If Incomes are Down, Where is the Economic Spending coming from? Industrial Production Still Lower, Credit Contraction, and Average Work Week at Record Low. Wells Fargo Considering Converting Option ARMs to Interest Only Loans.

- 2 Comment

With 8 million jobs lost in this great recession, it is rather surprising to see so many people enter into a deep capture mode of believing in a quick and efficient recovery. If we look at data in the misery index, the average American has a hard time swallowing the jagged economic recovery pill. They look at their paychecks and see no recovery. They look at rising healthcare costs and see no recovery. They send their kids to colleges where costs are going up 8,9, or even 10 percent per year. The data simply does not reflect this actual reality. Are things better than say in March? Depends on what we look at. Sure, the stock market is up a record 60 percent but does your life feel 60 percent better? Is your pay up by 60 percent? What about your bottom line? If we look at disposable income for the average American, it has actually fallen. If it follows that two-thirds of our economy is based on spending, then where is this money coming from?

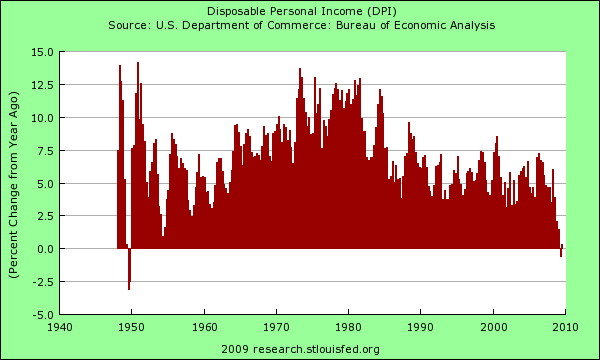

Let us first look at disposable income:

With over 70 years of data, disposable income has only gone negative on a year over year basis one other time and this was in the late 1940s. This is really not a typical occurrence. Yet when we deconstruct the GDP report and 3.5 percent growth, we realize that this equation:

GDP = private consumption + gross investment + government spending + (exports – imports)

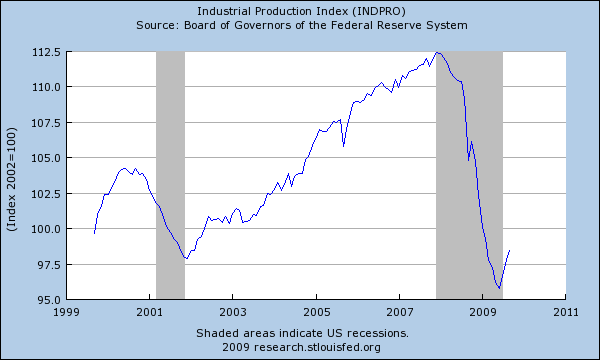

A large part of that growth came from government spending. The other growth came largely because of cash for clunkers with the auto sector contributing 1.6 percent of the 3.5 percent growth (typically about 0.1. or 0.2 percent). In other words, there should be little shock that GDP was up. Why not spend $2 trillion and make it go up by 7 percent? Of course, any thoughtful analysis shows the error in this reasoning. It is an adrenaline shot to the chest administered by the bailout syringe. The U.S. Treasury and Federal Reserve are juicing the markets and hoping this recovery sticks. The latest data relies on purely government back stops. If we look at industrial production, things are still looking like a recession:

And much of the bounce is coming from restocking and refilling inventories to meet the current demand. The real question is whether the demand will still be there without government spending. That is yet to be seen. In fact, there is already talks of a second stimulus and the government is still pumping money into the fragile housing sector trying to get Americans to buy homes yet again even though we just went through a decade long housing bubble.

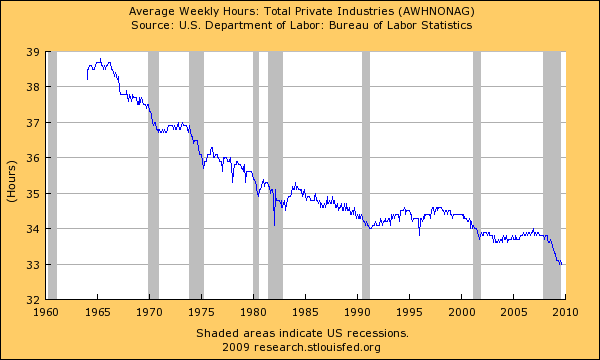

Yet the average American is working less hours and earning less money:

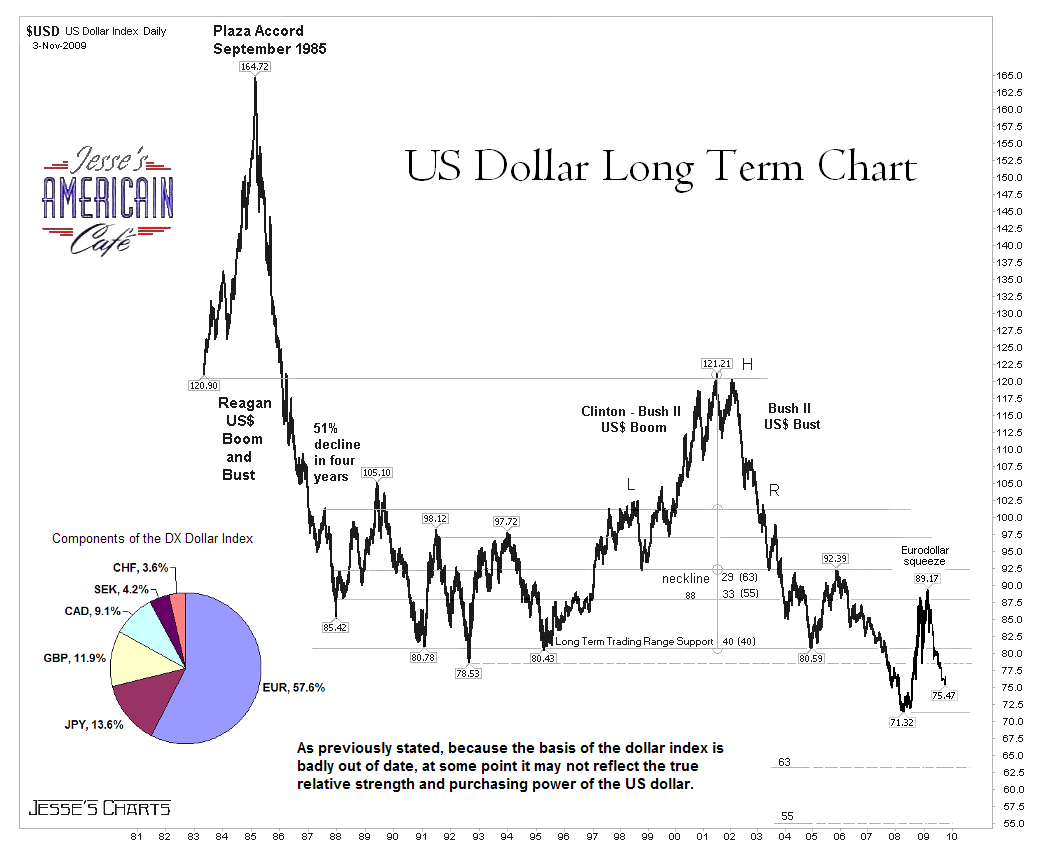

This is a fundamental question here. Most Americans don’t realize this but they are being taxed in numerous ways. For one, the current bailouts and government spending is coming at the cost of a weaker and flailing dollar – you are being paid in a weaker currency:

Source:Â Jesse’s Cafe

There is a cost for all this additional spending. The only reason we have yet to see the higher cost hit the typical balance sheet is because there has been $12 trillion in household net worth balance sheet destruction. This has occurred through the loss in real estate value and stock market value. This is real wealth destruction. Also, each bankruptcy and foreclosure in essence destroys the face value note and brings to reality a new cost. In other words, a $500,000 mortgage that is now linked to a home that is worth $200,000 and is foreclosed and sold, will only produce a $200,000 mortgage (depending on down the payment). So the system loses that $300,000 even if it was inflated values. There is still unrealistic prices in the system especially in the $3 trillion commercial real estate sector. That is why the Fed is reluctant to allow an audit of their books.

Americans haven’t yet felt the brunt of this but we are in a full-fledged disinflation period. Rents are going down and this is the largest component of the CPI. So those on fixed incomes are going to have to get by with less. Just look at Social Security that suspended the COLA for the time being. Have you looked at saving account interest rates? Close to zero. So the only game in town is basically the stock market (and commodities) if you want anything above 5 percent. The risk-free days are over. Even holding the U.S. dollar is now risky because of the massive spending.

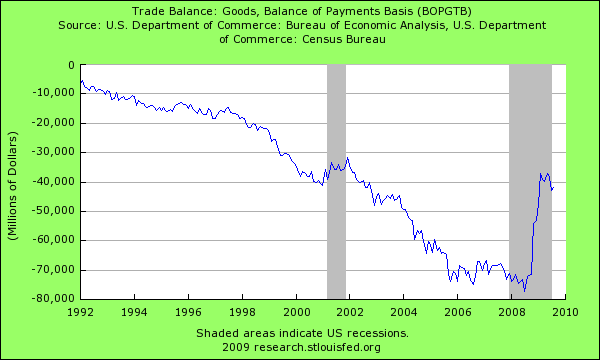

If we look at the balance of trade, things have improved simply because Americans are spending more and our lower dollar has made our products a bit more competitive:

Make no mistake, the improvement above is largely due to less consumption. So what will happen? The U.S. Treasury and Federal Reserve want a systematic devaluation of the US dollar. As the above chart points out, this is their current path. They are satisfied that Wall Street is back to the good old days and the taxpayer is subsidizing their casino at the cost of the US dollar. In their mind’s eye, they are looking for a decade long decline in the dollar followed by moderate to strong inflation. When was the last time that you saw on the mainstream media the U.S. dollar debated? In that way, we essentially inflate ourselves out of this bubble without the masses getting into a frenzy. Even the banks are betting on this.

Wells Fargo is now talking about converting their option ARM loans into interest only loans:

“NEW YORK (Dow Jones)–Wells Fargo & Co.’s (WFC) strategy for modifying its billions in troubled Pick-A-Pay mortgages looks a lot like a game of kick-the-can-down-the-road.

Wells Fargo, the fourth-largest U.S. bank by assets, holds more than $107 billion in debt tied to option-adjustable rate mortgages, a quintessential loan product from the housing boom that allowed borrowers to make small monthly payments in return for increasing their mortgage balance. Now, many Pick-A-Pay borrowers own homes worth far less than they owe in mortgage debt, even as many of them can afford a full monthly payment that pays down principal.

To solve that conundrum, Wells Fargo is taking a gamble: The bank is issuing thousands of interest-only loans that will defer borrowers’ balances for as long as six to 10 years. Wells Fargo is wagering that an eventual rise in housing prices in the country’s worst-hit regions, along with a rise in consumers’ income, will eventually combine to cover the bank’s billions in underwater Pick-A-Pay debt.

“We’re banking on the fact the economy will improve and recover over time,” Michael Heid, co-president of Wells Fargo Home Mortgage, said in an interview.”

Wells Fargo is essentially betting on another housing bubble. Think of an option ARM loan that is at $500,000 on a $250,000 home (58% of these loans are in California). Wells Fargo is betting that the current borrower by 2019 or whatever date will then be in a home valued at $500,000 or more. They are simply betting on another bubble spurred by the U.S. Treasury and Federal Reserve. In Japan, real estate values remain depressed after 20 years. This after trillions into their banking sector and trillions in fiscal stimulus (sound familiar?).

So going back to our initial question, if income is down where is the money coming from? It isn’t coming from credit card companies because they are slashing limits and credit. Right now it is coming from the government. But it comes at the cost of breaking the dollar down. Why else is gold now trading near $1,100? The world won’t finance our spending spree forever. Buying more cars and more homes is not a long lasting solution. I doubt that has any long-term sustainability. But the real question will come in 2010 with the stimulus running low. Will the real economy make up for lost incomes? Of course we need to create jobs and good paying positions for that but that has yet to be seen. Until then, we are spending money we don’t have to buoy the economy. Is that really good news?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

edward said:

Thanks for the great charts. I especially like the dollar chart. I have no idea how long the fed is going to be able to keep this game going. My money is on a higher gold price by playing the miners through gdx and an intermediate term continuation in the bear market in equities (spxu). My fear is that I might be wrong and equities will continue to rally because of the easy money.

November 6th, 2009 at 1:16 pm -

Concerned Citizen said:

This analysis is spot on. As you said, the dollar is going to continue to decline by design. And the Wells Fargo policy of refinancing the Option-ARM loans only postpones judgement day. Well over half of the homeowners with those loans are underwater — many of them will strategically default (mail the keys to the home to the bank — “jingle mail”) because it makes more economic sense than to keep paying for an asset for the next 6 or 10 years that isn’t worth even the loan balance. As Edward commented, equities could keep going up, even though the economy and real estate perform badly. During the Weimar hyperinflation, the stock market did well for stocks that had assets, it was just another way to own the asset. Gold and foreign currencies did best. More at beforeitsnews.com.

November 12th, 2009 at 11:43 am