The rise of college students applying for food stamps – Mixing of college debt, part-time work, and food stamps. Working 40 hours a week at a minimum wage job does not cover basic costs for a college education.

- 10 Comment

The drawn out election campaign has now come to an end and very little substantive action is likely to be taken to assist the middle class. Even more disturbing is how little attention was given to the growing number of poor Americans. Almost 47,000,000 million Americans are now on food stamps, a record both in nominal terms and also as a percentage of the population. Aligning with this record figure in food assistance is also the large burden of attending college. A telling trend has emerged where many college students are now applying and using food stamps to get by. At one point in the not so distant past, it was possible to take on a part-time job and attend college while coming out with little debt (or no debt). That balance is now largely gone with stagnant wages and college tuition inflation soaring through the roof. What does it say that many of our young Americans need to take on food stamps just to get through college?

The rise in food stamp usage

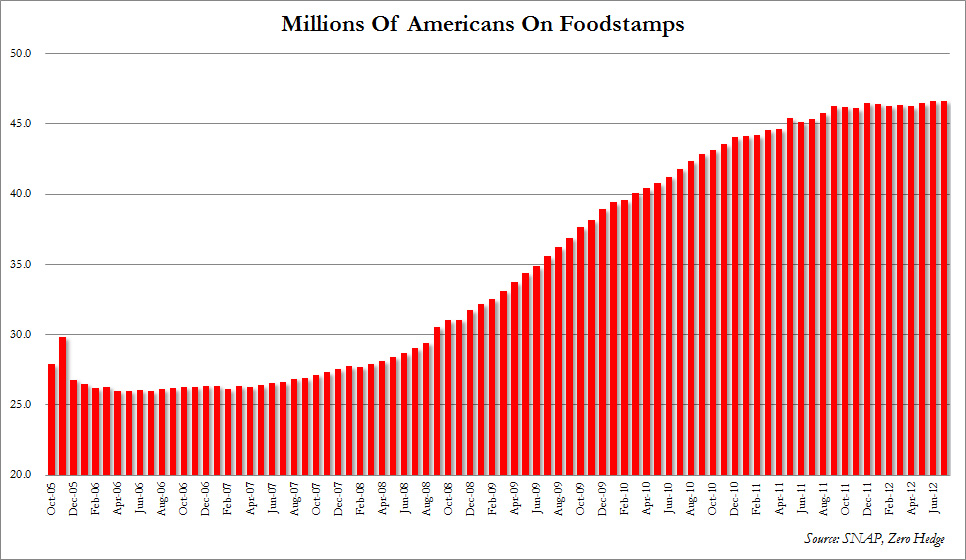

If we look at food stamp costs as a metric of economic health for the poor, the recession started in 2001 and has not let up:

What is more telling is the large number of Americans currently on food stamps. Roughly 47 million Americans are now receiving food assistance from the SNAP program. The number is startling and we see a massive rise in usage starting in 2005. At this point the debt bubble was going into full force but so was the acceleration of Americans needing additional support just to get by:

At its core, the large number of Americans on food stamps is a sign that little attention is being paid to the lower echelons of our society. Lip service is paid to the middle class but seeing net worth figures and wage stagnation tells you another story. The reality that a larger number of college students are on food stamps is revealing:

“(WaPo) Some college students now work two and three part-time jobs to cover living expenses and some of their tuition. They’re applying for more student loans and claiming financial independence on their tax forms to become eligible for financial aid that does not factor in parental contributions. They’re cutting corners by renting required textbooks instead of buying them or simply making due without some textbooks. They’re also bypassing expensive college meal plans and applying for food stamps, an option that once carried a social stigma on campus but no longer does now that food stamp usage is more commonplace at colleges around the country.â€

Now do the simple math here. The Federal minimum wage is $7.25 per hour. A typical year of college at a public school is likely to cost $20,000 (tuition, books, fees, etc). Assume this young American is working 20 hours a week and taking on a full load of course credits. So if you run the figures:

$7.25 x 20 = $145 per week (before taxes)

50 weeks of work = $7,250 (before taxes)

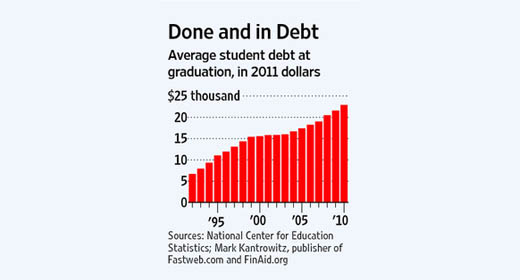

Even assuming 50 weeks of steady work and not factoring payroll taxes someone working 20 hours a week for 50 weeks of the year at minimum wage is going to get $7,250. This is far short from the $20,000 and we didn’t even factor in rent or transportation expenses. Is it any wonder why the student debt outstanding is now over $1 trillion? This scenario is for $20,000 a year for all expenses and with many private schools at $50,000, you can imagine how quickly many people are getting into financial trouble.

“For instance, Virginia spent $447,000 in SNAP benefits for college students in January 2007 but by January of this year the total had risen to $2.9 million, according to the state’s Department of Social Services. The state spent $30 million in food assistance benefits to college students in 2011.

“I never thought I would be on food stamps as a student, but with this economy I had no choice,†said student Courtney Davis, a second year student at Howard University majoring in maternal health and childcare.â€

That is an incredible jump in the above example. In 2007 Virginia spent $447,000 in food stamp benefits to college students. That number jumped up to $30 million in 2011, a 67 time increase. Things have gotten worse for those at the bottom rungs of our economy and when did we hear any party discuss this in the drawn out campaign? The only time this came up was as a criticism and no one offered concrete solutions.

These struggling college students are simply trying to get by:

“I am receiving about $200 worth of food stamps per month, and I can’t imagine living without them,†said Sheena Vails, a sophomore at the University of Missouri who lives in an apartment with three other student SNAP participants.â€

Keep in mind there is a difference between being poor and broke. College students have always been broke for the most part. Yet many would come out with little debt because college costs were much more affordable so that part-time work (which was easier to find) would help pay the way for a Spartan existence. Today as we just highlighted even a part-time job at 20 hours a week (even at 40) will not pay that $20,000 in college expenses. Forget about actually having time to study.

The financial system for the poor and the rising expenses for college are largely broken. The one segment of debt that is still roaring in terms of growth is college debt. If the government with banks pulled back its funding you can rest assured that costs would go down. This is why in the early 1990s the typical student left with a little more than $5,000 in debt while today, it is closer to $25,000 (and keep in mind household wages have been stagnant for over a decade):

College debt and food stamps. Not exactly a pair you would expect in an economic recovery.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!10 Comments on this post

Trackbacks

-

S' said:

thanks to the generous amounts ( too f’n much) a student can borrow from the government, tuitions have gotten way to high. reduce the amounts a student can borrow and watch tuitions fall. after all most of these schools are supposedly “not for profit”.

November 10th, 2012 at 3:04 am -

clarence swinney said:

PLUTOMERICA

What Happened to America 1980-2009???

Labor took it on the chin Financials took it to the bank

Here are awful numbers of our Plutocracy.

NET WEALTH OWNERSHIP

1%=35%–5%=63%–10%=77%–20%=89%–(80%=11%)

FINANCIAL WEALTH OWNERSHIP

1%=42%-5%=72%-10%=85%-20%=95%—(80%=5%)

If those numbers do not disgust you are a Republican.

ESTATE OWNERSHIP

One family owns more wealth than 90% of families.It began in 1981 when Reagan started cutting top rate from 70% to 28%,

a 60% tax cut for the rich. He increased spending by 80% and Debt 189%GW Bush tax cuts with 60% getting 16% and 5% got 48%.

We borrowed 6100B in 8 years so the rich could get richer.Republicans fought to keep 2% tax cut. That 2% own 50% of financial wealth

and take 30% of all individual income. It includes these incomes in millions-

4000-3000-2000-1000-500-100-50-10. They need a tax break more than we need jobs and investment in infrastructure.Boehner is saying he got a mandate not to raise taxes. Crazy Republican.

In 2013 budget it projects we borrow 900 Billion. That revenue can be gained via removing Bush tax cuts and cutting tax exemptions for the top 10%.

We MUST begin to cut the horrid debt that enriches the rich and burdens 80%.

Get $$$ out of control of government. It can be done.

In 2009, top 10% paid an 18% tax rate on individual income. Many paid 1% or less of income in Payroll taxes. 70,000,000 workers paid full rate. Top 50% paid a 12.5% Tax rate. 15% more would have balanced our budget.

Put bottom tax rate at 28% on ALL income.

clarence swinney political historian Lifeaholics of America burlington ncNovember 10th, 2012 at 9:17 am -

Don Levit said:

“If the government with banks pulled back its funding you can rest assured that costs would go down.”

I believe that is true. Prices tend to go upwards toward the money available.

If it works that way with college loans, what do you think would be the result of health insurance subsidies?

Don LevitNovember 10th, 2012 at 3:28 pm -

Dave said:

Students getting food stamps? Unheard of in my day. I was automatically excluded from food stamps when I was a student. I had a situation in school where I was 2 months behind on my rent and I had 4 slices of bread and a can of tuna 2 days before Christmas. Finally the student loan money came through that day and saved me.

On the other hand, I was on food stamps for a short time. My family was in a tough spot, so I started a crummy job just to get by. We did well enough to save a little, but I noticed customers with (food stamp) benefit cards could buy things I couldn’t afford, like magazines.

So, I applied for food stamps, and for a family of 3 got about $300. per month (more now). It was MUCH more than we needed for food, and it was a dilemma how to use it all.

Anyway, a few months later we were back on our feet and cancelled the food stamps.

Lessons. I HATE food stamps. I just HATE the indignity of them. But I also HATE the indignity of living with a can of tuna and 4 slices of bread being all the food security I have, or working 40+ hours at a crappy job so others can buy magazines and stuff I can’t afford.

So, food stamps for students? Right on! And, my sympathies. It is humiliating.

November 10th, 2012 at 11:49 pm -

Edward Ulysses Cate said:

Unfortunately, this “riot insurance” of financial assistance will eventually not be enough to survive. Then what will those 47 million do to survive?

Rhetorical question, as I can guess just as well as anyone.November 11th, 2012 at 8:01 pm -

Joseph E Fasciani said:

I’m 69, taught HS and vocational college intermittently since 1969 in addition to my career as a major nursery owner and creator of the landscape industry in SE British Columbia. Ever since 1987 I’ve told my adult students that if you cannot make at least C$ 16/hour, you cannot support another person, only yourself, and that minimally. So forget marriage or support a partner: it cannot be done. Stagflation is endemic in Victoria, BC since 2009, one of the wealthiest areas in all Canada!

When I arrived in Victoria in 1993, a small tin of Old El Paso green chiles was C $.89; today it’s $2.89. Maybe the chiles were unionised. In 1999 rent was $350/month per bedroom, w/utilities; today it’s $600, no utilities. Meanwhile, a wide range of public sector services was cut back or eliminated, so EVERYTHING became more costly–for the lower 85%. The upper 15% can afford whatever’s charged, though they moan, groan, and bitch about it as “unfair,” while they collect huge pay-cheques and ‘bonuses’!

Twenty-five years ago we thought college education could be cheap and universal. Now? Fergit about it! Clearly there’s been a MASSIVE failure of imagination, nerve, intelligence, and backbone to get even the most basics done appropriately. The solution?

I don’t see why people taking home more than C$ 500,000 yr should have their taxes frozen. Progressive taxation means that “the more the individual receives benefit from society, the more s/he should be willing to return to ensure the viability of that society,” PERIOD!

November 11th, 2012 at 11:18 pm -

Uncle Buck said:

One other important issue for young and lower wage workers is the Obamacare regulations affecting insurance coverage. The cap is 30 hours a week under the law. I believe that Kroger’s was capping employees at 28 hours a week in order to cut costs. It seems that future job growth will be in contract labor or part time hours so that companies do not go broke buy paying health insurance or the tax for not covering people.

November 12th, 2012 at 8:30 am -

jupiter said:

^ Few young and lower wage workers could afford healthcare before the ACA on 20, 30, 40, or 50 hours a week of work. Obamacare means these people will finally have an option for coverage. It’s a long way from where we need to be (universal healthcare), but it’s a step in the right direction.

November 14th, 2012 at 5:59 pm -

Glennis W. Chappelle said:

I think the tuition at all of these schools have hit the statasphere and the bottom needs to fall out now. When limited financial aid is instituted, then tuition will fall. Schools know the students have access to all of this money, so they are taking advantage of it. I really wonder how these students will ever re-pay these astronomical amounts of student loans.

I also feel financial aid should only cover tuition. Many students today are too busy trying to live the life they dream of after experiencing success. They need to EARN this one and stop trying to live in big apartments and drive cars they can’t afford.

April 2nd, 2013 at 6:41 pm -

James said:

I recently found out you can buy skins to put over your ebt card so it doesn’t look obvious. Ofcourse the cashier will know but at least the other people standing in line will not. Its called food stamps skin or you can get it here http://www.foodstampscovers.com

May 21st, 2013 at 4:52 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!