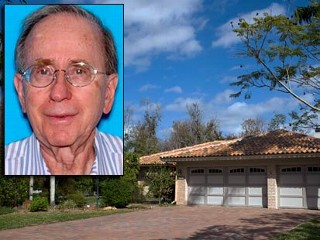

Art Nadel: Art Nadel the new Bernard Madoff? 76 Year Old Financial Swindler. Disbarred Early in his Career for taking client money to pay off Loan Sharks.

- 4 Comment

Art Nadel, if you haven’t heard, is another financial swindler in the similar vein of Bernard Madoff. Of course his $350 million swindle doesn’t hold a light to Madoff’s $50 billion Ponzi scheme but this does tell us one thing, where there is one roach there will be many more. And that is why we are seeing the pillars of the financial decadence decade come crashing down with bankruptcies flaring up and banks dropping like welterweight fighters.

It is important to first trace this story from the beginning since data is sketchy at the moment. Then attorney Arthur G. Nadel in the 1970s did a big no-no by dipping into an escrow account of a client to pay off loan sharks. At the time, he took $50,000 which was a clear violation of ethics and was disbarred for this action. Clearly, Mr. Nadel the now 76 year old man, had early experience in the shady practices of finance. This experience would serve him so well in a system that rewarded the swindler and smoke and mirrors salesman. Since the U.S. Treasury and Federal Reserve flooded the system with cheap money, this catered to financial deviants like Nadel and Madoff.

Nadel moved to Florida and this is where his big scheme was drawn up. He brought investors into his Scoop Real Estate Limited Partnership by mostly soliciting funds from the local Jewish community like Mr. Madoff. However, his web of deceit wasn’t limited to only that community.

Non-profits are also taking a hit from Art Nadel’s scheme including the YMCA in their local community. Art Nadel and his wife Peg Nadel would seem to be living a high life in Saratosa. The assets under their management exploded from $10 million to close to $350 billion in less than a decade. This is a lot of money for making things up but Art won’t be the first and last of these scheming financial crooks. This story is still breaking but public records show Art at the ripe old age of 76 (I saw a few articles have his age at 75).

Art Nadel would attend black-tie galas and had his office in Saratosa. He would seem to embodied the community. That is, until he skipped town last week. He left the family car at the Saratosa airport and there was a suicide note left in his office.

While Art bolted he left his wife Peg and their other partner to deal with a crowd wondering how a fund making 9 percent supposedly was virtually broke. As of Sunday, the FBI teamed up with the SEC to investigate the disappearance of Nadel.

Early reports indicate that he is in the Slidell Louisiana area but there is no final confirmation. In his note, he tells his wife to find solace in friends. Owning up to his mistake by skipping town and letting his wife take the downfall. His loan shark payoff days seem to still be with him from the late 1970s.

A recent lawsuit that was filed in Tampa, the SEC is now saying that Art transfered at least $1.25 million out of two of the funds into secret bank accounts that he controls. Don’t you love how these guys think with shell accounts and all this financial wizardry?

His enterprise started back in September of 1997 as a day trading operation with the dubious name of The Inside Scoop. You need to rewind to this time. The tech bubble was in full steam and saying you were a daytrader was the equivalent of you saying at the height of this housing bubble that you were an investment banker.

Initially, it started out small with about 100 members. The trading speculation game started dwindling and it became a more “sophisticated” trading house. Interestingly enough, this Mr. Nadel was a jazz pianist and according to early reports did most of the trading. The only one hearing any blues are his investors as he is off somewhere in the U.S. while the FBI hunts him down.

His investment strategy speaks of what is absolutely wrong and perverted regarding the hedge fund world. He would have one-third of his money in cash, bet one third on a rise, and the other third on a decline. These funds are meant to hedge bets in all situations. That is an absurd premise. Remember Long Term Capital Management with the greatest financial minds supposedly figured out a way to mathematically eliminate risk? That all came crashing down becuase people are nuts, greedy, and many times random like Mr. Madoff and Mr. Nadel and will do stupid illogical things. How do you hedge against a former jazz pianist who was an attorney but paid off a loan shark and is now running from the FBI becuase he swindled investors from $350 million? Maybe I missed that chapter in my investments class. If we can hedge our money perfectly, why does anyone work and actually try to produce anything? Let us hedge our way out of our $49 trillion in debt. It is a perverted scheme that let people like this scam artist Nadel and his wife live a life of fancy decadence while millions of Americans struggle to do the right thing by working hard and scrimping by. These people are too sophisticated for that to even lift a finger for an honest day’s work. They laugh at the working class of America. They openly would say this during the bubble but let us see how many will be public about this now.

But according to the New York Times, last year with major volatility 2 out of 3 of the hedge funds lost money and saw heavy money being withdrawn similar to what Mr. Madoff faced. With all this news going around, panic ran deep and investors wanted out and by the end of the year, $50 million in year-end redemptions were being called in.

It is yet to be seen whether this was a true Ponzi scheme similar to Madoff’s but one thing is certain. Art Nadel is on the run but will be found shortly. It’ll be interesting to find how much money left the SEC finds. The fact that we have a swindler at heart by his earlier actions and his dubious trading habits, the FBI is now searching for another financial expert gone wild. The impact of this is only starting to be realized. Art Nadel and Bernard Madoff are not the first, and the last financial swindlers that come out of this mess. I will give you a quote from the excellent book The Great Crash 1929, from John Kenneth Galbraith:

“In many ways the effect of the crash on embezzlement was more significant than on suicide. To the economist embezzlement is the most interesting of crimes. Alone among the various forms of larceny it has a time parameter. Weeks, months, or years may elapse between the commission of the crime and its discovery. (This is a period, incidentally, when the embezzler has his gain and the man who has been embezzled, oddly enough, feels no loss. There is a net increase in psychic wealth.) At any given time there exists an inventory of undiscovered embezzlement in – or more precisely not in – the country’s businesses and banks. This inventory – it should perhaps be called the bezzle – amounts at any moment to many millions of dollars. It also varies in size with the business cycle. In good times people are relaxed, trusting, and money is plentiful. But even though money is plentiful, there are always many people who need more. Under these circumstances the rate of embezzlement grows, the rate of discovery falls off, and the bezzle increases rapidly. In depression all this is reversed. Money is watched with a narrow, suspicious eye. The man who handles it is assumed to be dishonest until he proves himself otherwise. Audits are penetrating and meticulous. Commercial morality is enormously improved. The bezzle shrinks.

“…Just as the boom accelerated the rate of growth, so the crash enormously advanced the rate of discovery. Within a few days, something close to universal trust turned into something akin to universal suspicion. Audits were ordered. Strained or preoccupied behavior was noticed. Most important, the collapse in stock values made irredeemable the position of the employee who had embezzled to play the market. He now confessed.”

Get ready for 2009 because I have a feeling we’ll be hearing a lot of bezzling going on.

Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

milt tomkins said:

Really..this is getting ridiculous…You are right..I bet there will be more.. Maybe even one bigger than Madoff…in researching more about hedge funds I came across a few books that were fascinating ..honest, and informative…..Hedge Fund Trading Secrets Revealed by Robert Dorfman… and Confessions of a Street Addict by Jim Cramer….both these books take you on a great ride about hedge funds and how they make money. I learned about this secret society than I ever would have imagined. Dorfman actually teaches traders his strategies. Now i know for sure why its hard to make money in the markets. They aren’t designed for the little guy to win

January 22nd, 2009 at 7:52 am -

Yourambi said:

What a joke. All of these guys should be put in jail in hell along with the other money managers who put peoples hard earned money with crooks like Madoff and Nadel.

Was nobody doing there jobs?

Been reading up on this to see what people should have been doing. Best thing I saw so far was a book called “hedge fund operational due diligence understanding the risks”. Author was Jason Scharfman.

Where the hell was somebody at the SEC just following what this guy says in his book to catch these crooks…. geez!

January 22nd, 2009 at 8:27 am -

Larry Conners said:

Why must we keep reliving the past..? Don’t we ever learn..?

The ” greatest financial minds ” my ass…just some greedy, money grubbing dirtbags that should be publicly humiliated, removed from their positions, and ostracized by the financial sector….wishful thinking in a nation of pop culture addicts where it was found that in 2008 over 75% of Americans never read or bought a book…

Apathy breeds socialism…let someone else take care of the problem.

January 22nd, 2009 at 10:05 am -

George said:

Just get rid of the Federal Reserve System, repeal the 16th Amendment, and all the stealing will stop.

We use credit / debt as money, it is not money !

We have been flim-flammed, bamboozeled, ponzi schemed, and robbed of trillions of dollars and all the gold, by the bankers of the 300, known as the banking cartel that sleeps in bed with our government, also known as the bankers minions.

Real Money = Real and Free Economy

Fiat Money = Debt / Enslavement

Think of this simple fact:

The Federal Reserve System has the Treasury print up money, The Federal Reserve System then hands it to the Congress with the interest attached. Now, if there’s interest on the dollar and you only get a dollar, where does the money for the interest payment come from?

It’s a ponzi scheme you moron.Now, there’s a time for peace and a time for action. I would say there is no better time than now for action to stop this den of thieves and vipers and return this country’s currency back into the hands of the people and Congress, not private bankers that kill anyone in their way.

January 22nd, 2009 at 10:42 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!