American Consumers Cutting up that Final Credit Card: The End of a 30 Year Consumption Era and the Nervous Breakdown of the Spending Psychosis.

- 4 Comment

Imagine sitting in a messy room. Chopped plastic all around you as you sit there clasping a set of red scissors.  Only one more credit card sits in the middle of the room starring back at you. Can I do it you ask? Is it possible to go forward in life with no credit cards? As you make the final cut, a new era has begun. The American consumer is now psychologically maxed out.

Now this is very different from what has occurred in previous recessions where American consumers merely took a few steps back to reassess how they would once again go back to spending once happy days were here again. This is something more on par with what occurred during the 1930s when American consumers actually changed their way of life. We haven’t seen that occur since then but now many Americans have but no choice and to make this change. Some are welcoming it but many are resentful.

Normally credit card companies would fight like starving vultures over a carcass for additional customers. Yet in a sign of the times, American Express is offering few select cardholders $300 to close their accounts:

“(Yahoo!) Card holders have until the end of February to accept the offer and must close their accounts in March or April. Each card holder will receive a $300 pre-paid American Express card.

American Express, often seen as catering to relatively wealthy customers and companies, has been expanding its credit card business in recent years by reaching out to a wider range of clients.

But that strategy has backfired. The company’s earnings tumbled in the fourth quarter as credit losses jumped and debt-burdened consumers slashed spending.”

The irony here is that customers that elect to take up this offer will receive essentially an American Express pre-paid card that looks and feels like a credit card but isn’t anything like one. No cold turkey here. We are weaning ourselves off the debt treadmill even if it means getting surrogate plastic to help us out. It is a confrontation that has been 30 years in the making but the seeds were planted back many decades ago.

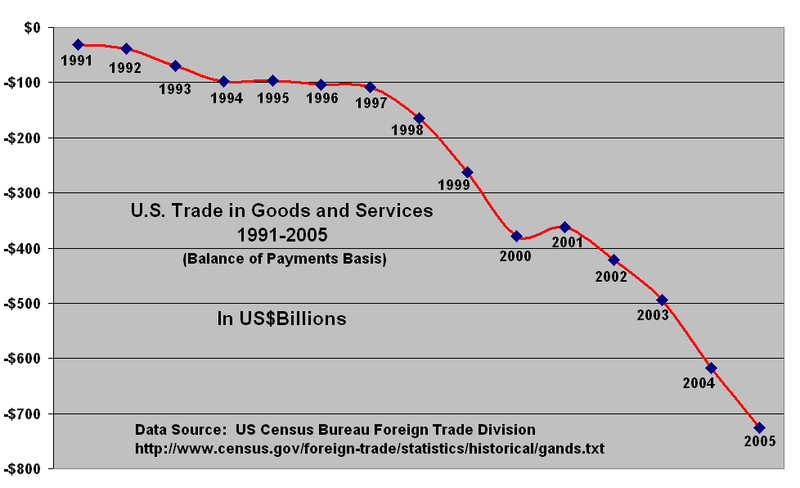

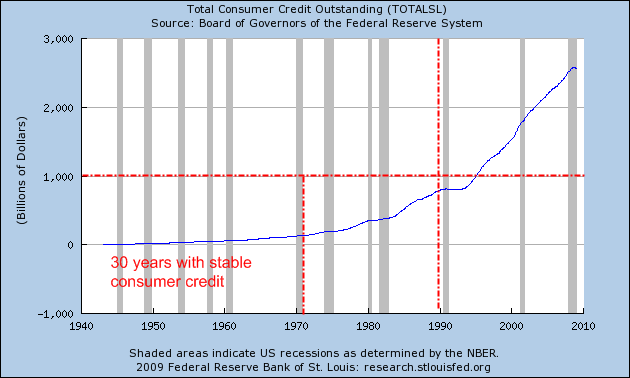

Consumption has always been a part of the American psyche. Yet much of the major break in customary trends occurred in the early 1990s when we started consuming more than we were producing. And much of the above was financed via debt. The focus shifted from actual production to consumption yet much of the consumption was not financed by productivity but by debt. All we need to do is look at consumer debt over this time span:

It is interesting that in terms of consumer debt, we had a relatively stable period from 1940 to 1970. Nearly an entire generation with only marginal growth in consumer credit. Credit cards started making a push in the 1950s with Diners Club and American Express. This was then followed by other big names like Visa or when Citibank merged its Everything Card with Master Charge in 1969. From that point on Americans have been using credit cards taking the amount of credit card debt alone to $963 billion. Keep in mind that with consumer credit, people have also committed to automobile loans and other such installment debt.

Yet there is now sufficient evidence that this trend is breaking. A recent Washington Post-ABC post poll found that the burns in the consumer psychology are going to be deep and won’t recede like the tide. What was found in the article is crucial to helping us understand how deep this recession will be:

“Two-thirds of those polled said they’ve cut back on their spending, including nearly a third who have pulled back “sharply.” Americans across income groups said they are opening their wallets less often these days, with those with lower family incomes more likely to say they’ve sharply slashed their spending. One-third said someone in their household has lost a job or had their pay or hours cut in recent months.

Also contributing to the new spate of penny-pinching are widespread concerns about how much longer the recession will last. Overall, 70 percent of Americans anticipate a downturn lasting well into 2010 or longer; more than a third see it lasting two or more years. Those who see an extended recession are more likely to say they’ve pared back their typical buying habits.”

This is crucial to understand. Since roughly 70 percent of our GDP is based on consumption, we should be listening to what the consumer is saying. First, two-thirds have cut back on their spending. What the poll also tells us is that some of this cutting back has come from job losses or cuts in hours. That is why only looking at the 7.6% headline unemployment rate does not highlight the entire picture. Over half of Americans are changing their consumption patterns.

The other thing we find is many are gearing up for a long winter. Many are expecting this recession to last well into 2010. We are in month 14 of the recession and only need 2 more months to make this the longest downturn since the Great Depression. Most people realize things will not change by the end of the year.

“Nearly six in 10, 57 percent, said the current economic situation is a cause of stress in their lives, including more than a quarter who label that anxiety “serious.” Overall, about two-thirds said the recession has hit home, with job losses and pay cuts reaching far and wide: three-quarters of respondents said a close friend, immediate family member or someone in their household has been impacted.”

People rarely spend big money when they are fearful. Have you ever wondered why they put the luxury name brand stores in hotels in Vegas? And have you wondered why they are near high stakes player tables? Because they understand human psychology and at its core people will spend when they have a high. What happened this decade is people were high off the housing bubble and kept seeing their paper home equity increase and this only fed into the psychology of spending. This was the fuel to keep the game going. The credit card companies kept their product in front of you were it was direct mailing, television, or magazines. Have you noticed a drop in your direct mail for credit cards or HELOC products?

And that is why putting all this together including what is found in the poll, I think we are going to see a generational shift in spending come from this bursting bubble. A lot of it is being driven by real numbers such as drops in home prices and job losses but a big change will come from people simply hunkering down and knowing how it is to be burned. There are many who have never lived through a serious global economic crisis of this magnitude. Things I believe, have changed and those changes are permanent at least for this generation.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Surviving A Recession said:

All I can say is bravo! Although reduced consumer spending will have a negative impact on our economy, the economy will survive. I think people spending less and saving more means that personal finances will stabilize. Hopefully, this will mean that there will be fewer house holds living paycheck to paycheck. I just think that being financially sound is a better way of life. Maybe when the dust settles we can finally start concentrating on things that really matter; family and having a good life.

February 26th, 2009 at 9:10 am -

MrVincent said:

That was a very well written article.

People who dont follow markets have been asking me what is going on and I tell them that a great unwinding is occurring. The capacity that has been built into the system since the late 70s has to unwind now that the baby boomers have dramatically cut thier spending.

Actually, the boomers are finally realizing that they are going to have to make money the old fashioned way – by having very little debt. The problem of course is that when you have an electronics store and resturaunt on every corner, someone is going to suffer.

I think the next shoe that is dropping is commercial real estate.

Of course you are so right in what your saying and that is why I am posting here today. Not many realize that we need to prepare for retirement now and govt trying to get banks to lend makes no sense now that we have seen the light.

During this unwinding I predict that this huge generation will continue to either pay down debt or walk away from it. Whatever works to get them to a place where they can claim early retirement and prepare for self actualization. Having the noose of a house around their neck is not going to help.

I also predict that there will be a steady amount of housing inventory for sale for many years to come. This generation may realize that in order to retire early they may have to rent a small apartment somewhere close to an airport so they can travel.

They bragged about their cars in high school, they bragged about their jobs after college, they bragged about their houses in mid life and I believe they will brag about their vacations in retirement.

I am 49 and a younger baby boomer. I was also a real estate investor since 1978 so I have seen it all. In 2002 I thought we had entered another real estate bubble. LOL, I had no idea how big it would get.

February 26th, 2009 at 8:52 pm -

Marcus said:

I hope you are right, but I don’t think so. We are becoming a society where everything should have happened yesterday. People spend without thinking while saving and planning for the future is an afterthought. People make their own graves and thus they must lie in them. The US government is just a reflection of what society is and look how they spend with reckless abandon. I hope I am wrong.

February 26th, 2009 at 11:23 pm -

DanyBoy said:

Agree, this article touched on some major issues for our time.

Mr Vincent, agree.Certain things are non-negotiable in this world: you reap just what you sow.

To those who cling to the belief that we’ll emerge from all this fast, prosperous and unchanged in our values, hang on to your hats (and your gold)!We are living through the very earliest phases of what will be looked back on as our “where’s the depression” -moment.

There will still be sniggering during bull market rallies.

Until we go through the next phase of change in the darker stages of the crisis.

It will change us as a country and a world forever and irrevocably.

The point about changing from an ultra-platic consumerist culture is well-taken. But now the bill is coming due for an entire. generation of recklessness. Hopes for a soft landing through increased savings and eating humble pie are pathetically misguided.We no longer make anything and we damn well near no longer own anything (courtesy of the credit bubbles). We’re in debt for the past (T Bonds), present (need imports to keep the lights on and to eat) and future (we are mortgaging that at the present moment in Washington, IOU). We’ll be paying down debt for years to come as a haircut on GDP which we need to pay down debt.

February 28th, 2009 at 6:40 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!