Multi-generational living is here to stay in a low wage economy: Over 57 million Americans live in multi-generational households.

- 3 Comment

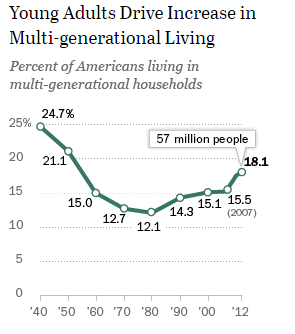

The Great Recession might be officially over on paper, but the social impact continues to be felt today. The structural changes are deep and profound and have caused a major rise in multi-generational households. Many young Americans burdened by low wage jobs and college debt may have no other option but to move back home with parents. The number of people living in such households has doubled since 1980. More than 18 percent of the population now lives in this arrangement. A large push has come from those 25 to 34 given that 1 in 4 now live in a household with multiple generations. Money is tight and rising living expenses including rents have kept many from venturing out on their own. The economy has been adding jobs but many of these jobs are coming from the low wage sector and are simply not providing a base for moving out. This latest election was driven by people unhappy with the economy but also wanting higher wages.

Living at home

Multi-generational living used to be the common way of living in the 1940s and 1950s. The trend was unmistakably moving lower for an entire generation until it hit a bottom in the 1980s. Since that time, it has gradually shifted higher.

The recent Great Recession has accelerated this trend:

Source: Pew Research

57 million people now live in multi-generational households. Young adults have been the driving force of this trend. Two main factors are pushing this trend:

-1. College debt

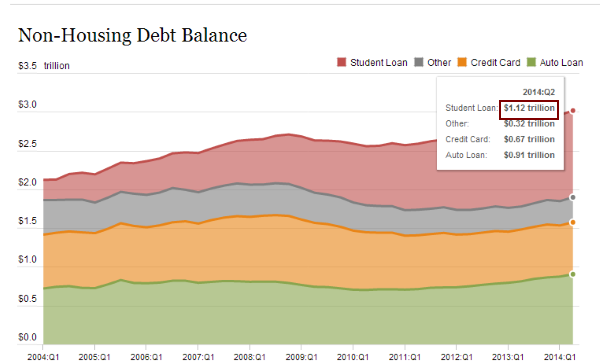

The student debt bubble seems to be in the news every day yet student debt continues to grow:

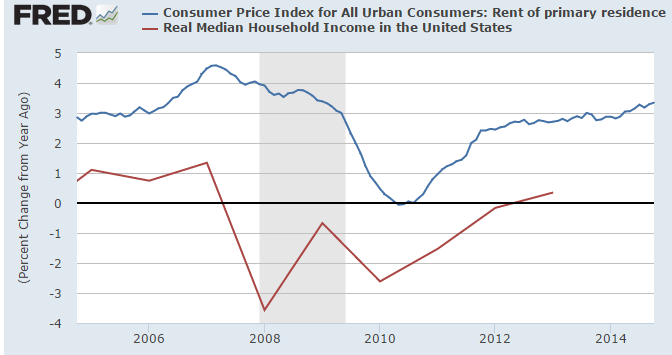

Student debt is now the largest non-housing debt in the economy. This hinders young adults from moving out on their own and forming new households. You also have low wage jobs dominating the employment sector so young adults simply do not have the income coming in to support a new household. Ironically the big banking bailouts supported a feverish hunger for investment properties from large investors crowding out many future households. This made buying a single family home much more expensive but also drove the cost of rents higher:

Rents are going up much faster than actual household incomes. This is another big reason why many young adults are unable to venture out on their own and start new households. Household formation is a key driver in our economy. Many new households drive spending in large goods like refrigerators, furniture, and electronics. Instead one fridge, you now have two when a young adult ventures out to form their own household. The current trend is reversing this so we should see this seep into consumer spending.

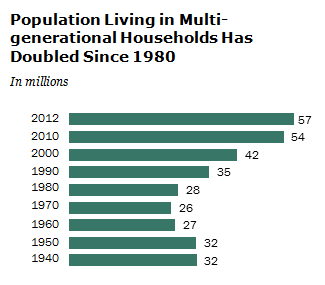

The raw numbers of multi-generational households are large:

The numbers have doubled since 1980 with the trend accelerating since the Great Recession hit. There doesn’t seem to be any reversing of this trend in the short-term but what this does highlight is an economy that is especially hard on young adults.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

ORRonin said:

Elections have consequences.

November 20th, 2014 at 9:54 pm -

AC said:

What better time to sign the Trans Pacific Partnership (another ‘free trade’ treaty) and import millions of more unemployed people from the south.

November 21st, 2014 at 7:12 pm -

Ame said:

I think quite a few multi-generational households are that way because the Baby Boom generation needs the younger to take care of them. The Baby Boomers didn’t save enough for retirement and possibly because of health issues, are also unable to continue working. They either move in with their children, or the children move in with them. They depend financially upon their children. But those same children depend upon their parents for free childcare, as well as a piece of their social security check. They are pooling their resources and talents; it’s that simple.

It’s not an altogether bad thing that families are depending upon each other. Perhaps this nation will learn that people are more important than things.November 22nd, 2014 at 9:30 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â