Hitting the credit card wall – Credit card debt contracts 17 percent as the grand American household deleveraging continues. Average household with credit card debt carries $16,000 at an average rate of 15% – Real broke housewives. Orange County California witnesses a 600 percent jump in bankruptcies.

- 3 Comment

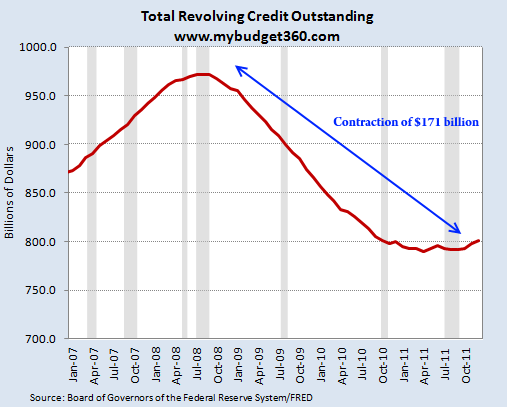

Credit card debt has become a big financial albatross for many American families. According to the Federal Reserve Survey on Consumer Finance over 176 million credit cardholders exist in the United States. This is an amazing figure when you actually think about what a credit card is. A credit card essentially allows you to spend money you do not have today on the promise you will pay it off tomorrow. We constantly hear how great it is to have credit cards to build credit as long as you pay off your balance each month. The data tells us something very different from this ideal utopia vision of credit card debt. The average credit card debt per household with a credit card balance is close to $16,000. Given that some households have little credit card debt, you can imagine how high the debt is for others. A big part of our economy was built on the back of credit card debt. Because of the massive deleveraging experienced by Americans, credit card debt has now contracted by $171 billion since the recession began. What happens when the credit card bill comes home?

Credit card debt trends

The apex of revolving debt in the US was hit in 2008 when the recession was raging at a full pace. Over $970 billion in credit card debt was hit at this point:

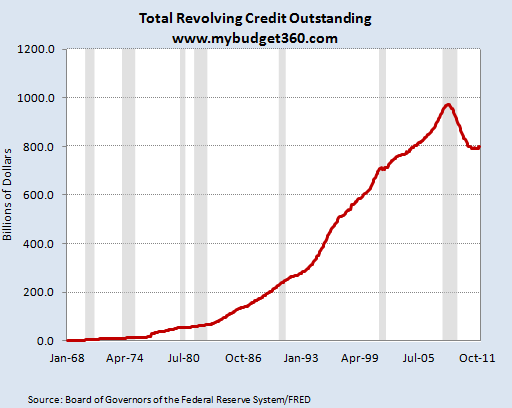

Keep in mind that this $970+ billion in credit card debt was being carried over from previous months. In other words, people that do not pay off their credit card debt balance in full. This deleveraging in credit card debt is truly a once in a generation type event:

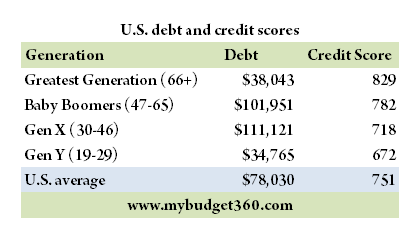

Going back to data from 1968 there wasn’t one year where year-over-year credit card debt fell in the United States. So to see a 17 percent contraction in revolving credit is a monumental event. For the US household something akin to a peak event in debt was reached. And is it any wonder? The average debt for US household is roughly $78,000:

The above figures are even more startling when you realize that the per capita income is $25,000. Even using the median household income of $50,000 we realize that many households are significantly leveraged for years, even decades to come. Why else would credit card debt contract so severely after nearly half a century of unimpeded growth? You also need to examine the younger household debt and how much of it is now being replaced by student loan debt. The college debt bubble will burst at some point as student loan debt surges to roughly $1 trillion in 2012.

Part of it has to also do with the high interest rates charged by credit card institutions:

Source:Â CreditCards.com

So take the typical household with credit card debt at $16,000 and assume they only pay the minimum amount each month. If they are only covering the interest, at the national average rate, they are paying roughly $200 a month without having one cent going to the initial principal. This is why credit card debt can become so troublesome for many Americans and essentially a transfer of wealth from the majority to a few giant financial institutions with access to cheap readily available funding.

While a good number of credit card debt is being paid off, a large amount is being paid off by bankruptcy. This isn’t exactly the kind of deleveraging that is healthy. When people look at the mortgage debt stalling out they fail to examine the fact that a giant portion of this was because of forced deleveraging via the 5,000,000 or so completed foreclosures since the recession hit. Nothing can clear mortgage debt faster than simply not paying your mortgage and giving the house back to the bank.

The addiction to debt

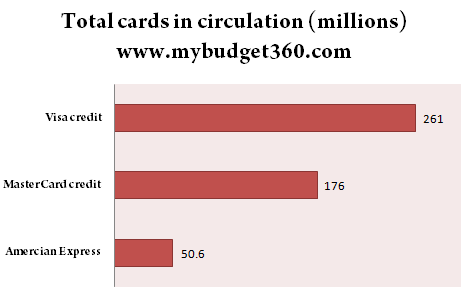

If you really want to see the addiction to credit card debt just look at the actual number of credit cards floating out in the economy:

There are more credit cards out in the economy than households since the average number of credit cards per household is over 3. These are devices that essentially allow people to spend money they don’t have on potential future earnings. It would be one thing if people paid off their credit cards each month and didn’t pay 15 percent interest on funds they borrowed. Yet the $800 billion in outstanding credit card debt tells you that this is not the case. Banks are immensely profitable here since they can borrow from the Federal Reserve at virtually zero percent, they will pay you virtually zero percent on your savings deposits, but then they will charge you 15 percent on money loaned out to you. Now that is a racket we should all be fortunate to be a part of.

Some tend to think this is only happening in very poor areas of the country. You can look at Orange County California, home of all those reality housewife shows, and realize that too much debt is also an issue with supposedly wealthy counties:

Source:Â OC Register

So much for the idea that only the poor file for bankruptcy. Orange County bankruptcies are up 600 percent from 2006. The drop from 2005 to 2006 was largely due to people rushing to file before new rules came into place in 2005 that made bankruptcy even tougher. Even with that said, Orange County is now seeing a peak in bankruptcies near the 2010 highs. Credit card debt and other forms of debt can impact all parts of the country. The great deleveraging of the American household continues well into 2012.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

3 Comments on this post

Trackbacks

-

clarence swinney said:

Always Great pics. Thanks

March 3rd, 2012 at 6:57 am -

KENNY G said:

Any young person with a lot of debt will become a slave for the elites and will eventually wind up in the military and the rest of our fellow americans that receive a check from the gov. will also be put to work in order to keep eating……..this is our future………the 3rd world is at our door steps and all those on ss,welfare,and all those failed private and public pension funds will be our future work force as cheap labor comes back to the states………….learn how to grow food.

March 4th, 2012 at 9:37 am -

Hillary said:

Wow that is staggering information. I am glad I never got into credit card debt.

March 5th, 2012 at 4:06 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!