Credit Card Addicted Nation: How Americans have Pushed Themselves off the Fiscal Cliff. $931 Billion in Credit Card Debt Outstanding.

- 8 Comment

Credit cards were developed as a form of convenience and not another stream of household income. The first major use in the United States started in the 1920s when it was used for the purposes of fueling the expanding auto owner population. Bank of America created the BankAmericard in 1958 which later became the Visa system. If we rewind to the start of the decade, let us use January 2000 as the date, Americans had $614 billion in credit card debt. Today that number now stands at $931 billion. Now this wouldn’t be such an issue if real wages and savings had increased over this timeframe but the reality is, Americans used over $300 billion in credit card debt to maintain a lifestyle beyond their means. Much of this came in conjunctions with the housing bubble which took three decades to expand.

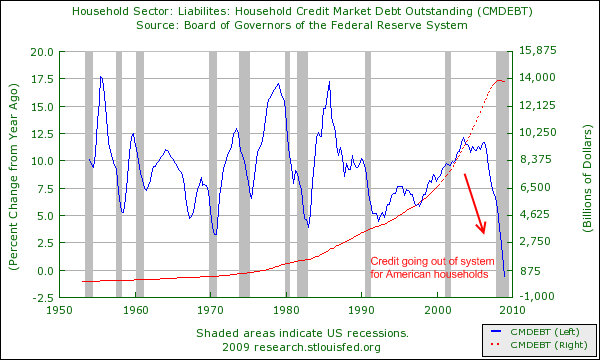

This has also come from aggressive marketing from credit card companies but also the changing societal landscape. Just think of online shopping. Can you imagine someone sending in a check to purchase an item and actually needing to wait? The instant gratification became a hit when credit cards turned into casino chips. This boom in debt is massive:

As you can see from the chart, Americans started massively going into debt starting in the 1970s and that has continued for decades. The blue line above shows Americans are pulling back their usage of debt at the fastest pace in half a century (actually, quicker if we had data that goes beyond the 1950s). Now this is occurring because the U.S. Treasury and Federal Reserve although bailing out Wall Street and banks, has given banks even more power and money and banks realize that they still have years of bad debt to remedy and are only holding on to funds to fix their balance sheet. End result? Credit growth for the average American is halting by force. As I had mentioned previously credit card companies yanked 8 million credit cards from the system back in February. Now the problem is many Americans view credit cards as a form of wealth or pseudo-income so having their credit reduced was equivalent to a wage cut.

In fact, if we look at bankruptcy filings we will see that in 2005 filings surged because many people wanted to beat the new bankruptcy legislation that would make it harder for people to file:

It is interesting to note that we are now approaching those peak levels on top of having the stricter bankruptcy legislation. Keep in mind 2005 was a supposedly good year. The housing bubble was still going and pseudo wealth was still flowing like a waterfall. Yet an enormous part of this decade was fueled by debt and not actual real wealth. Much of that has been washed away with $13.8 trillion in household wealth disappearing since the recession started and now 26,000,000 Americans are unemployed or underemployed.

Yet the credit card was only the ultimate logical extension of a society fueled by debt. Like those first cards in the 1920s which were used for auto fuel, the modern day credit card was used to fuel the economy. Have you ever tried paying for an item over $500 in cash? If you do or have, it will definitely make you think twice. Psychologically the impact this has is you see what you are actually paying for in real terms. It is very different to swipe a card and be done with it. That is why so many Americans have gotten into massive amounts of debt and have used the credit card to the extreme. Many card companies are now upping their minimum payments from 2% to 5% a month and this slight increase is causing hire defaults.

In fact, defaults are now at their highest point ever:

“(Reuters)Â * Chargeoff rate rises over 10 percent for the first time

* Moody’s sees chargeoffs peaking at around 12 percent

* Moody’s says bad loans will peak in Q2 2010

NEW YORK, June 24 (Reuters) – The U.S. monthly credit card chargeoff rate surpassed 10 percent and hit a sixth straight record high in May, Moody’s Investors Services said on Wednesday, as unemployment grew to a 26-year high.

The chargeoff rate index — which measures credit card loans the banks do not expect to be repaid — rose to 10.62 percent in May from 9.97 percent in April.”

Now keep in mind it takes months before a credit card company will charge-off an account. That is, some of these people have stopped paying back in 2008. Given our rising unemployment and weak economy, you can expect the rate to rise. The fact that credit is being sucked out of the system will make many Americans feel like they are quitting a hard narcotic cold turkey. This is the final straw that breaks the debt based economy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!8 Comments on this post

Trackbacks

-

Hal said:

This is a serious issue. It’s one of the reasons I keep telling all my friends and family to focus on sliming back expenses and paying off that credit card debt as quickly as possible. Then focus on putting your money in savings and assets that retain value.

July 1st, 2009 at 6:53 am -

Car Loan Rates Guy said:

That chart is crazy. Americans are in crazy debt, and just when we start saving a little, the press goes crazy with “highest savings rate ever” type articles that are lulling people into thinking it’s nearly enough to stave off the second financial storm that’s coming.

July 1st, 2009 at 5:36 pm -

darrell moss said:

I believe the reason credit card debt began to rise in the 1970’s was the oil companies’ granting permission to Arab oil owners to raise the price of crude oil.

Twenty eight cents a gallon gas became $1.00 a gallon practically overnight.

By 1979, the inflation the higher oil prices caused was into double digits and we saw what Paul Volker did to stop it.

Double digit interest rates caused all states with a 12% usury limit to strike it and today we see interest rates in excess of 30% routinely charged on credit cards.

Historians will one day see a connection between Opec’s 1970’s price increases, the resultant, predictable inflation, the cancellation of usury laws it caused, and today’s higher intererst rates on credit cards.

Today’s credit card debt reflects as much or more the higher allowed interest rates than it does a drastic change in the buying publics use of credit cards. Or one might say that any change that did occur in the use of credit cards was due more to higher interest rates than to the public’s demand for instant gratification.

Oil company executives who just happened to be bankers back in the 1970’s today ride a two pronged beast of higher gas prices and higher interest rates roughshod over a public who can’t fight back.

July 1st, 2009 at 10:56 pm -

Terrance Stuart said:

It appears banks will need to come up with a different instrument that eleminates their risk, brings them income from usage and keeps the convenience of plastic over wads of cash or check verification. They may have found that with the new pre-paid credit cards?

I recall reading that several years ago that the USA accounted for nearly ten trillion dollars in consumer debt in one year, the growing export economies of China and to a lesser extent India counted their consumer use in the billions. It will be interesting to see what trends out as a result of this sea change in attitude towards debt coupled with increased costs for energy, and other commodities that loom into the future.

July 2nd, 2009 at 4:35 am -

David Kaiser said:

Are you aware that Bank of America just sold a large chunk of its credit card balances to Barclay’s Bank? I learned this when my B of A US Air Visa card was closed out and I received a Barclay’s Bank mastercard instead. I discovered I now owed the existing (small) balance to Barclay’s! I suspect B of A wanted to get more cash in its balance shee in order to get out from under TARP.

July 2nd, 2009 at 4:43 am -

Sharonsj said:

Don’t make it sound like we all rush out to buy stuff we don’t need like giant flat-screen TVs and expensive meals in fancy restaurants. A lot of people use credit cards because they have no money after paying bills–and still need to either pay more bills or get something they really need to live–like food. I’ve been reading that people who lose their jobs and can’t survive on unemployment, or whose unemployment has run out, then use credit cards for necessities. The only reason card rates are going up is that the banks know people are tapped out and larger numbers will be defaulting, so they’re trying to sock it to you before then.

July 2nd, 2009 at 7:53 am -

dale wagner said:

I knew there was credit card debt But very close to a TRILLION DOLLARS.? which we will hit this year in fall 2009 .My goodness americans what are you buying.. I didnt know this either America is the only place in the world that has Storage units There popping up all over the place for americans to store the Piles of Garbage they dont ned. We are building these Condo storage units like homes and condos I cant believe we are the only country in the world that buys so much trash and now we need a place to store the TRASH.And 8 million creit cards are being yanked out of american hands. heck i bet its alot more then that 18 million i bet is the TRUE numbers Nay 25 million cards need to be yanked.

July 4th, 2009 at 7:49 am -

loans said:

im using credit cards everywhere, and its not because, i dont have money-its a lifestyle-im not carrying money, u CANT BELIEVE, but even, on my way to to the church, ive got to find them first

August 11th, 2009 at 6:24 am