Employment Engineering: Firing those who Work with Their Hands. Finance, Insurance, and Real Estate Jobs Protected by Bailout Structure. Other Sectors Dealing with Depression Trends.

- 3 Comment

It is hard to imagine why Wall Street would cheer a 10.2 percent official unemployment rate since the stock market actually ended the day higher after this dismal news. Since the start of the recession, 8 million people have lost their jobs. A total of approximately 27 million people are unemployed, underemployed, or have given up looking for work. All the talk of improvement got people out looking for work again and that is why the unemployment rate saw a big jump from 9.8 percent to 10.2 percent even though employers “only” cut 190,000 in October. The data is deceptive for many reasons. For one, long-term unemployment is a sign that many jobs will be lost forever. The second more ominous point is that many sectors are experiencing mini-depressions.

All job cuts are not equal. If we had to sum it up, paper pushing jobs in the financial sector seem more immune than good producing jobs. Let us look at how the real employment situation is panning out:

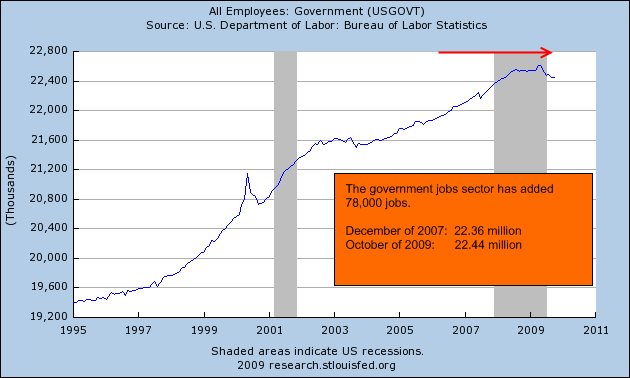

Since the start of the recession 22 months ago in December of 2007, the government has added 78,000 jobs employing some 22.44 million people. It is interesting to look at local and state taxes that are being pummeled yet this sector is still up. It would be one thing to create new jobs but looking at the chart above, jobs were never cut. What did the government actually do? States like California implemented furloughs and raised taxes in many cases.  Of course, the major issue in many states is the bloated pension system that puts an unsupportable burden on those who are actually still working. I can understand that someone needs to live and support themselves in retirement. But in California for example, you have many people receiving $100,000+ pensions and many only worked until their early 50s. What is clear from the above is the government did not cut any jobs on a net basis. So we can scratch this sector when looking at where the jobs were lost.

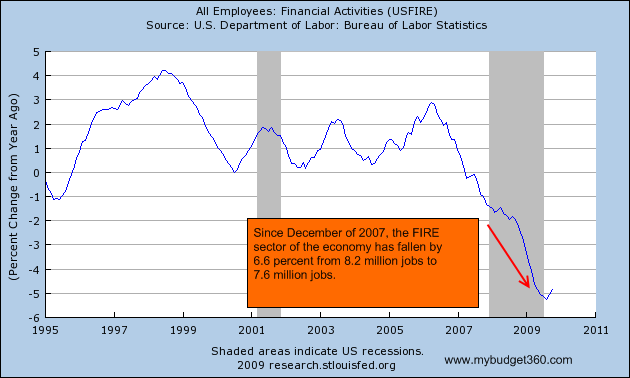

The next sector is the FIRE economy:

Given the 8 million jobs officially lost in this recession, a mere 600,000 came from the finance, insurance, and real estate industries. This is the sector that is largely responsible for the housing bubble and the entire finance mess yet it is not taking a major cut as it should. Why? The bailouts are targeted in protecting many of these Wall Street paper pushers. In fact, you can see that in the last month it actually added jobs. The 6.6 percent drop does not reflect the actual overall fall in employment. Again, this sector is being supported by the trillions in taxpayer money. So where are the job cuts really coming from?

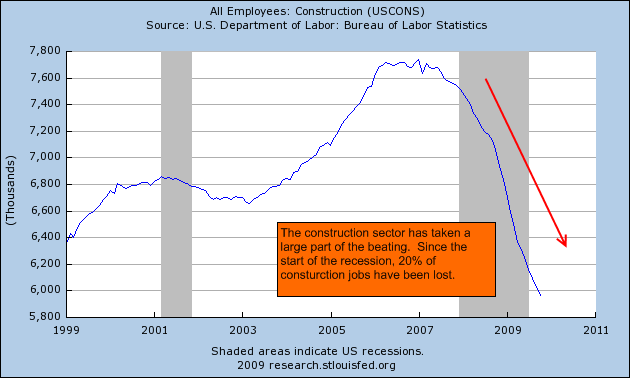

Construction employment has taken it on the chin:

Construction employment is down by a stunning 20 percent since the start of the recession. It is interesting that from the start of the recession, construction and the FIRE sector had roughly the same number of employees benefiting from the housing bubble but where the FIRE sector lost 600,000 jobs, the construction sector has seen 1,557,000 jobs cut, nearly 3 times the rate of the FIRE sector. Apparently building a home is less valuable than writing a toxic mortgage. Again, the government bailouts are protecting an over employed FIRE sector while throwing other sectors of the economy to the wolves. Keep in mind both of these sectors used the same underlying asset (real estate) to expand. The housing bubble is now the U.S. Treasury and Federal Reserve bailout of the FIRE economy.

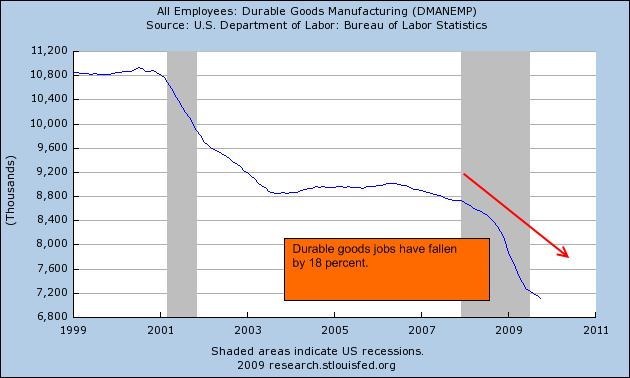

Durable goods manufacturing has also been slammed:

Durable good manufacturing has fallen a stunning 18 percent since the recession started. If we look at construction and durable goods, both sectors are experiencing depressions while the FIRE sector is experiencing a tiny recession. And take this data point as a reference:

Durable goods and manufacturing:

December 2007 jobs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 8.728 million jobs

October 2009 jobs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 7.121 million jobs

FIRE sector:

December 2007 jobs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 8.242 million jobs

October 2009 jobs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 7.697 million jobs

This should tell you what is happening to many average Americans. Only two years ago, the durable goods and manufacturing sector had 486,000 more jobs than the FIRE sector. Now, the FIRE economy has done a role reversal and has 576,000 more jobs than the durable goods manufacturing sector! Who are we really bailing out here?

Conclusion

Simply taking the employment report at face value is meaningless. What is happening is the bailout structure is designed to prop up the primary industries that created the housing bubble. Many of the FIRE jobs are over compensated Wall Street cronies who are using taxpayer dollars to gamble. The real fact is many sectors of the American economy are in deep recession. Unless you work for the government or the FIRE sector, chances are your industry is in a deep recession. Then again, why else would the stock market be up by 60 percent since March? It is easy to make money when you eliminate the biggest line item (employees) for short-term bottom line gains for those in the FIRE economy since your job is subsidized by the taxpayer.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

3 Comments on this post

Trackbacks

-

Sockeyeslammin said:

Great observation and truth. Peel away the feely-good, “let’s all have a hug” garbage, and this is where taxpayer dollars are really going. The bucks are going into the Pit Boss’ pockets on the casino floor of the derivative, repackaged loan pyramid scheme.

November 8th, 2009 at 11:12 pm -

Thomas said:

“It is hard to imagine why Wall Street would cheer a 10.2 percent official unemployment rate since the stock market actually ended the day higher after this dismal news.”

(Real opinion piece follows 😉 )

If you remember that stock exchange (as a whole) has long ago disconnected from the real world and economist in corporations see commonly workers as a cost, nothing more, then you can understand why stock prices raise when unemployment rises: Less workers -> less costs -> more profit is the chain of thought.

Stock markets haven’t ever been interested in products produced or who buys those, too complicated for them: If stocks sell and prices rise, then all is well, it’s a closed world.

Explains why the bailout money went straight to stocks: Bank executives get their bonuses based on stock price and so they get the most of if to their own pockets by raising stock prices, not by “helping customers”. And figuring that took about a minute, which obviously was too much for the president and his assistants. It seems that you an always trust the FED to help their fellows in need, not the nation.

Mental thinking (by bank executives) that caused whole crisis hasn’t changed a bit. I suspect it won’t chance until it’s forced to and that’s something current administration obviously isn’t going to do.

November 22nd, 2009 at 8:27 pm -

bridging loans said:

Employment?

I have been in flint, michigan for a little over a year now. Why is it so hard to find a job? If anyone out tthere is from flint, got any advice? I’m getting ready to file for bankruptcy and all my fiance’ and his mom do is yell at me to get a job. He has a job, he’s the owner of a painting company, and his mom thinks i can just go out and find one no problem. Guess what it’s not that easy anymore, that’s what i tell her. I’ve never had any problem like this before, finding employment was always easy for me. Any employers reading this, your missing out on a great worker.April 8th, 2010 at 3:53 am