risks doing the same. The next chart shows us the exponential growth of debt in this decade:

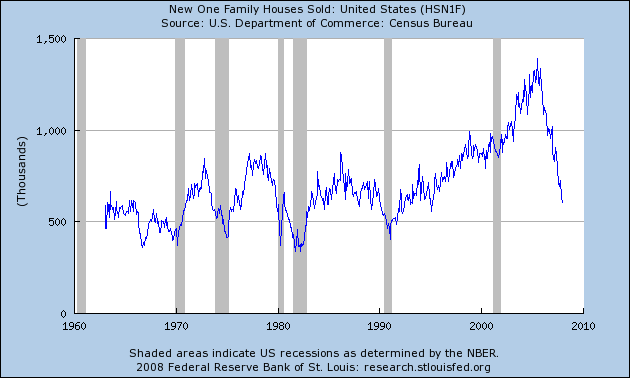

You’ll notice how the graph takes off in parabolic fashion starting in 2000. We went from the technology bubble of the 1990s to the housing and debt bubble of the 2000s. And unless central banks can find another bubble to inflate, this may be the endgame and decline of the housing market. The following chart shows that the housing market peaked for new homes in 2006:

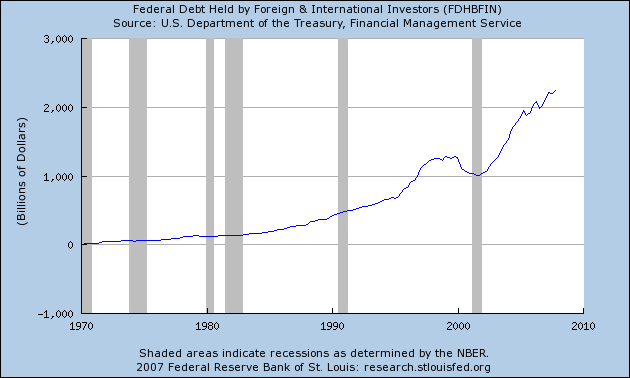

With this week’s declining housing report, we are trending lower and 2008 will turn out to be the worst housing market since the Great Depression. The blame can be passed around but the reality of all this is the American consumer is maxed out. Incredibly people would buy homes for $1 million so long as someone was willing to give them the debt to do so. Now that the collateral is coming home to roost, investors are asking where did all this credit come from? In a few short words, foreign investors:

As you can see from the above chart, shortly after the 2001 recession foreign investments into the U.S. exploded. Yet these were investments into debt markets. The perception from many foreign investors was many of these obligations were safe like government bonds because the blessing of our largest credit agencies said so. As has already been noted, these ratings were inflated like the properties held in these mortgage backed portfolios. If you are planning on buying, you can expect more inventory to hit the market this year since fundamentals are weak. Rates are also good for prime borrowers. So if your credit is shored up and you live in a non-bubble area, this may be a great time to buy. Unfortunately many people do live in these overinflated metro areas. I wish there was one over arching answer but buying depends on where you live. Should you buy in Los Angeles? No. Should you buy in Dallas. Yes.

As the Fed wrestles with this market, their rate cutting apparatus is no longer as effectives as it once was because this is no longer a liquidity issue but a solvency problem. American consumers are saturated with debt and no longer can service the current debt available to them. You can offer banks billions of dollars but without credit worthy and willing consumers, this housing market is crushed.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!