California construction employment back to 1997 levels. California building permits at all time record low.

- 0 Comments

Solving the California state budget crisis just got that much tougher. Estimated tax revenues came in nearly $3 billion less than expected wiping out a steady stream of months where things seemed to be improving at least on the revenue front. And this should come as no surprise. California has done very little to wean itself off its dependence on real estate. So it should come as no shock that with real estate still in the doldrums, that income is reluctant to pick up. California takes in nearly half of its revenues through payroll taxes and with a 12.6 unemployment rate, a revenue short fall is mathematically expected.

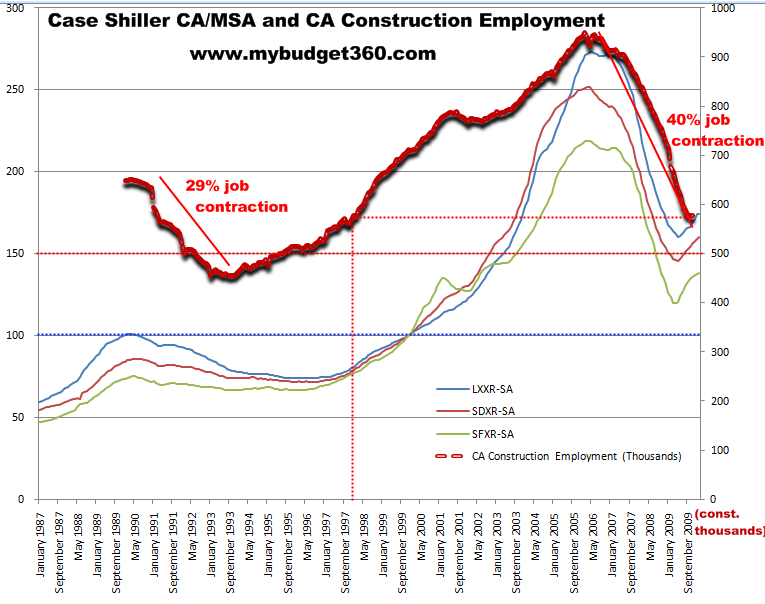

Since California is so dependent on real estate, I wanted to track trends in construction employment and housing prices for three large metro areas. We’ll look at Los Angeles, San Diego, and San Francisco over 23 years. Let us first measure the fluctuations in real estate and construction employment:

Source:Â Case-Shiller

From the above it is apparent that California has been here before with a previous real estate bubble back in the late 1980s. You’ll notice that as prices ebbed lower, construction employment contracted severely at that time. In the 1990s, construction employment fell by 29 percent before reaching a bottom. In our current bubble, construction employment has now fallen by 40 percent and it is unclear whether this is the actual bottom. The recession is still in full force in California demonstrated by the weaker than expected tax revenues. You’ll also notice in the chart above that prices remained stagnant for almost a decade in all three of the California metro areas we are measuring. How long will prices stay low this time?

The chart above shows that prices have ticked up slightly. But much of this is due to artificial stimulus through the Federal Reserve and U.S. Treasury. Tax credits have also front loaded sales and have pulled future sales forward. Even more recent micro data is showing that local housing markets are now starting to soften now that the federal tax credit has ended.

At the peak of our current housing bubble, California had 948,000 people working in the construction industry versus 648,000 back in 1990. Construction employment increased from peak to peak by 46 percent while the actual population increased by 20 percent over this same timeframe.

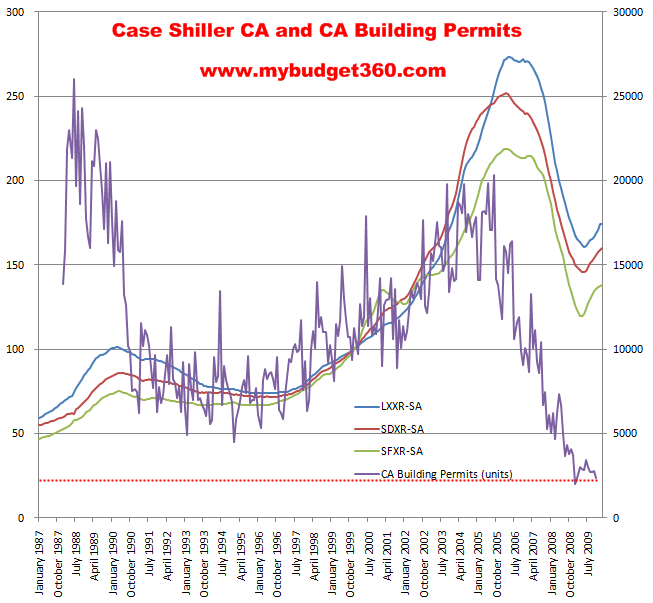

If there were true demand on the ground for new additional housing units, builders would be requesting building permits in mass. That is not the case:

In fact, the current amount of requested building permits is at an all time record low. Even the previous bust did not take permits to this level. Why is this still so low? Because approximately 40 percent of all California home sales are foreclosure re-sales. In other words, people are going after existing homes. The demand for more expensive brand new homes is not strong enough to warrant builders to get out there and begin hiring more construction workers to build additional housing. The public still is looking for more affordable options in terms of buying California housing. This also makes it unlikely that construction will play a role in hiring large numbers of unemployed Californians.

Even with building permits, it is interesting to see that permits remained low well into the late 1990s. So a housing bust will usher in at least 5 to 7 years near the trough in terms of prices, permits, and construction employment. Employment hasn’t picked up. Permits are still near the bottom. Prices slightly ticked up but as we have mentioned, much of this has to do with artificial measures that won’t be around in the market for a very long time.

“If the price peak was in 2007 and we track the previous more modest bust, we can expect a trough near 2012 or 2014 but again this isn’t your ordinary housing boom and bust as we all know.”

With all this data, many are assuming that the bottom has been reached in the state simply because prices ticked up slightly. This isn’t all that clear by looking at the above. Vacancy rates for rentals are still high and prices have actually fallen in many markets. Given the current employment situation, many are choosing to rent simply because of their employment status. With competitive rents, buying a home may not make financial sense for many. The average budget for many just doesn’t cut a mortgage payment in a still volatile market.

That is the question many are asking in California. In some areas, homes are selling for $150,000 to $200,000 that once sold for $500,000 or more. In these, areas it may make financial sense to buy. But in more lucrative parts of Los Angeles, San Diego, and San Francisco prices are still elevated at levels that speak to bubble pricing.

Building permits and construction employment are really one in the same. If anything, these will be the first spots to look for a recovery in housing. But don’t feel that once it changes, you’ll need to jump in.  In a bust this big, most Californians will have a 5 to 7 year window if history is any guide to buy a home without worrying about prices getting away from them. I think many have learned that lesson the hard way.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!