Solving the massive debt problem with more debt. American consumers carry as much debt as annual U.S. GDP. Credit card debt declines but auto loans and student loans go up?

- 3 Comment

The Federal Reserve has come to the aid of bailing out Greece. I wonder how many Americans even know that billions of U.S. dollars are going to prop up a failing European country in Greece that got into the mess they are in because of too much debt. In the end, the Euro is still crashing down because Greece is merely one country out of many with massive debt problems. Middle class Americans don’t need an extensive lesson in economics to understand this. If you take on too much debt, at a certain point you will end up paying the piper. This doesn’t matter if you spend too much money on clothing by charging up your credit card or buying a home that you clearly couldn’t afford. In the end, a bill comes due. Unlike Wall Street who operates the Washington D.C. purse strings, you are small enough to fail in their eyes. If you purchase a home that is too expensive, you will either have to pay the mortgage or end up in foreclosure. Giant amounts of debt have ruined individuals as well as countries.

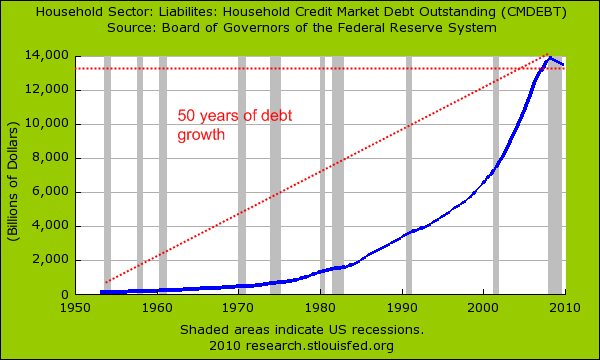

The trend of taking on too much debt has been going on for over half a century:

And you will notice that we have reached a point of too much debt in this recession. This is actually a historical event. Americans are on the hook for as much household debt as our annual GDP. U.S. households currently carry $13.5 trillion in household debt. Most of this is connected to mortgage debt. Yet with 7 million households in foreclosure or 30+ days late, you have to ask if this debt is really even worth that much? It actually isn’t. One third of U.S mortgage holders are underwater on their mortgage. So banks might be pretending that the mortgages are worth $10.2 trillion when in reality, the actual market values of the homes are closer to $8 trillion. The only way this gets balanced out is through purging of debt through foreclosure or bankruptcies (including purging the too big to fail banks on Wall Street). Yet banks have no incentive to mark to market any item when they can keep getting taxpayer money to fund their gambling on Wall Street.

If you break down the above household debt, it looks like this:

Home mortgages:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $10.26 trillion

Consumer debt:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2.481 trillion

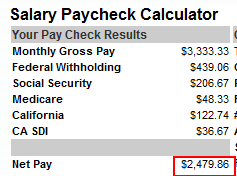

The consumer debt amount is incredibly problematic because this is money many Americans never had in the first place. Think of someone making $40,000 a year with no money saved purchasing the average new car costing $25,000. They didn’t really “purchase†it but financed the entire amount. So for the next 5, 6, or 7 years they have committed approximately $400 per month to finance this car (we’ll use 6 years at 5%). This is a large portion of their income:

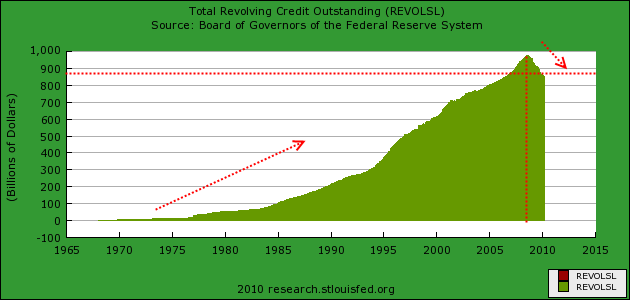

The person just committed 16 percent of their net pay for the next few years. This is money they never had. Now with a stable economy, it is likely that the full loan would be paid back. Not in a recession as deep as this one. And during the crazy credit bubble people were able to take on incredible amounts of credit card debt with no actual verification of income. During the boom, there were people claiming that everyone paid off their credit card off each month. The facts showed otherwise:

We were on path to having $1 trillion in outstanding credit card debt.  That is $1 trillion that Americans spent with money they had yet to earn. Banks were willing to lend this out because if all failed, they could call on their plutocrats to bail them out while middle class Americans were left paying bills and facing higher taxes and the prospect of inflation because of the monetization of banking debt. This is why in recent polls and surveys Americans are increasing disenfranchised with both Republicans and Democrats alike. Banks purchase air-time with both political parties because like the stock market, they hedge their bets in order to win even if their actions destroy the real economy.

Even though credit card debt has shrunk, people are getting deeper into debt with auto and student loans:

“WASHINGTON (MarketWatch) – U.S. consumers increased their debt in March for the second month in the past three, the Federal Reserve reported Friday. Total seasonally adjusted consumer debt rose $1.95 billion, or at about a 1.0% annual rate, in March to $2.451 trillion. The increase was unexpected. Economists surveyed by MarketWatch expected consumer credit to decline by $4.5 billion in March. On a year-on-year basis, consumer credit is down 3.4%. The increase in January was led by non-revolving debt, such as auto loans, personal loans and student loans, which rose $5.1 billion or 3.9%. Credit-card debt fell $3.2 billion, or 4.5%, to $852.6 billion. This is the record 18h straight monthly drop in credit card debt. Since the collapse of Lehman Brothers in September 2008, credit card debt is down 12.6%, while nonrevolving debt is down 0.3%.â€

The student loan market has now become another subprime loan market. Many for-profit colleges allow students to finance 90+ percent of their education through federal loans and many students come out with worthless degrees. These for-profit schools market and advertise heavily in lower income areas where unemployment is high and promise the world if you go to their schools. Students come out with $20,000 to $50,000 in debt and a degree that has no market value. The schools don’t care because now the government is on the hook for the loans. Does this sound familiar? Do you notice how no other country has such a gigantic student loan market like the U.S.? Now we have millions of students jumping into massive student loan debt that many will be unable to pay. Frontline on PBS estimated that nearly 40 to 50 percent of for-profit student loans end up in default (if you measure defaults accurately). Ironically this figure is edging up to the default rates of subprime loans in the housing market.

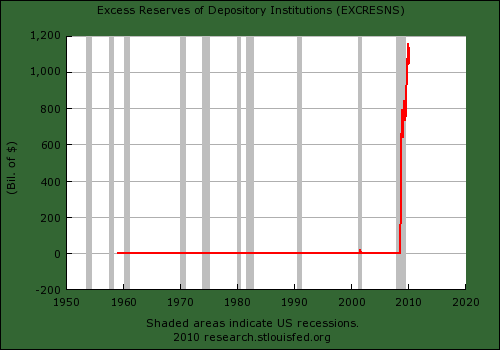

Debt has been the engine of growth in the last decade. The fact that credit card debt has been contracting fiercely since the recession started is good. What isn’t good is banks used the pretense for the bailouts that they needed extra money to keep lending to Americans. This has not happened. In fact, banks are sitting on large chunks of that money:

Now why would banks sit on over $1 trillion in excess reserves? Because they know what they have on their balance sheet. And more trouble is down the road. Why would they lend to a middle class America with less money when they can gamble on the stock market and make bigger profits in one quarter? Debt access for middle class Americans has become restricted but debt access to Wall Street is alive and kicking. And the amount of debt in the U.S. is stunning:

Corporate debt:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $7.2 trillion

State and local governments: Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2.3 trillion

Federal government:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $7.8 trillion

Even though it isn’t openly stated, we are trying to solve a problem of too much debt with more debt. How is that working out for Europe?

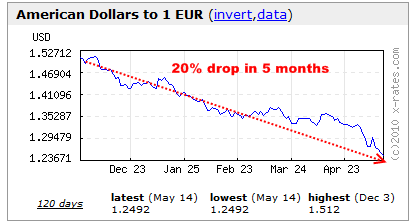

The Euro has fallen 20% in five months even after they announced a $1 trillion bailout. We all know that more debt is never the answer to a problem that started out with too much debt.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Stephanie said:

Your article shows a chart where the US dollar has declined by 20% vs. the Euro. This is erroneous:

http://www.mybudget360.com/wp-content/uploads/2010/05/euro.png

In fact, the chart shows how the Euro has declined against the USD since December ’09.

The EUR has declined so much – and the USD has risen so much – that pundits are predicting 1:1 parity between the two currencies.

I take no issue with the article, just the misuse of a chart. If I got it wrong, apologies.

May 16th, 2010 at 8:49 am -

mybudget360 said:

Hello Stephanie,

That is correct. I clicked on the invert data so the text on the chart doesn’t reflect this but yes, it is the Euro that has fallen by 20% YTD against the dollar. The Euro is in bad shape. We have yet to tackle the issues being faced by Spain (unemployment 20%) and also Portugal.

Too much debt cannot be solved with more debt. Should be easy to grasp but we keep going down this path. Japan showed that quantitative easing doesn’t solve problems yet here we are.

May 16th, 2010 at 12:50 pm -

JP Merzetti said:

The important points:

An entire decade of economy fueled by debt, rather than productivity.

Education which has produced profit for lenders, and an educated

class of citizens who don’t contribute to the economy (no jobs.)

Yet again another bubble (student loan) to add to the mix.I see a picture of a society collectively behaving like the fool who maxes out all his cards, spending far more than he earns, hoping for

some nebulous turnaround that will never come.

The why of it is the saddest thing of all: emulating the national pastime, and the philosophy of meaning in consumption.

Saddest of all – that this supercedes any normal exercise of caution and restraint / something we would expect in all adult citizens of reasonably independent and astute intelligence.May 16th, 2010 at 2:36 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!