Why oil is crashing and the black swan event of 2014: The price of oil is down by 40 percent in six months and hardly anyone saw this coming.

- 3 Comment

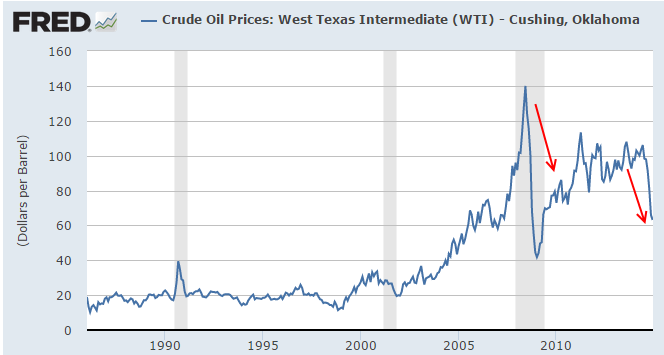

Black swan events are bound to happen in financial markets. It appeared that 2014 would be a year where stock markets gained footing in the world of supposedly low volatility until oil prices came crashing down. The crash in oil is enormous. It has sent many countries into panic mode including Russia where interest rates were hiked up to 17 percent. This produced little result since the change in oil prices has come so abruptly. Oil is down over 40 percent in the last six months. The current price of a barrel of oil is $55.40. What so many analysts got wrong is the assumption that high cost oil was here indefinitely and that somehow the global economy would be on perma-debt growth. Obviously things can change dramatically over night. As we saw with the recent spending bill, sneaky provisions for derivatives were popped in for the next financial bailout. But with oil, this is a global commodity with massive market implications. This is the financial story of the year and it will setup 2015 for an interesting period.

High oil prices are clearly not set in stone

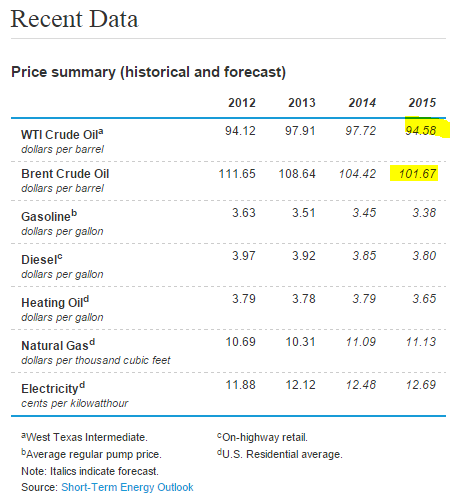

The U.S. Energy Information Administration (EIA) was projecting high oil prices deep into 2015. In fact, they were projecting oil at roughly $95 per barrel deep into 2015. Oil rarely makes massive moves like the one we are currently experiencing. Something else is going on here. You have OPEC maintaining supply during a time when demand was waning. The initial perception is that OPEC is trying to stifle off high cost drillers that involve shale and fracking. Yet there are also other more complicated factors at play here.

The EIA is off on their projections:

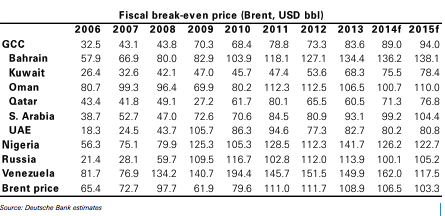

At close to $100 per barrel, there were many countries doing exceptionally well with high oil prices. Russia and Venezuela depend on high oil prices for a large part of their fiscal stability:

Most apparent, is the massive damage this is doing to the Russian economy. Russia is a big player in oil but current prices are causing massive internal pain. Russia stands only behind Saudi Arabia for oil exports:

Source:Â EIA

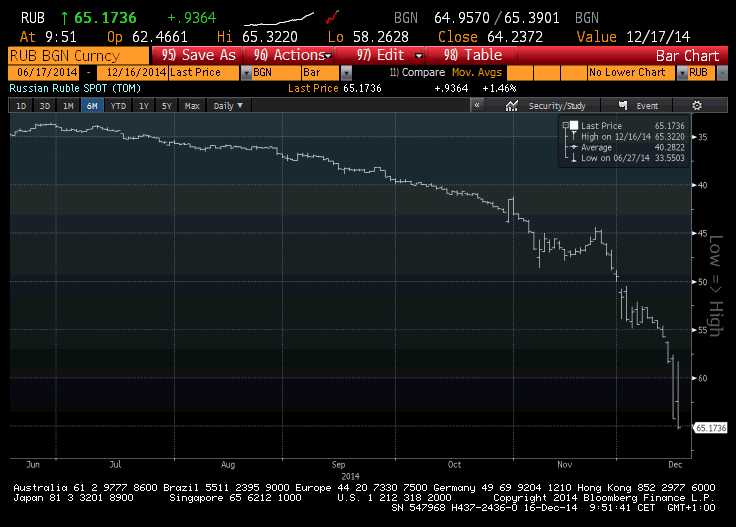

The Russian Ruble has tumbled versus the dollar:

Russia is facing some major challenges ahead:

“(Forbes) Despite appeals from its smaller members such as Ecuador and Venezuela for production to be cut, OPEC has allowed the oil price to fall freely. On November 27thit announced that it would not cut production. And on December 15th, the United Arab Emirates’ Energy Minister suggested that oil could fall as low as $40 a barrel.

This was disastrous. The CBR’s worst-case scenario for the Russian economy assumed the oil price would fall to $60 a barrel. A price of $40 a barrel was simply unimaginable. Russia’s economy is terribly dependent on oil: if the oil price falls so low, severe economic recession is inevitable and default becomes a real possibility. The ruble’s slide worsened, bond yields spiked and CDS rose exponentially as capital flight intensified.â€

Of course you can expect that there will be some major geo-political uncertainty entering the market because of these actions. The U.S. is now squeezing the vice grip on Russia by stating they will continue to maintain economic sanctions.

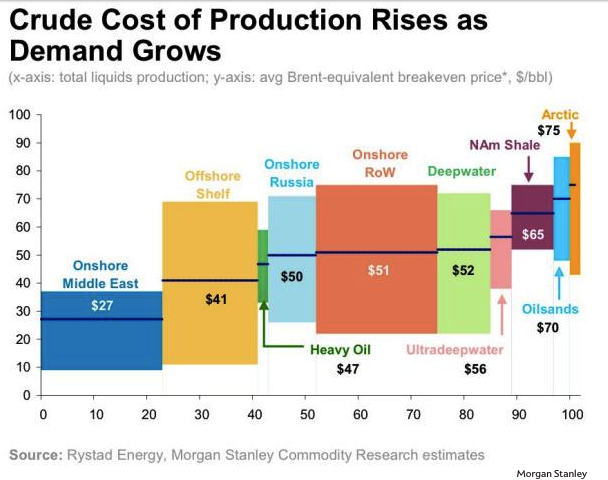

The cost to produce oil really depends on where you are looking:

So obviously the move by major OPEC players will hurt high cost producers, it will also cut deep into the budgets of countries that rely on oil to support their budgets. This is causing massive volatility in global currency markets. Oil rarely does major moves like this:

The last time we saw a move this deep was during the Great Recession where oil prices plunged to the $40 range in 2009 when markets were in full on panic mode. It is hard to tell what long-term implications this will have on the U.S. economy but for the short-term, consumers will have some relief and will have more money to spend for the holidays. The U.S. dollar has gained strength in the short-term. Longer-term the world is going to face uncertain volatility especially if oil stays at these new prices levels. If you were to say that oil would be in the $50 range a few months ago people would have thought you crazy. Apparently there are mega bad bets that are now being called in and volatility is back in the game. This is the black swan event of the year.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Don Ross said:

Pay no heed, my friends. The New York / London / Zionist EU Bankers are making a last play to make President Putin heel. Off the radar of course, is the collapse of the Thai markets, with others to follow.

Putin is made of steel, not putty. Stand your ground, President Putin – millions of Americans stand by you.

All this oil price plunge shows and proves is that oil prices are not set by supply and demand or earth resources, but by the Zionist controlled US Congress and its behind the scenes oil puppeteers.

No, my friends – this has nothing to do with oil supply per se – but everything to protect the fiction of the US dollar as the safe medium of stored value.

Millions of Americans support Putin – the Wall Street criminal cabals have savaged the American public for the last time when they appropriated American home equity. We will not allow it again.December 17th, 2014 at 5:45 am -

terrance said:

I saw it coming. The Saudi’s want to punish Iran and Russia by continuing to pump oil at reduced prices. We are pumping oil and gas in tandem with the strategy to starve the bastards. We have huge deposits. Fools often mistakenly believe deposits and reserves are equal, hence the confusion about the true situation in North America. About a year of this and there will be geopolitical changes through what psychologists would call pasive aggressiveness.

December 17th, 2014 at 8:23 am -

Ame said:

If you store gasoline, wait for prices to go below $2.00 a gallon and keep a close eye (daily) on it. When it jumps up, get yourself to the station and stock up…it will skyrocket after the dive.

December 22nd, 2014 at 6:49 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â