What Isn’t Happening with the $3 Trillion Commercial Real Estate Market: Loans Falling and Vacancy Rates at Record Heights at 10 Percent.

- 0 Comments

With commercial real estate, you can learn a lot from what isn’t happening. We all know that the $3 trillion commercial real estate market is already taking a drubbing in terms of pricing. CRE prices are down over 40 percent from their peak elevated levels. Yet with commercial real estate you don’t have the typical headline grabbing stories of individuals being forced out of their homes in foreclosures. With CRE it is seen as a more calculated business move and those losing their shirts are those who should have known better. Now this is how things should be but the U.S. Treasury and Federal Reserve have already back stopped the entire banking system so implicitly, the failing of any real estate is now a direct burden to all taxpayers.

What is not happening is a natural stable demand from the market. Why? Just like the residential market, commercial properties were over built. We have years of excess to work off. That is why I simply don’t buy the notion that we will somehow be back on the run by tweaking a few balance sheet numbers. The problem is many structures are now built and are sitting vacant yet the loans still need servicing. Who is going to pay for it? The U.S. Treasury has already had low key talks about a preemptive bailout for this industry labeled Plan C.

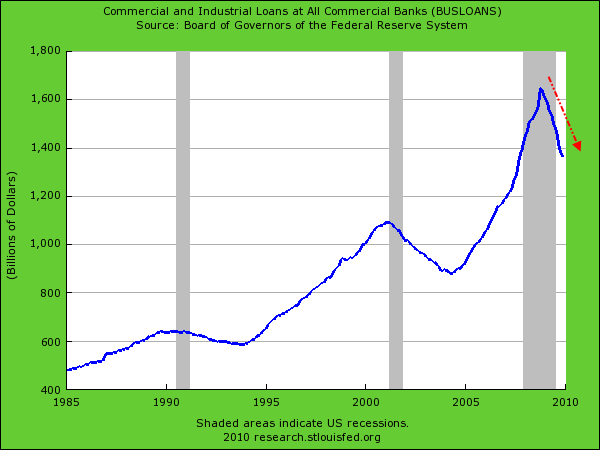

While banks tell the public all is well, their actions speak louder:

If things were improving in the overall economy it is likely you would see a natural demand for CRE loans. People want to build something or start a new business and loans are easily available so long as you can fill the building. The chart above shows a very clear pattern. Less and less loans are being made in this sector. Do banks know something the public doesn’t?

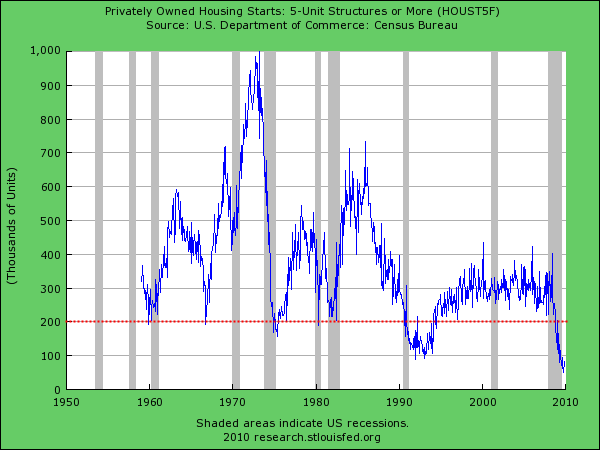

Larger housing complexes fall in the commercial category. Typically these are places with more than 4 units at least on the residential front. Assuming a market demand, you would expect to see permits rise:

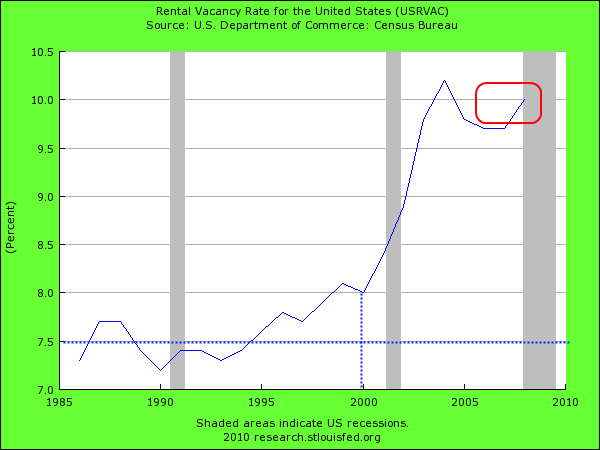

The above chart clearly shows anything but this. This is an important indicator because those who sense the economy is turning are more likely to build additional housing units. This is a large part of our economy since banking heavily relies on real estate for profits. That is largely a reason for the gigantic banking bailout while the vast majority of Americans wonder what they got for the $14 trillion in financial backstops. The chart clearly shows one thing and that is there is virtually no demand for large unit housing complexes. We are at record keeping demand lows even after all the bailouts. Why? Well most of these larger complexes are rental units and the market seems to be flush with these units:

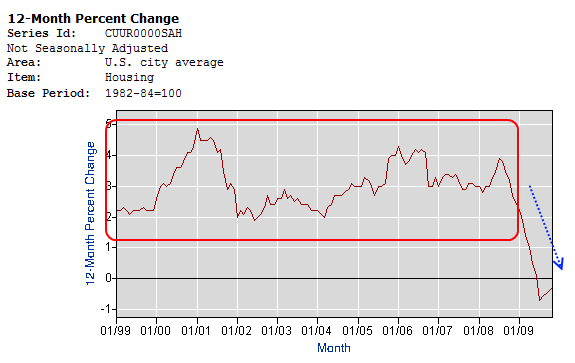

The market is saturated with rentals. Anyone that is both a landlord and renter will know this. Many places are offering free HDTVs with a one year contract or even better, a few months of free rent. Rentals always have a higher vacancy than regular homes because that is the nature of the property. Renters are more mobile and vacancies are just part of the game. But the current vacancy rate at nearly 10 percent is putting downward pressure on rent prices. In fact, the BLS uses an owner’s equivalent of rent and this has been falling:

The interesting thing about the BLS data is that it understated the housing bubble because most people during the bubble shifted to buying overpriced homes while the data series was still focused on rental equivalents. Now, with such a high rate in rental vacancies and large numbers of foreclosures the BLS is adjusting quickly to the downside and making it look like we are having massive deflation since housing makes up over 30 percent of the BLS CPI measure. Why is this important?  This factors into many things including the cost of living adjustments many receive.

So all this adds into the fact that commercial real estate has very little pricing power in today’s market. So what are the too big to fail banks doing? They are laying the problem off on the public. This was seen when Morgan Stanley simply walked away from the debt obligation in a San Francisco CRE deal:

“(WSJ) So we’ve discussed the ethics of individual borrowers walking away from their mortgages. (Some say we’ve over-discussed it.) If it’s immoral, as some would say, for a borrower to walk away their mortgage, is it any different for a bank?

Morgan Stanley is doing just that. News reports on Thursday said the bank plans to give back five San Francisco office buildings to its lender-just two years after buying them at the top of the market.

“This isn’t a default or foreclosure situation,” spokeswoman Alyson Barnes told Bloomberg News. “We are going to give them the properties to get out of the loan obligation.”

Sound familiar?

Morgan Stanley bought the buildings, along with five others, in San Francisco’s financial district as part of a $2.5 billion purchase from Blackstone Group in May 2007. The buildings were formerly owned by billionaire investor Sam Zell’s Equity Office Properties and acquired by Blackstone in its $39 billion buyout of the real estate firm earlier that year, Bloomberg reports. One analyst estimates that the buildings are now worth half of what Morgan Stanley paid.”

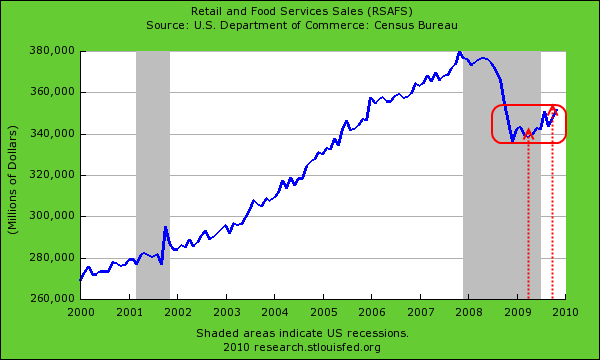

Now this is fascinating coming from an industry leader who has had its champion in the U.S. government moralizing that people shouldn’t walk away from their debt obligations. The CRE market is in for a long and troubled road ahead. Right now much of the data on retail sales is being championed as great but we are comparing it to data that was down in the abyss:

When you hear of those wonderful year over year gains we are going back to early 2009 when the economy was flying off a cliff. So sure, things are up but what are we comparing it to?

The Federal Reserve has over $2 trillion in questionable assets that they are fighting to keep from an audit. It is likely many loans in their portfolio are now commercial loans. The fact that vacancy rates are so high and the employment situation is still dismal, where will the demand come from? If anything, the best we can hope for is that current spaces get leased out and we start reaching more equilibrium levels of vacancies. But we are so far away from even that.

What isn’t happening in the CRE market is very telling. 2010 is expected to bring much pain in this market and so far, we have had very little evidence pointing to any upsurge in this market.   And with $3 trillion at stake, any small movements mean big bucks.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!