The banking system’s methodical way of punishing savers: How punishing savers is encouraging a low savings rate and high levels of debt.

- 0 Comments

Would you be motivated to save money if your rate of return was 0 percent? That is the situation facing many Americans looking to put their hard earned dollars into the current banking system. Underlying the zero percent stated rate however is the reality that the real rate is closer to negative three percent given the rate of inflation. To keep it short and sweet, you will lose money simply by putting it into a regular savings account or even a certificate of deposit (CD). The Federal Reserve carries a lot of power in our financial system. The mere mention of shifting course sent the markets into a financial panic. The problem of course is the Fed has conditioned a public to very low rates and risk is being mispriced. These low rates in classical conditioning fashion have created a market addicted to lower and lower rates. The current system punishes savers and the setup has worked when we look at data to discourage saving.

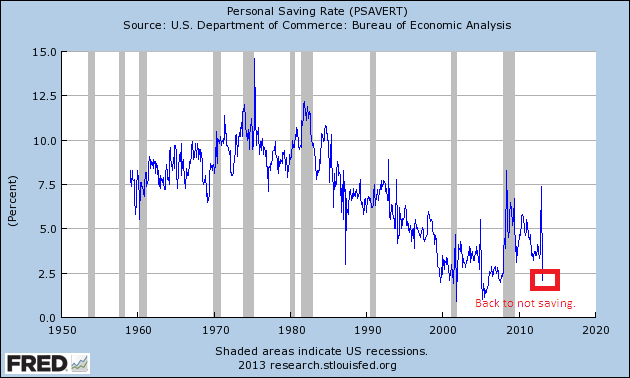

Personal saving rate back to record lows

Americans implicitly or explicitly have taken the bait for which the Fed has laid out. The Fed wants people to go into debt to buy homes, cars, educations, and anything else that can be financed. Why save and wait? This motto is reflected in the amount Americans are saving:

This is basic monetary policy here. If you want to cool down an economy, you raise rates to slow down spending. You want people to spend, you lower rates. You want people to spend money they don’t have an encourage banking speculation, you create the current environment the Fed has laid out.

There is nothing inherently bad about having debt. It is a part of any modern economy. Yet the amount of debt that is currently floating in the economy is truly amazing. For US households, the breaking point seemed to be reached when households were spending more than they were earning. Seems rather obvious but that was the operating guidebook for the last few decades.

While US households have pulled back via a process deleveraging, US banks have double-down and are speculating as if the financial crisis never occurred. It isn’t entirely clear whether the low rate environment is helping out your regular American family. It is abundantly clear that it is helping the financial sector.

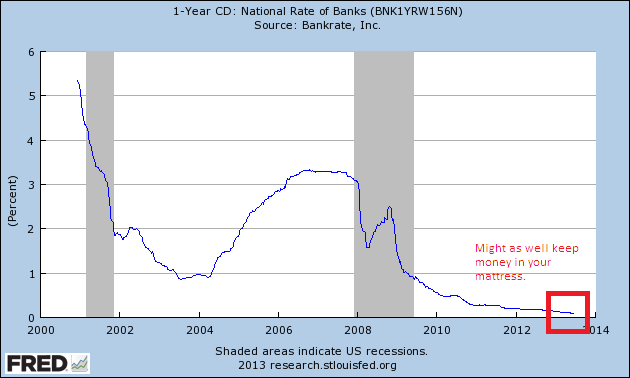

Low because of negative rates

The latest CPI reading shows year-over-year gains of 2.4 percent. Compare that to what you can get on a 1-year CD:

You would be losing money by locking your money up for 12 months. Short of having a place to store your cash, what other motivation would you have to save in the traditional banking system? It is clear why people are back to spending everything they got (and many are simply ignoring plans for retirement hoping that something like Social Security will be there when the time comes to not work). Of course not planning isn’t exactly a good recipe for future success but that is the default for most Americans. Given the current rates in the market and what is being provided by local too big to fail banks, many are opting to spend today or go into debt to purchase items. Hard to blame them since the Fed has essentially created this system and rewards go to those utilizing these artificially low rates.

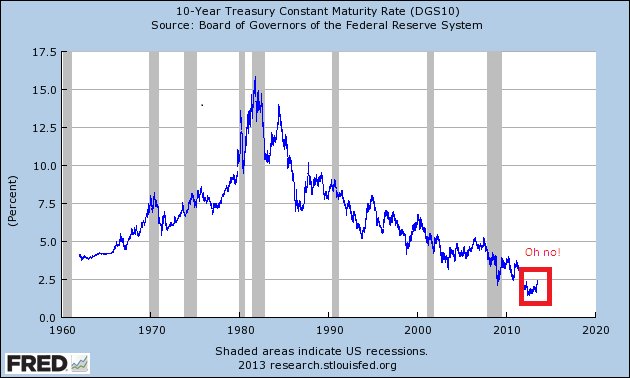

Fed might be losing control of low rates and will likely get more aggressive

The market went into a mini-panic when the Fed mentioned it would slow down its aggressive quantitative easing. This little utterance did this to the market:

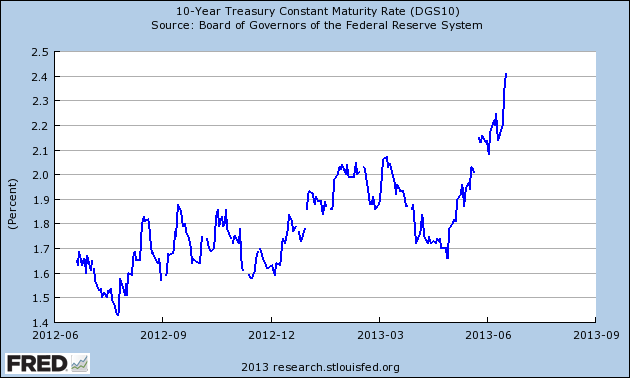

Okay, maybe in the scheme of things looking back many decades, rates are still historically low. In fact, looking at the above chart you don’t even see the movement. But let us look at the one year chart:

The 10-year rate went from 1.5 to 2.5 over this timeframe (an 86 percent move). This is enormous. Again, in the bigger picture this isn’t anything big but the Fed is conditioning the system to punish savers. Higher rates like this actually would encourage saving. So why did the market react so extreme? The reason for the market reaction was that most players in the stock market are big money investors betting on low rates for a very longtime. Anything shocking this thesis crushes their future goals. The public is merely caught up in the bigger financial shell game of pyramids of debt. Punishing savers to this level is really not a solution to our financial crisis. It would be better to allow more transparency and price discovery so that people can play on an even field. Instead, the market is guessing as to what the Fed will do next (anything but a free market). You already see negative effects of the low rate environment. The fact that you have big money buying up foreclosed homes to sell or rent back to the public with low rates shows how poorly allocated capital is in our current system.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!