The working class Hunger Games: Reality TV show now pits working class against working class family for the chance to earn $101,000.

- 1 Comment

Reality TV has a nice connection to our growing low wage economy. Reality TV is easy to make, costs relatively little, and can be flushed away if it fails. If a hit occurs, the big profits are frontloaded to the network while “stars†can make money after the cream has been taken away. There is a certain dark psychological draw of watching people in struggling situations (think of shows like Intervention or the morning talk shows). These shows still exist because there is an audience to watch. So it was interesting to see a show called the Briefcase appear on network TV that is couched as an opportunity for struggling families to get a break. The break is the chance to receive $101,000. The catch? Another family is also offered this much and both enter into a modern day version of the prisoner’s dilemma. It is difficult to watch because these families represent the struggles of millions of Americans caught up in the low wage high debt culture and then are put into an emotional predicament. Poor against poor.  The choice appears to be seem ruthless and take the money or continue to struggle in your financial misery but show some empathy and likely forfeit the money. All I could think of watching this is that we are entering a new version of the low wage Hunger Games.

Reality TV for the low wage economy

For those interested in the premise of the show, here it is:

“(Salon) Here’s the premise of the show, as Lyons explains it. A family dealing with what CBS euphemistically calls “financial setbacks†is given a briefcase full of $101,000. They are then shown another “financial setbacksâ€-plagued family and are told they must decide how much of the cash to share — if any. Unbeknownst to either family, this alienating setup is presented to both. Lyons writes that in the early episodes sent to critics, the families find their responsibility to be so great as to cause one woman to vomit and “several†to say it’s “the hardest decision they’ve ever made.â€

How do they make such a decision? By engaging in a time-honored American tradition of separating the poor into two, mutually exclusive categories: those who deserve to be poor, and those who don’t.â€

If your moral compass is going haywire just reading the above, then you probably won’t enjoy the show. The show basically highlights the lottery aspect of big money in our economy. This invisible hand comes from out of nowhere to offer a family a respite away from soul crunching poverty but at the same time, you are forced to act out your emotional struggle on screen. The bread and circus aspect of our media.

If the show has any success, they have a nearly unlimited supply of Americans to choose from:

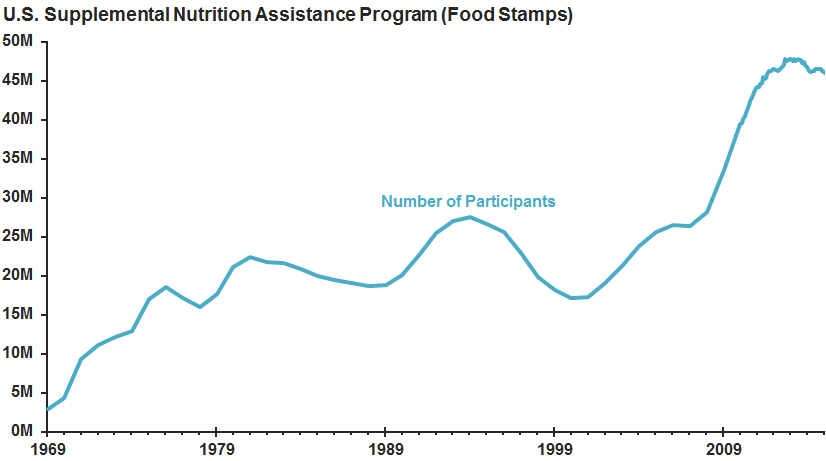

46 million Americans are on food stamps and this has given rise to the dollar store economy. Of course we rarely see this on the media since there is no sense in advertising to millions that are too broke to even pay their bills. What was interesting is during the ads, you saw commercials for expensive cars and really expensive tech gear (probably some of the items that got these families in trouble in the first place).

The show does highlight a bigger issue at hand that involves the contraction of the middle class:

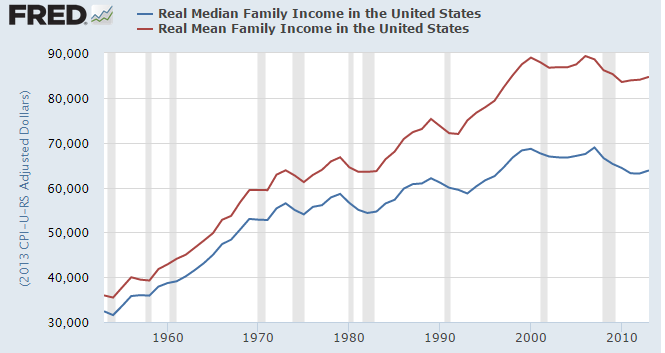

Mean wages are up because of larger incomes flowing to a smaller group of Americans. The median is a better representation of the nation overall and the median household income of Americans is now back to where it was over two decades ago adjusting for the all important inflation.

The fact that this kind of poverty reality TV is now making it on network television is telling. You simply cannot ignore the army of working and middle class Americans struggling to get by. What is troubling is that you are pitting poor against poor and somehow taking the attention away from the bigger question: why is the middle class imploding?

Welcome to the modern day low wage Hunger Games.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Commodus said:

Looking forward to watching this show.

May 31st, 2015 at 3:10 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â