Plan C as in Commercial Real Estate – FDIC: 115 Bank Failures in 2009. Total Assets of FDIC Insured Banks $13.3 Trillion. $3 Trillion Backed by Shaky Commercial Real Estate.

- 0 Comments

It is one thing when a few analysts say that commercial real estate, that $3 trillion elephant in the room, is going to experience trouble starting next year. It is another thing when billionaire investor Wilbur Ross comes out and states that commercial real estate is going to crash and burn. We’ve been looking at commercial real estate for sometime and the U.S. Treasury has already had talks regarding a preemptive CRE bailout called “Plan C.”

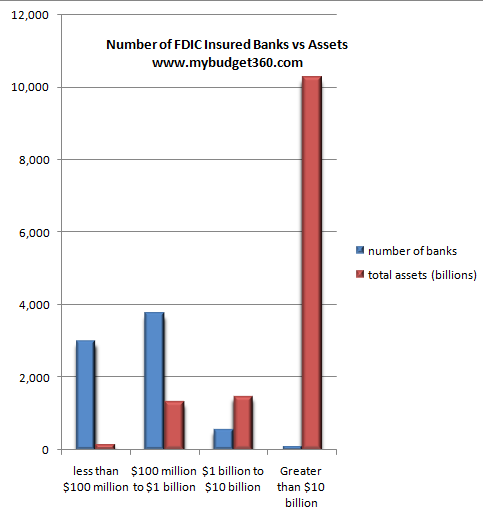

The commercial real estate sector is even more fragile than residential real estate because commercial space is a direct reflection of the health of the economy. In other words, how much office space do you need without workers? How many strip malls can you fill without shoppers? Not many. Commercial real estate is also financed in a unique way where loans are refinanced typically on five year terms. Many are coming due starting next year. Friday’s multiple bank failures, 9 in one day and a cost of $2.5 billion to the FDIC fund, was the most closures in one day since the recession started. Even with this giant number, most of the assets at FDIC insured banks sit with a few banks:

The FDIC insures over 8,000 banks covering $13.3 trillion in assets. In reality, 100 banks hold over $10 trillion of those assets. The banks that are failing typically do not fall in the top 100. And many of these recent bank failures are starting to show signs of commercial real estate fatigue. Ross summed up the overall scenario well:

“(FT) All of the components of real estate value are going in the wrong direction simultaneously,” said Ross, one of nine money managers participating in a government program to remove toxic assets from bank balance sheets. “Occupancy rates are going down. Rent rates are going down and the capitalization rate – the return that investors are demanding to buy a property – are going up.”

There is some form of twisted irony in the above. The government has tunnel vision focus on residential real estate. The Federal Reserve has bought nearly $1.25 trillion in GSE MBS thus keeping mortgage rates at historical lows. Not enough? What about a nice $8,000 tax credit? Still need more? What about going with FHA insured loans that only require 3.5 percent down? In other words, the government has stepped into the vacuum left by the toxic mortgage lenders. So we shouldn’t be surprised when FHA insured loans, Fannie Mae, and Freddie Mac loan portfolios start showing historic amounts of defaults. Yet the consequence of pushing many renters to homeownership, is you speed up the crash in commercial real estate. We should be honest and admit that not everyone can be a homeowner. And this is okay. They can rent. Nothing wrong with that. But now we are seeing enormous apartment vacancy rates because we are temporarily shifting some into homes they cannot afford. They will only default later as we have seen with the current decade long housing bubble.

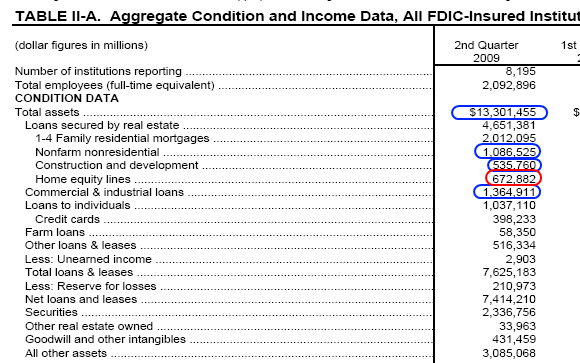

Commercial real estate is a gigantic line item of the FDIC insured banks:

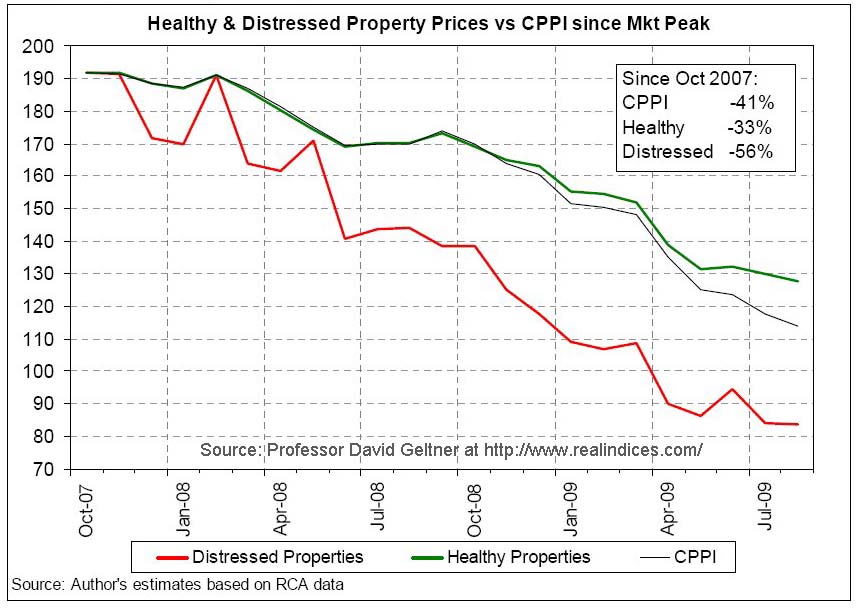

In fact, if you add up nonfarm residential, construction and equipment, and commercial/industrial loans the number is approximately $3 trillion. Contrast this to the $2 trillion in more conventional residential loans. In other words, this has the potential of being bigger than the residential downturn. Commercial real estate values took longer to fall than residential property values, but not only have they caught up, they have surpassed the percentage amount of declines:

With many of these loans coming due in the next few years, the question will focus on the ability of companies to get the loans refinanced. But who will take on a loan of an empty commercial building? For residential property, the government for better or worse has a big mechanism through Fannie Mae, Freddie Mac, and FHA insured loans to buy up these loans. The government currently backs 95 percent of all residential mortgages. It is the market. Yet with commercial real estate, there really isn’t a government mechanism fortunately (that is, unless the U.S. Treasury plows through with Plan C and starts bailing out this industry).

The FDIC and other agencies are trying to jump out in front of this freight train. Maybe it isn’t call Plan C but something is in the works:

“(AP) WASHINGTON – Banks must accurately identify their potential losses when modifying troubled commercial real estate loans under federal guidelines issued Friday.

Regulators have warned that rising losses on commercial real estate loans pose risks for U.S. banks, with small and mid-size banks especially vulnerable. Nearly $500 billion in commercial real estate loans are expected to come due annually over the next few years.

Agencies including the Federal Deposit Insurance Corp., Federal Reserve and Office of Thrift Supervision released the new guidelines for banks, which emphasize that modifying loans in a prudent fashion is often in the best interest of both the bank and the creditworthy commercial borrower.

Under the guidelines, loans to creditworthy borrowers that have been restructured and are current won’t be classified as high risk by regulators solely because the collateral backing them has declined to an amount less than the loan balance.”

This will be a fascinating challenge here. Jean Paul Getty had it right when he said, “If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.” And the banks have a gigantic problem. You can expect workouts but what can you workout with a property that is completely vacant? Is there any price point that will work? We are going to find out soon enough.

The commercial real estate debacle is coming in line with the appearance of a stabilization in the residential market. The CRE debacle has the potential to destabilize the market again. Expect to see more banks go under because of horrible CRE loans.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!