The Canadian housing market will implode in dramatic fashion: 5 charts highlighting the inevitable pop to Canada’s real estate boom.

- 0 Comments

The Canadian housing market is deep into bubble territory. We all know that bubbles can go on for longer than most people think. But with the crash in oil prices and people fully believing their own hype, the market is setup for a big fall from grace. It is interesting how most from the outside can see what is coming but those within the system just can’t accept the fact that prices are massively overvalued. Just like bubbles can grow to outsized proportions, corrections can hit quickly. Virtually all analysts did not see the massive correction in oil hitting late in 2014. But it did. Many within Canada especially those tied to the real estate industry are deep into a trance believing they are immune to the economic rules that apply to all economies. The economy is dependent on oil and construction and both of those industries are taking hits. Yet somehow, home prices will continue to move up just because? Canadian households are deep into debt and make American households look like penny pinchers. Here are five charts showing that the implosion in Canada’s housing market is inevitable.

#1 – Housing never corrected

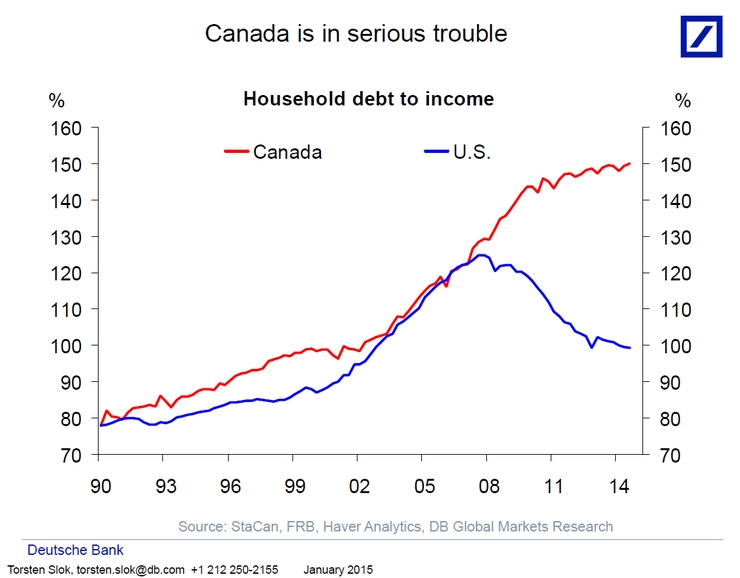

Unlike the US housing market that did suffer a dramatic correction, Canada’s housing market continued going up right through the global recession. Households in the US did deleverage, mostly by force of foreclosures and bankruptcies, while in Canada many households simply double-downed right through the Great Recession.

Take a look at this chart:

Canadian households are deeper in debt relative to income compared to Americans at the apex of our credit induced bubble. Yet somehow, the rules are different in Canada.

#2 – Consumer debt is massive

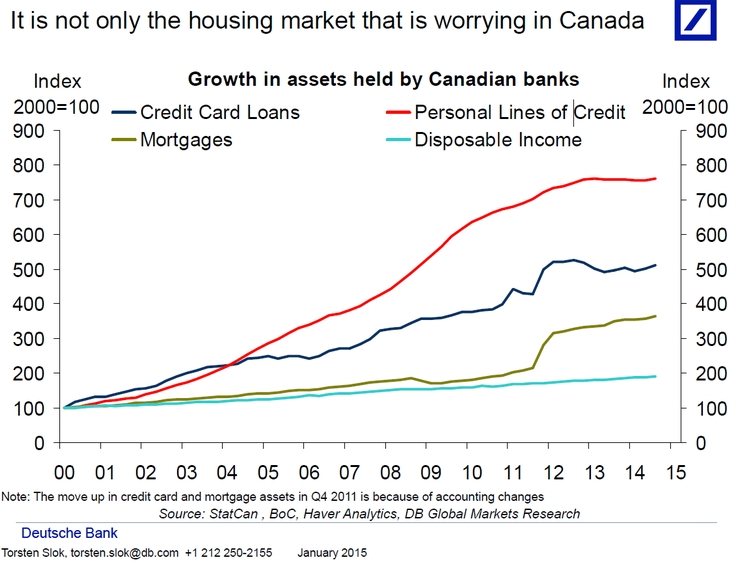

But maybe Canadians are using their debt more wisely?

Credit card debt and personal lines of credit are expanding much faster than mortgage debt which is already going off the charts. Look at the light blue line of income growth. This is a debt induced boom and all the data points to this. Now you have the circular business environment where you need real estate to stay inflated to keep things going. In the US the deleveraging meant a flood of low wage labor. Can low wage labor sustain the ridiculous prices of real estate?

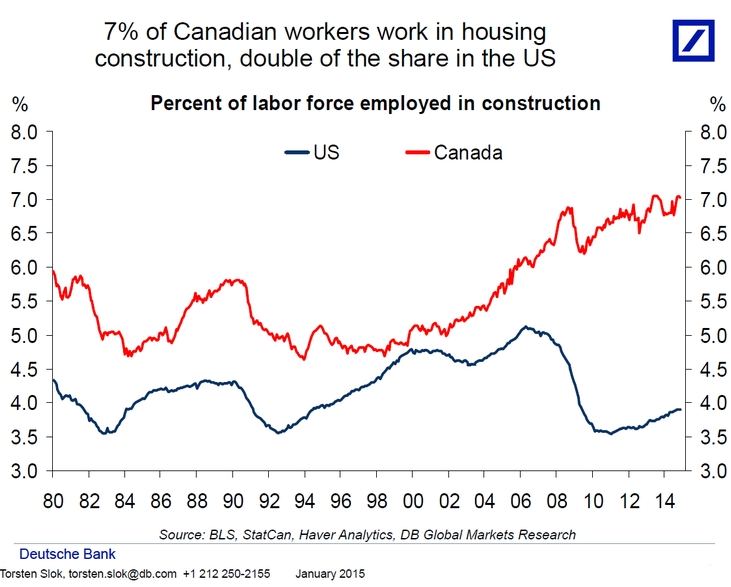

#3 – Heavy dependence on construction

A big part of the economy in Canada depends on construction at nearly twice the percentage of the US economy:

What this means is that building must go on to sustain the current structure. But the structure is built on massively inflated prices. What happens when the rate of growth slows down? It already is in many areas and this is new territory for Canada.

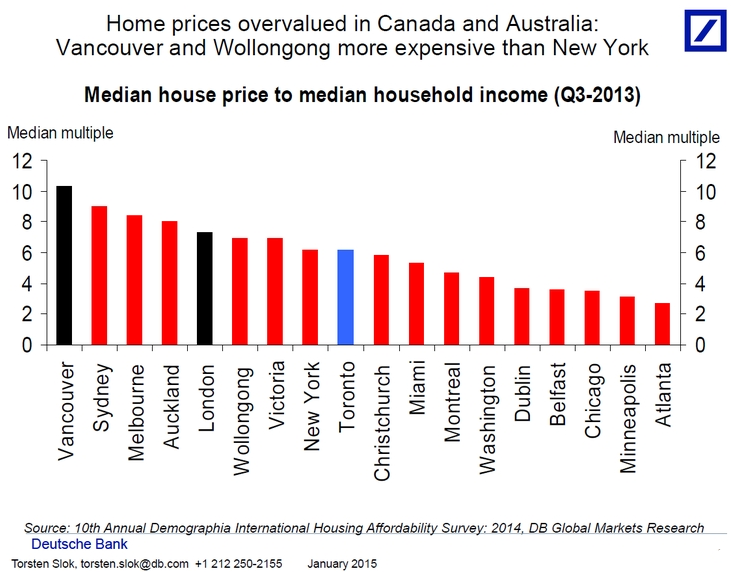

#4 – Hot money flowing to certain cities

Take a look at some of the most inflated cities in the world. Vancouver and Toronto take the cake here:

Vancouver is enjoying the flood of hot money from foreign money especially from China. How does this help those in the current market? It is also fully dependent on hot money continually flowing in.

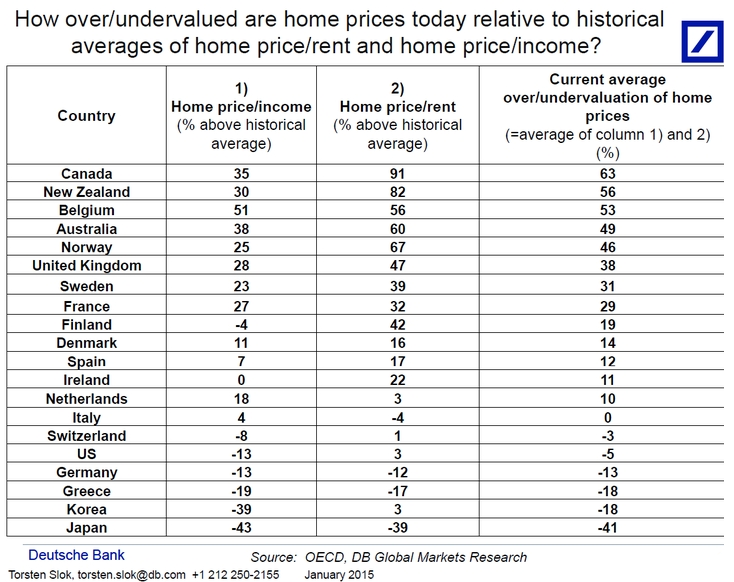

#5 – One of the most overvalued markets in the world

Because of all of this Canada’s housing market is one of the most inflated in the world:

What does an implosion look like? Currently prices are overvalued by 35 percent relative to historical income levels. Of course people will say this does not matter thanks to low interest rates on mortgages but debt is debt. Let us see how someone feels when they buy a condo and see the price plummet by 20 percent how easy it is to swallow that big monthly payment especially with stagnant income growth. Canada’s housing market is going to have a meeting with reality soon. As we all know in the US, bubbles can go on for much longer than we think but inevitably, bubbles pop and they do make a loud sound.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â