Real Estate Still Overpriced in California in many Markets and Paying your Mortgage with Unemployment Benefits – Examining Housing Values through Employment and Local Market Trends. Los Angeles has a 4.4 Income to Home Price Ratio even after a 42 Percent Price Decline.

- 3 Comment

As housing prices have collapsed from their halcyon bubble peak, many are peering out into the foreclosure landscape that is the current U.S. real estate market and are wondering if prices now fall in line with economic fundamentals. The problem in many areas across the U.S. isn’t so much with housing prices but actual employment and wages. Take for example cities like Detroit where homes can be had for less than the price of the cars they are producing. At the crux of the banking bailout and its subsequent failure was that it only focused on aiding the stability of the current banking order. As trillions of dollars have been funneled to prop up banks, in reality, little has been done in remedying the foreclosure crisis because at the core, prices were in bubbles. The pop is always painful. Trying to mitigate the problem has essentially created a transfer of wealth to banks where they now, after years of cronyism, can now offer principal reductions which actually had a place in what are known as cram downs through bankruptcy. A pound of flesh was always extracted.

But let us return to current housing values. Are prices cheap?

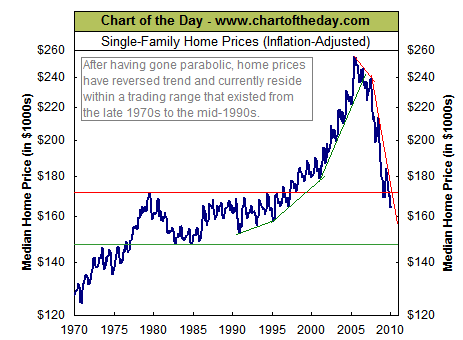

Source:Â Chart of Day

On the surface, especially when you aggregate the U.S. into one data point, the above chart seems to show prices coming back in line. But this is highly deceptive for a variety of reasons. As we have noted, home prices should ideally be a function of local incomes and economic industries. After all, these are the people that will live in these places and service the debt. At times it appears those in Wall Street have never ventured out to actually see the cities where many of their toxic loans were made. Not only do they not care, they have no idea what the local economy can support. I recall that in 1929, at the height of the stock market right before the crash, a time when supposedly all was well 60 percent of Americans fell under the poverty line! This egocentric view of Wall Street has not changed over the century.

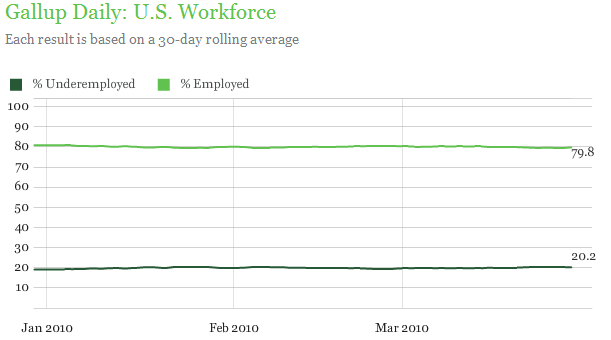

And when we think of home prices, we first have to look at employment levels:

Gallup now has a poll tracking underemployment and we find that 20.2 percent of Americans fall in this category. This is why in the midst of one of the most historical stock market rebounds ever, many Americans are unable to pay their bills. This is another reason why in the middle of countless government programs, home foreclosures are still on pace for another record this year. It has gotten to the point where some banks are offering a six month payment free plan where if unemployment hits you, then you can stop paying your mortgage (millions have already done so):

“(CNN Money) We’re planning to help recently unemployed homeowners by giving them the ability to pay as little as $500 a month on their mortgage, which is effectively less than the price of an average one-bedroom rental nationally,” Sanjiv Das, CitiMortgage’s president and CEO, told CNN Radio.

Borrowers are covered by the program for 90 days when they submit documents proving they are recent recipients of state unemployment benefits, Das said. Some homeowners may be able to get extensions after the 90 days expire, depending on their situation.â€

As worthy a cause this may be, many Americans already know another option is available. Renting. All these banking bailouts and mortgage gimmicks have failed to address the actual underlying problems in the overall economy. In fact, they try to return to the heyday of the housing and banking bubble. As you have noticed, home values have not increased yet stock values of banks have soared. This is no accident.

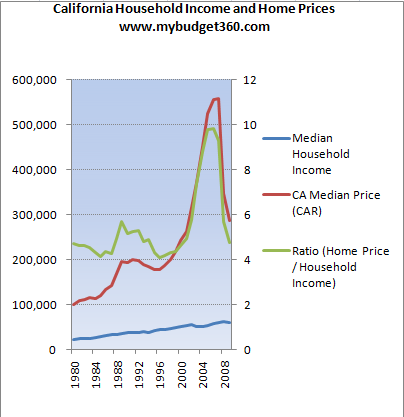

In states like California, home valuations are still in bubbles in many cities. Let us take a look at California as one entity first:

One often used metric of home valuation is household income versus price. Even after a 50 percent drop in home values in the state, home values are still too high with a home price to income ratio of over four. Overtime it seems that a ratio of three seems to reflect a “fair†value and of course this depends on local economies since some states have higher wages. It is important to note that California was actually in line with home values in 1970 and then went off on its own path. But a state with a 12.5 percent unemployment rate, much higher than nationwide data, is hard to stand pat and justify sky high prices in certain areas. In some regions like Riverside County homes with five figures can now be found. Yet this correction means little to the middle class if they have no job or fear being cut. There can be no sustained housing recovery without having an economy to back it up.

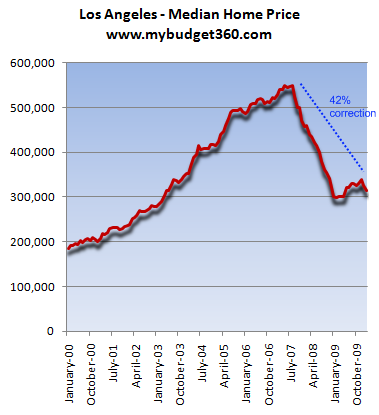

Now we can use Nevada, Arizona, and Michigan to show really “affordable†housing but again looking at this in context of employment it doesn’t really show the entire story. Let us rather look at a diverse market area like Los Angeles County since this is a good example of an overpriced region that has corrected fiercely yet is still overpriced:

Prices in Los Angeles County have fallen by 42 percent from their peak. Although this correction seems significant the median price is still $315,000 while the median household income is at $70,029 (a ratio of 4.4). Much of this is skewed since lower priced areas are the bulk of recent home sales. In some cities the ratio is over 7. Now compare this to values in 2000 when the median home price was $187,000 and median household income was approximately $50,000 (a ratio of 3.74). Keep in mind this is based on 2008 Census data. Since then, the unemployment rate in Los Angeles is now over 13 percent meaning the underemployment rate is up to 25 percent.

It is easy to get caught up in the depth of price cuts but prices have fallen for an important reason. They were overpriced. The question now centers on economic valuations and many areas are still in deep economic trouble and home prices do not reflect these new realities. That is why for most Americans, when they hear about an economic recovery to them it centers around employment.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Donovan Moore said:

I wrote an article about the same subject, how according to historical records- and I went back to the 20’s, home prices will continue to drop. The story can be found at:

March 30th, 2010 at 10:49 pm -

Craig said:

It would be interesting to see an overlay of construction costs because for example here in South Florida, home prices are well below the cost of new construction. In other words, you can’t build the equivalent house for the price of an existing recently built home. This is a situation that won’t exist forever and has to be resolved either by lower construction costs or higher home prices or some combination.

April 18th, 2010 at 8:02 am -

Thom said:

LOL Florida IMHO FL is a joke, and a bad one. FL is to me an overpriced trainwreck pawning off cheaply built cinder block garages as houses at outragious prices, especially in Palm Beach County,. Florida has a horrid economy, high crime, and nothing but poor paying jobs. Florida real estate esp. if you factor in air conditioning 365 days a year and hurricane insurance! in my view will do nothing but decline to where it should be.

As for California where does one begin? The land of little shacks for 500K and up now there is a real laugh, especially West LA and Malibu as of 2012 are so grossly overpriced in my opinion anyone buying there would have to first pay to get their head examined.

June 10th, 2012 at 9:04 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!