Employment Situation: Job Anti-Growth – A Decade with Zero Net Added Jobs. 131 Million Nonfarm Payroll Employment in June of 2000. 131 Million Nonfarm Payroll Employment in June of 2009. 6,460,000 job losses since start of Recession.

- 2 Comment

The so-called second half recovery got off to a rocky start. The market was expecting 367,000 job losses for the month of June but instead got 100,000 more than expected. The market quickly turned sour as 26,000,000 Americans are now unemployed or underemployed in the job market. Yet what is even more troubling is the magnitude and severity of job losses hitting our economy. To put this into perspective, as of June 2009 we had 131.16 million Americans employed in “nonfarm” occupations. As of June 2000 that number was 131.83 million. That is, we are going to have a decade of no net job growth.

In this same timeframe, we have added 24,000,000 people to the population. But let us take a sobering look at the magnitude of job cuts we are seeing:

You will see that with the chart above the 2001 recession, which was modest by many standards, saw nonfarm employment peak right before the recession and did not hit a trough until January of 2004. Given that this recession is the deepest since the Great Depression even if we follow the 2001 model, we shouldn’t expect to see a trough until 2011. I am amazed that some people can look at a 467,000 job loss number and say it is okay. There is nothing good about the employment report released Thursday.

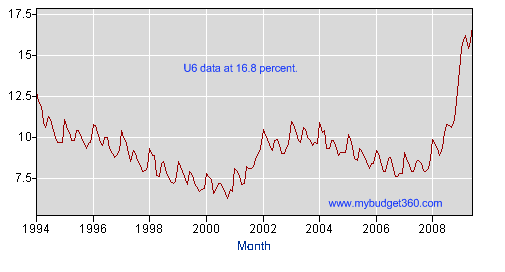

If we dig deeper, we realize that the true unemployment rate measured by the U-6 data is showing a much more painful economic environment:

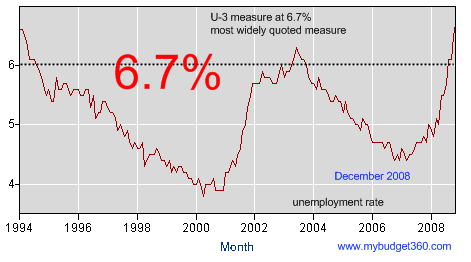

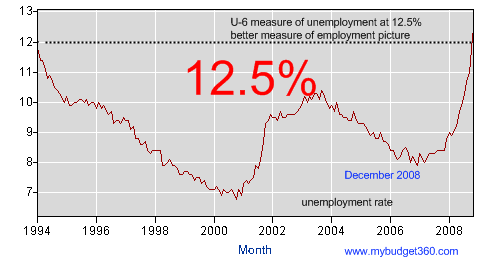

The U-6 number now shows a 16.8 percent unemployment and underemployment rate. This is now in record territory. Back in December of 2008 I posted these two charts and stated that people will start feeling this as a minor depression when the U-6 rate hit 19 percent:

Now the rate of job losses is still very high and it is very likely that we will see that 19 percent rate for the U-6 figure. There are many out there believing that a second half recovery is imminent but what sectors are going to employ the 26,000,000 unemployed and underemployed Americans? It is hard to imagine any industry having the slack to pick up this job loss amount. Take a look at how widespread job losses are hitting the economy:

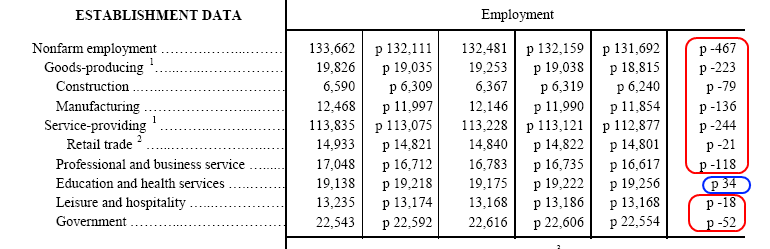

The only sector that added jobs was education and health services and even here, it was a modest amount of jobs. Every other sector including government shed jobs. There really is no place to hide. Now assuming we go back to the peak employment days when 138 million people were employed in nonfarm jobs, that means that we will need to find 7 million jobs for currently unemployed or underemployed Americans (this of course assumes we lose no more jobs from here but the momentum is still moving forward).

The problem of course if we look at the data above again, we are losing higher paying jobs in “goods-producing” and also in manufacturing. These sectors are getting hit the hardest. Sectors like “leisure and hospitality” and “retail trade” are losing jobs but at a slower pace thus inflating the situation. The real story is good paying jobs are disappearing at a faster rate.

It is amazing how quickly things are changing. Since the start of the recession in December of 2007 we have seen 6,460,000 job losses. And keep in mind this is the official number. During this time, we have seen those working part-time for “economic reasons” go from 4.4 million to 9.3 million. And how many people are working less hours, seeing no raises, and are having to cut back? These numbers aren’t reflected here. Already with the job losses and the part-time for economic reasons, we see that over 11 million Americans have either lost their job or are working part-time for economic reasons since December of 2007.

The employment situation is tough because many of the jobs added this past decade were based on the bubble economy. Real estate and finance dominated many sectors. In a sense, it is no surprise that we are now seeing no net added jobs for the entire decade. The question not being explored by the media or those calling for a second half recovery is what industry is going to make up for all these job losses? To try to re-inflate the bubble by giving banks and the housing industry more money is simply a bad approach yet that is for the most part what we are doing and calling it stimulus. Is it any wonder that it hasn’t worked for the average American?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

titi said:

From 2000-2001 to present days was also recession, masked by the use of ongoing decline of US dollar. Unfortunately to come out of recession/depression will involve to lower standard of living.

July 3rd, 2009 at 1:39 am -

vivo said:

Thanks for your research, appalling numbers.

July 4th, 2009 at 11:19 pm