Can the U.S. Dollar Rally while Stocks go Down? U.S. Dollar Fueling Stock Market Rally: Examining the Dow World Index and Dow Index in Relation to the U.S. Dollar. U.S. Dollar down 35 Percent since 2001.

- 1 Comment

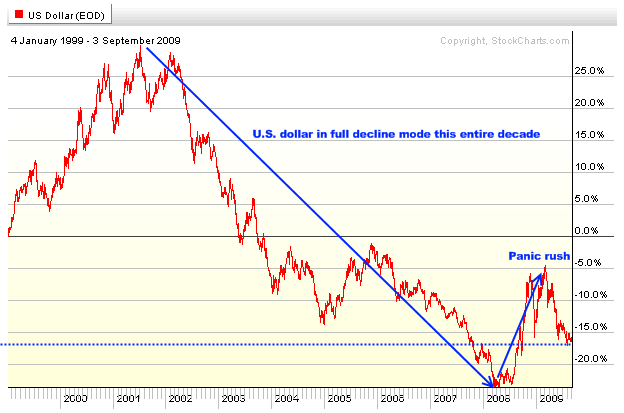

The role of the U.S. dollar is coming into question during this economic crisis. Most average Americans are oblivious to the fact that since 2001, the U.S. dollar has fallen a stunning 35 percent. What seemed as good economic times was purely a credit bubble fueled by easy money from the U.S. Treasury and Federal Reserve. During this time, the stock market brushed off the technology bust of the 1990s only to reach a subsequent market high in 2007. That of course has gone by the wayside. The market from the peak in 2007 dropped 54 percent but what is even more startling the world Dow Index fell 59 percent in a few months after reaching its high in late 2008. First, let us examine the movement of the U.S. dollar since the crisis has started:

I will put up another chart showing the longer term trend of the U.S. dollar. However, in this chart you can see that when the U.S. stock markets made their highs in late 2007, both the U.S. dollar and domestic stock markets started trending lower simultaneously. If anything, the local stock markets simply caught up with the overall U.S. dollar trend:

But what happened during that time when the dollar hit the 70 mark in 2008? Let us rewind and see what was being said at the time:

“(Forbes June 2008) That in turn has helped to push up the prices for imported goods flowing into the U.S., such as oil, and fuelled a rise in consumer prices.

Bernanke called that development ‘unwelcome’. He said the Fed is ‘attentive to the implications of changes in the value of the dollar for inflation and inflation expectations’.

The euro/dollar rate, which had risen to almost $1.5630 in early London trading, dropped below $1.5450 after Bernanke’s dollar supportive remarks.

‘In short, the Fed doesn’t want to see a weaker U.S. dollar because it would boost inflation and is putting a greater weight on the currency in setting interest rates,’ said NAB Capital Markets head of currency strategy John Kyriakopoulos.

He said Bernanke’s comments suggest another interest rate cut by the Fed is unlikely unless the economy falls over a cliff, which isn’t the central bank’s forecast.”

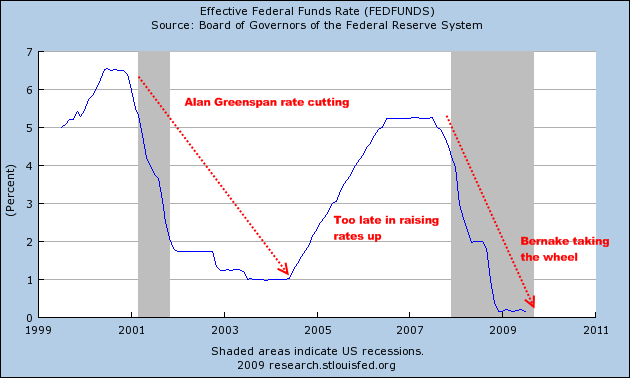

Now keep in mind this was only a month before the peak, and a few months before the stock market tanked. In fact, the Federal Reserve has encouraged a weak dollar since 2001 thanks to Alan Greenspan and his rate cutting magic. Cutting interest rates by default encourages a weaker currency. Just take a look at this chart:

As I have repeatedly stated, the Federal Reserve and U.S. Treasury are determined to implode the U.S. dollar. They are desperate and are trying everything they can to create inflation. If you look at the initial chart, the only thing that reversed this was the implosion of the global markets. People at this point ran back to the U.S. dollar for safety. That pushed up the U.S. dollar Index from 70 to 89 during the March 2009 panic. Since that point, the U.S. dollar has fallen 12 percent while the stock market has jumped 44 percent:

This is a fascinating observation. In this past decade it would seem that the only thing that would cause the Dow to rally is a weaker dollar. So this begs the question how much of the rally is because of a weak dollar? Probably a good portion. Why would the S&P 500 rally 50 percent from the bottom with weak earnings rivaling those of the Great Depression?

If we look at the global markets, we see that they arrived to the market correction one year later but got hit even harder and have yet to recover as much as the U.S. market:

The Dow World Index fell 59 percent in a few months and since that time, is now back up 38 percent. The U.S. Treasury and Federal Reserve are on a path to destroy the U.S. dollar. They can claim a strong dollar policy like they did in 2008 but they have been making it weaker as time goes along to keep the debt spending binge going. And with trillions in new fiscal programs, it seems like we are going to need to borrow much more. The question is, in what direction will the dollar go? If globally things get bad again and they may, there might be short term pressure pushing the dollar up. Looking at the Fed funds rate you might wonder who in their right mind would want to put money into the U.S. dollar but keep in mind in a year with deflation, people simply don’t want to lose their money.

You have countries like Ireland, Iceland, Japan, or Spain that are in even worse shape than the U.S. So the flight to safety is still a big concern. Yet the question of the U.S. dollar strength will have much to do with the health of the stock market. Can the U.S. dollar rally while the stock market goes down? It did from October of 2008 to March of 2009 so don’t bet against it if we hit another global tough patch.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

bob said:

Thanks for a most incisive report. Pity that the economic mags and media do not produce articles of this calibre. But then again , perhaps they dare not.

September 4th, 2009 at 7:59 am