Bankruptcy Filings to Match Divorce Filings in 2009: 1.5 Million. 35.8 Million Americans on Food Stamps – 11 Percent of the Population. The 5 Indicators of the Misery Index.

- 3 Comment

It is a sobering fact that in 2009, there will be as many people filing for bankruptcy as those filing for a divorce. We are on track to seeing an average of nearly 5,900 bankruptcy filings a day for 2009. While some people use the stock market as their barometer of economic recovery, there are a few other “misery” indicators that show things are still bad for millions of Americans and counter the recovery talks. If you want to track a broader recovery, I would recommend people examine the five indicators of the misery index. Food stamps, bankruptcies, long-term unemployed, foreclosures, and credit card defaults are probably your best gauges to the real economic recovery.

The problem we currently face is even after the global economy was brought to its knees by the current Wall Street banking structure, things still haven’t changed at the core of their mission. The same banks are back taking inordinate amounts of risk with the now explicit backing of the U.S. Taxpayer. It is no surprise then that our U.S. dollar has been pummeled by the policies of the Federal Reserve and U.S. Treasury.

Let us examine each component of the misery index.

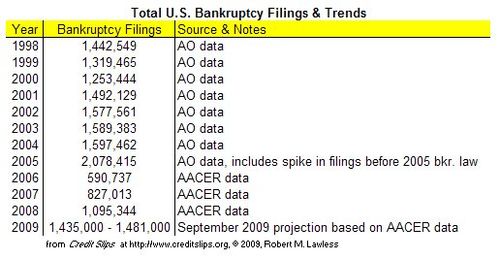

Bankruptcies

Source:Â Credit Slips

It shouldn’t come as a surprise that bankruptcy filings are now approaching their pre-2005 levels. Keep in mind that in 2005, tough bankruptcy legislation came into effect thus spurring a massive wave of bankruptcies from people seeking to avoid the new tougher standards. Even with these new standards in place, there is only so much blood that you can squeeze out of a turnip. Some will be quick to point out that bankruptcy filings hurt big corporate giants mostly. On the contrary, 98.5% of all bankruptcy filings come from individuals at the end of their rope. Most people don’t file for bankruptcy with a smile on their face.

We will see a slowing or moderating pace for the fourth quarter since there is a bit of seasonality with filings. But Q1 of 2010 should give us a better indicator of where things are heading. But one thing is irrefutable, bankruptcy filings are going up. In this category, the recovery is not taking place.

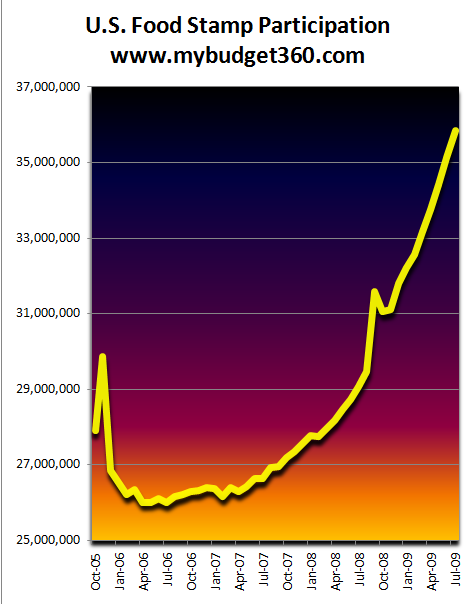

Food Stamps

Over 35,800,000 people are currently receiving food stamps in the U.S. That is 11 percent of our entire population is receiving government assistance through the SNAP program (i.e., food stamps). As the chart above can attest to, the number of people is still booming. Obviously in any economic down turn, this rate will increase but this percentage is one of the highest on record. It is also clear that the growth is currently exponential.

Here is the government expenditure per year on food stamps:

2006:Â Â Â Â $30.6 billion

2007:Â Â Â Â $30.3 billion

2008:Â Â Â Â $34.6 billion

2009:Â $40 billion (still need August and September data – average out we are approaching $50 billion for 2009)

Just think of how quickly this number is jumping. The problem with the current system is that some people are still governed by the trickle down school of economics. They believe that if Wall Street is up 60 percent (thanks to government bailouts) that somehow crumbs will trickle down to working and middle class Americans. Clearly it isn’t happening right now. The recovery is looking more like a minor depression to many.

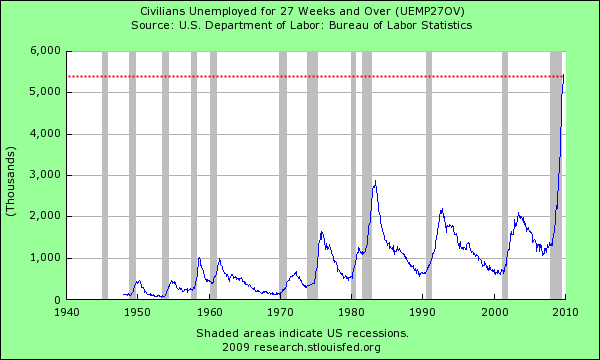

Long-term unemployed

It is telling that the biggest category of our currently unemployed population is those classified as long-term unemployed. These are people that have been out of work for 27 weeks or more. Think of how grueling it is to be out of work for half a year in this economic climate. The issue at the core of long-term unemployment is that it reflects potential permanent job losses. That is, many of the 8,000,000 jobs lost since the recession started are never coming back. For every one job opening you have six able bodied workers competing for it.

It is hard to see what industry is going to pick up the slack for these long-term unemployed. Many are now coming to the end of their unemployment insurance and in many cases, in some states this can be as long as 90+ weeks. The long-term unemployment trend tells us that we have yet to see any economic recovery as well. Sure the stock market may be up but what use is that to the average American that pays most of their bills through a job?

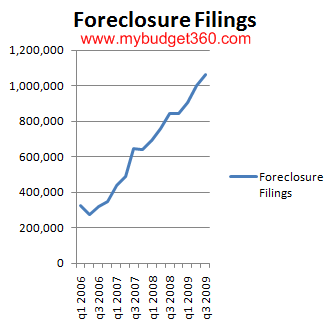

Foreclosures

At the root of most of this is the housing market. Take a long and close look at the chart above. Q3 of 2009 was the worst foreclosure quarter on record. Clearly foreclosures are not a sign of economic recovery but here we are, two years into the crisis and foreclosures are still at record levels. Much of this comes from the decade long housing bubble. But keep in mind each additional foreclosure is another home on the market, another family looking for different shelter, and an economic loss to the system. It is hard to see any of the government stop-gap measures fixing this in the short-term. The loan modification programs have yet to yield any significant change.

It is also the case that the government has gotten more risky with tax credits and allowing lax lending standards with FHA insured loans in getting more people to buy. In the short run this may offer the appearance of growth but over the long haul, this will only add to future defaults.

The foreclosure numbers show us a very different picture from the current recovery rhetoric.

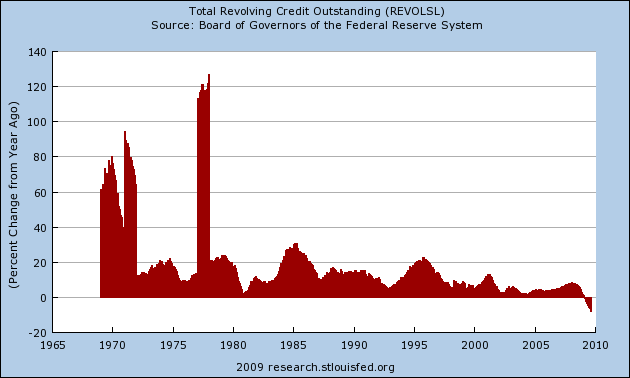

Credit Card Defaults

For the first time in data tracking history, has total revolving credit contracted on a year over year basis. At a time when the above data shows that more Americans need more support, the credit card companies are yanking lines of credit. They are also charging higher fees on good standing customers to make up for their rising defaults for years of easy financing. Here is some sobering data:

Credit card direct mail offers:

Q3 of 2006:Â Â Â Â Â Â Â Â 2.1 billion

Q3 of 2009:Â Â Â Â Â Â Â Â 391 million

Now you know why your daily mail is much lighter. Credit card companies who are giant receivers of taxpayer bailout money are actually closing their doors on the same people who are bailing them out. They are hiking up fees and closing down credit lines unless consumers give in to their onerous ways.

The bottom line is the misery index shows no solid economic recovery. I suppose it depends on what we are looking at if we want to say we are in a recovery. If we are looking at banking profits and Wall Street then yes, the recovery is here. If we are looking at other data like bankruptcies, unemployment or foreclosures then the story is very different.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

madmilker said:

Retail makes NOTHING but those 15 Cargo Ships emit as much pollution as 760 MILLION AUTOMOBILES.

The American taxpayers pay $9 billion in HIDDEN TAXES jus to clean the fish out of ballast tanks of ships.

If the American consumer keeps spending George Washington to a foreign land for so-call cheap items….he can’t help the American people being stuck in a foreign bank.

America was NOT like tis before Wal*Mart.

November 4th, 2009 at 5:58 am -

Doug Ward said:

Amurkastan indeed wasn’t like that pre Walmart.

HOWEVER. Americans are idiots that continually vote against their own best interest….including making Walmart the #1 retailer.

Notice that the same idiots that frequent the Walmart vote republicanT.I left the US, and got out of the dollar, after El Idioto was allowed to steal his second term.

Best move I ever made.I actually still try to buy some American goods. Mostly from my pals in the outdoor sporting goods industry. Most of those guys are old now and the younger ones have already shipped out so that’s nearly over too. America is history. Another fallen Empire due to greed and ignorance.

November 5th, 2009 at 3:30 am -

Melisande Luna said:

Hey, there’s no denying that low, low prices have mucho appeal. Imagine a store where aisles and aisles of low, low prices offered countless bargains to help stretch our anorexic dollars out. Wouldn’t you want to shop there? Doesn’t it sound like a wonderful place? That’s progress, baby!

Much like a squamous cell growth will progress into sarcoma, the problem with the expansion of Wal-Mart isn’t its low prices. The problem with Wal-Mart is that Wal-Mart is on the US corporate welfare dole. Taxpayer subsidies are the reason Wal-Mart is building SuperCenters everywhere while still offering us those low, low price tags we all love so darned much. Feel the progress yet?

In spite of the fact that Wal-Mart appears to offer contributions to a community, such as Sam’s Club, employment for the retired, welfare-to-work, and developmentally disabled employee, that doesn’t change the fact that these charitable gestures result in HUGE corporate tax breaks.

Wal-Mart’s massive profit margin allows them to offer low, low prices earned off of the sweat of an immense group of disenfranchised, non-union workers who are paid low, low wages and worked just enough low, low hours to not qualify for health insurance, ever.

One result of Wal-Mart’s “passing the savings on to you” employer policies is that a vast many of Wal-Mart’s employees are eligible for Medicare, food stamps, welfare, and earned income tax credits. In fact, the annual amount of tax money spent to subsidize the low, low wages of every single Wal-Mart retail employee is estimated to be as high as $14,000 each, and no less than $6,000.

With all those hidden taxpayer subsidies underwriting the Supersizing of Wal-Mart, doesn’t it seem like those low, low prices are climbing? I’m seeing the growth; where’s the progress?

The low, low tactics don’t stop there, friends and neighbors, Washington DC researchers, JobsFirst, has compiled documents that account for over one billion dollars in direct US government subsidies given to Wal-Mart since 1980, which doesn’t take into account the taxpayer funds spent on employee welfare subsidies. Evidently, Wal-Mart is the largest US corporate beneficiary of US government grants, tax waivers, abatements, exemptions, easements, bonds, sales tax incentives, employee training allotments, infrastructure, access roads, utilities, etc. Why, there’s an entire eight-lane freeway out in Oklahoma that dead ends at a Wal-Mart distribution center. No potholes in it either. Just try to get the government to fix the potholes on your street.

Since a great many of my neighbors are Republicans, I won’t even attempt to sway you with liberal-media borne tales of Wal-Mart’s profiteering on the backs of child laborers in China, or what a threat China is becoming to the American economy, or how all of our jobs are being outsourced via operations similar to Wal Mart’s. We’ll worry about the sociopolitical economic concerns of ruinous foreign and domestic policies, later.

For now, it’s time to address our government’s dirty dealing corporate welfare subsidy cards to Wal-Mart cons so they can play low,low price Monty with the easily bamboozled American shills, er…taxpayers. When that happens, and the State is sponsoring it, it’s not an economic system based on free-market capital anymore, it’s state-sponsored monopocapitalism, or, more simply put, fascism. It’s a cancer. Comprende?

I didn’t think so.

Listen, do y’all think you’ll be rapturing along soon or waking the heck up or at least try reading a different book for once? I’m darned tired of hearing you pro-death-penalty-pro-interfering-with-other-peoples’-lives-pro-lifers using Jesus as a some sort of Morality– brand-name logo icon to defend the rightness of your right-wing righteousness, the likes of which is apparently comprised of some pretty god darned unchristian works: elitism, war, depleted uranium, envy, sloth, greed, voting to eliminate social programs for the poor while simultaneously blathering on about your right to purchase cheap plastic garbage from a cracked back megasuper sto rich on welfare!

Class dismissed, retardos. Like, amen, or whatever.

November 5th, 2009 at 11:03 am