American International Group: AIG Founded in Shanghai China in 1919. Who are we Bailing out Here?

- 2 Comment

American International Group, AIG was founded in 1919 by Cornelius Starr who established the agency in Shanghai, China. The business took off and was very successful in Asia. Later, Starr expanded the company to Latin America, Europe, and the Middle East. It is fascinating how many in the media are portraying AIG as some homegrown company when in fact, it didn’t start branching out seriously into the U.S. until 1962, nearly 43 years later. I just find it fascinating how the media can beat on the automakers, American companies for the most part from day one while not batting an eye to AIG requesting an additional $60 billion lifeline. The U.S. Treasury and Federal Reserve only represent the U.S. taxpayer in name alone. They are protecting the highest bidders in the financial industry.

AIG has been hammered in this financial crisis. In fact, its share price fell to $1.25 on September 16, 2008 after hitting a one-year high of $70.13. It is now trading in the pennies after word is now out that they will report another stunning loss. Where did AIG get hit badly? From Credit default swaps and collateralized debt obligations. AIG is one of the biggest government bailouts for a single company next to Fannie Mae and Freddie Mac. The amounts sunk into one company are stunning.

After Lehman Brothers collapsed, the largest bankruptcy in history investors started comparing notes and realized AIG had eerily similar problems. In fact, they were trading mortgage backed securities at the rate of 1.7 to 2 times those used by Lehman. And this is a company that we bailed out on the premise that it would stymie a global crisis. Well now we know sinking more and more money into these companies only bails out Wall Street and those close to the industry. Americans are losing jobs at the quickest pace since World War II.

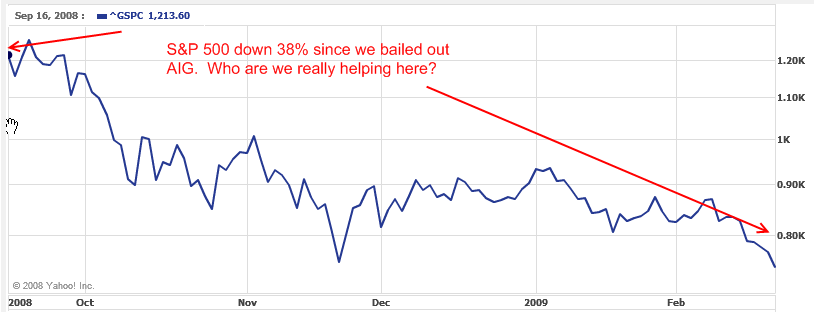

If you remember September of last year, many things were moving at once. Lehman Brothers, AIG, the TARP plan. Yet now as we stand with the market collapsing and at lows not seen since 1997, did we really stop the collapse? Let us go back to September 16, 2008:

That is right. Since we’ve bailed out AIG the S&P 500 is now off by 38%. Thank goodness we bailed out all those companies and allocated billions to banks. Otherwise, the market might actually be in some real pain right?

AIG owns nearly 20% of the People’s Insurance Company of China (PICC). In Hong Kong AIG has 2.2 million policy holders. They have major holdings in Singapore, Pakistan, and India. In fact, bailing out AIG is like bailing out the world in some sort of way. Yet the media has done a fantastic job as masquerading this and trying to make it appear that American taxpayers are really protecting a company with most of their holdings in the U.S. Can you imagine how people would respond if they found out we are bailing out a company with stakes all over the world that represent a gigantic portion of their portfolio? It is fascinating that since that time, we have heard nothing of the first 40 years of the company. Can you imagine if Japan tried to bail out Ford instead of say, Toyota? Just imagine how the Japanese would feel about that.

AIG is an enormous company with over $1 trillion in assets and 116,000 employees. I think the reason that we are bailing out this company also have something to do with the fact that we need to continue borrowing from the Chinese. It only makes logical sense. After all, would you want to anger one of your largest lenders? All the money we are spending is borrowed and comes from certain regions of the world. If these lenders backed off, you can probably imagine what would happen to the U.S. dollar. The Federal Reserve and U.S. Treasury might enjoy seeing a tanking dollar.

Nothing could highlight this connection further by what Secretary of State Clinton had to say on her trip to Asia:

“(AFP) By continuing to support American Treasury instruments the Chinese are recognizing our interconnection. We are truly going to rise or fall together,” Clinton said at the US embassy in Beijing on the weekend.”

The article goes on to highlight the connection we now have:

“China’s economic planners also understand the dilemma of investing so heavily in US debt.

“If it ceased to buy US treasuries, the value of existing holdings of dollar-denominated assets would drop sharply,” said Su Chang, Beijing-based economist with CEBM Group, a consulting firm.”

In fact, we are so interconnected we are now bailing out companies that didn’t even originate in the United States.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Dan D. said:

Is AIG an example that trying to bailout these failing companies is not working? AIG has received a $150 Billion rescue package from the government and still is reportedly asking for more help.

When these failing companies are still going under despite multi-billion dollar rescue packages is it time to reexamine the current economic initiatives being promulgated today by the government?

http://www.weeklypoint.com/2009/02/24/aig-fears-60-billion-loss-begs-for-more-taxpayer-money/

February 24th, 2009 at 2:59 pm -

Ryan-Stock Market Prices for American International Group said:

AIG: Bigger Loss, Bigger Bailout

Losing $100 billion in a year does not look like an easy task, but American International Group Inc. (NYSE: AIG) managed to achieve it. The company reported its 4Q08 loss at $61.7 billion, the biggest quarterly loss in corporate history, which brought the total loss for FY08 at $99.3 billion, or $37.84 per share .

The recent quarterly losses suffered by Merrill Lynch and Citigroup (NYSE: C), at $15.4 billion and $8.3 billion, respectively, look very small by comparison now.

March 29th, 2009 at 9:36 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!