Most over valued region in San Francisco gets a taste of the commercial real estate bust. $3 trillion in loans starting to implode at a faster rate. Why commercial real estate will plunge FDIC insured banks into closure. Bought for $415,000 per apartment unit.

- 1 Comment

The commercial real estate bust is in full swing. This $3 trillion mortgage market is standing to push hundreds of banks into failure and adding additional strain to the embattled FDIC. Commercial real estate (CRE) is a good indicator of where things are heading economically because it is a reflection of what revenues are being brought in by certain properties. For example, a strip mall owner will lease out space to clients that ideally will earn more money each month to cover their rents. That is typically how CRE deals went down. But for the past decade people invested in CRE with the implied notion that they could always sell the underlying CRE for a higher price irrespective of the actual revenue stream the real estate could produce. For CRE this is sin number one.

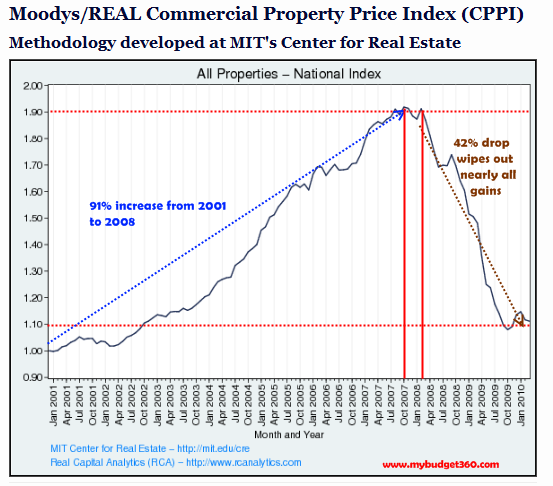

Commercial real estate values went on a 91 percent tear from 2001 to 2008:

Source:Â MIT Center for Real Estate

That 91 percent gain has been nearly wiped out since 2008 with a 42 percent price decline. A 7 year rally can evaporate in one year. Many banks have been trying to put off confronting dealing with poor performing CRE loans but they are now coming due in full force:

“(SF Chronicle) The commercial real estate meltdown has caught up with one of the largest apartment complexes in the country – San Francisco’s Parkmerced.

The loan on the property is headed for default, according to the development’s owner.

“Parkmerced and its lenders engaged a special servicer (a company that specializes in handling loans in default) to support the payments of the loan on the property,” said Seth Mallen, an executive vice president of Stellar Management, co-owner of Parkmerced, in a statement released Wednesday.

The statement did not disclose the amount owed, much of it coming due in October, but real estate analysts have said there are two notes amounting to $500 million or more.

“We knew the October date was looming. This was a decision to move to the servicer so that our financial obligations will continue to be met,” said P.J. Johnston, a spokesman for Stellar Management, a New York real estate company.

He did not name the servicer.â€

$500 million in notes are coming due. How many residential homes would have to fail to meet that number? And keep in mind this is for a CRE deal with apartments which are usually easier to value.

What is the occupancy rate?

What are market rents?

What other costs do you have per year?

Normally this is how you value an apartment deal. But here, clearly what happened in the California real estate craze someone purchased this apartment not looking at cash flows but looking at appreciation numbers.

Parkmerced is no tiny deal spanning over 116-acres and having 1,683 rental units in 11 towers. The place was purchased for $700 million and has had improvement made since that time. Run the quick numbers:

$700 million / 1,683 = $415,923 per unit cost

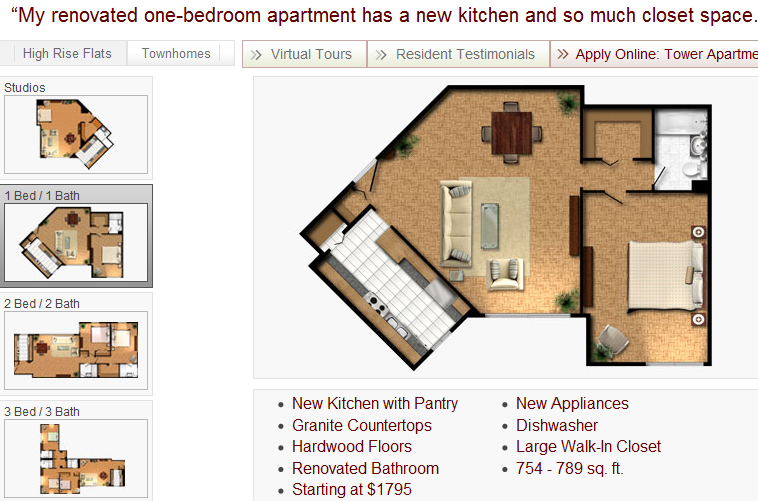

I went online to check monthly rental rates:

Studios:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,850

1 bed / 1 bath:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,795

2 bed / 2 bath:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2,595

3 bed / 3 bath:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $3,380

Now who really knows what the current occupancy rate is in this market. But anyone can tell you that for $415,000 per unit costs you better have near full occupancy at the higher price range. Is it any wonder that this place is now under scrutiny of default? This has garnered national media attention simply because of the deal size. But there are thousands of these deals on smaller scales all around the country. People bet on appreciation instead of focusing on cash flows. This was a big mistake in the CRE market and is going to drown hundreds of banks that the FDIC insures. Just look at one aspect of the loan equation here:

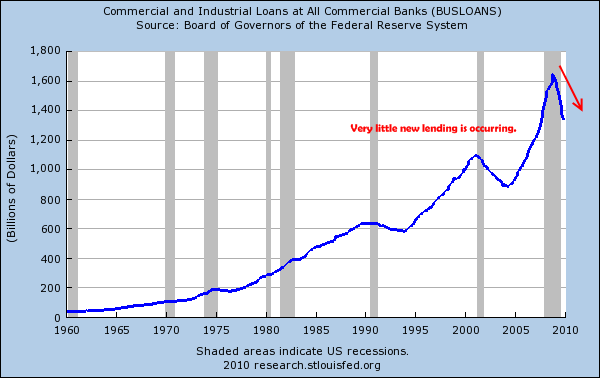

Why do you think banks have stopped lending in this arena? The market is completely saturated with vacant real estate. Commercial real estate either has a market or sits empty. At least with residential real estate if you drop prices low enough you will get buyers. With CRE if you built a complex with no foot traffic you can’t give the stuff away. The loan is only one aspect of costs. You have utilities and other fixed overhead. The fact that banks have pulled back from this market tells us no good deals are coming to the table.

Why would you construct any more CRE today with so much vacant property? So many of these CRE deals are now coming due and have shorter refinancing windows of 3, 5, or even 7 years and the note is fully due. Which bank in their right mind would refinance a loan out? The too big to fail have a large enough taxpayer money buffer to ignore these deals and sit back pretending CRE values are still high. But smaller banks either have to get the borrower to pay or hope that another sucker bank will take the loan off their books. This is not happening.

A $3 trillion market will collapse many small time banks and the FDIC is going to be extremely busy for years to come.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

mmm said:

and “safe” money is losing purchace power each and every day just like it did when those unit prices inflated withput being calculated in the inflation nymbers, only now its mostly because it became the habitual ripoff of the savers ….

June 1st, 2010 at 8:45 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!