The ambiguous financial state of housing – 3 issues repeating the housing bubble mistakes; Real estate psychology, down payments required, and bring back lending responsibility to immediate areas.

- 2 Comment

The overwhelming evidence of what went wrong to create the housing bubble is irrefutable. It is clear that allowing buyers to purchase a home with little to no documentation was a bad idea. So why continue doing this today? It was abundantly obvious that zero down or low down mortgages was a recipe for disaster. Yet we are still encouraging low down payment loans today. It is also clear that allowing Wall Street free reign on the housing and credit markets has created the largest credit bubble in history. Then why allow them to continue as usual as if nothing has happened over the last decade? The reasons for the housing market are clear to most Americans for obvious reasons. Manias usually cloud judgment and get the better of those who are blinded by greed. But typically, after a mania lessons are learned and new enforcement is placed in the market. None of that has occurred even in the middle of our Great Recession.

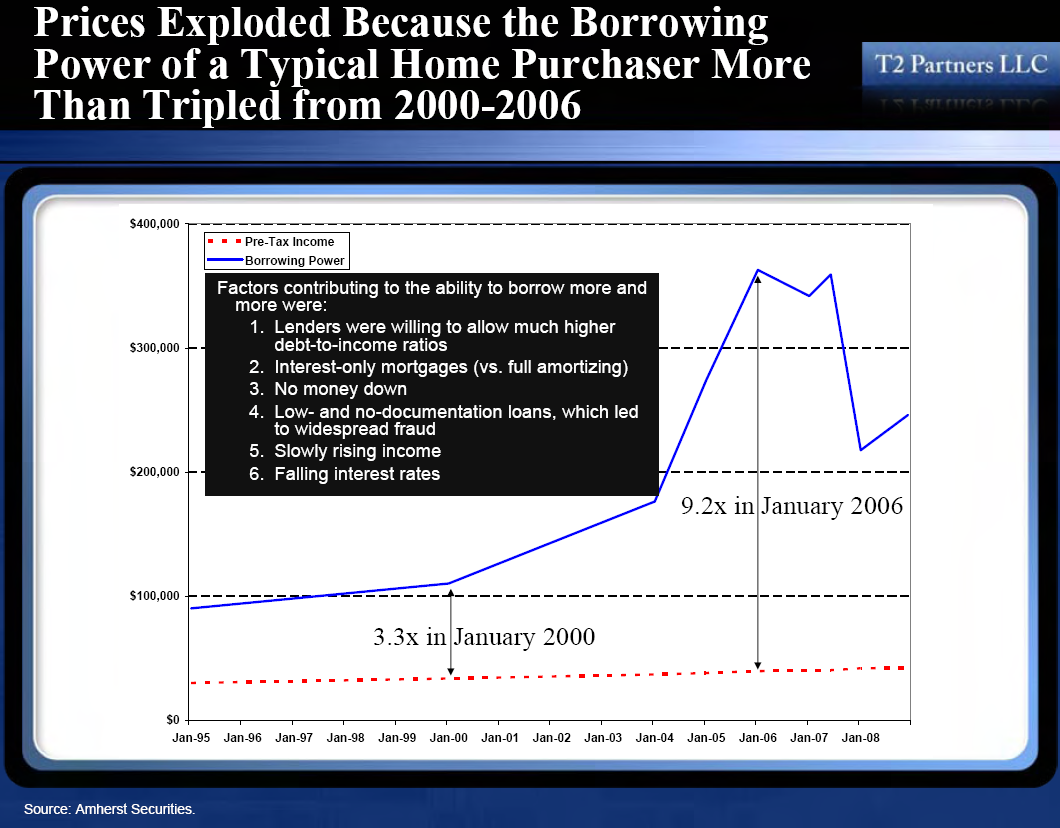

I believe there are three main culprits to the housing bubble. From Wall Street to government encouragement, the housing bubble was allowed to expand to unprecedented heights because of a psychological shift in our society. Yet many of these problems still persist today. If we look back at how much buying power Americans had during the housing boom, it is astounding:

Source:Â T2 Partners

The buying power of Americans during the boom was incredible. Unprecedented in the history of home buying in our country. Much of this was allowed and fostered by Wall Street who had an insatiable demand for home mortgages regardless of quality. In 2000, a family making $60,000 was able to purchase an $180,000 home and that would be stretching their budget. At the height in 2006 this same family making the same income now had the ability to buy a $500,000 home (i.e., buying with an option ARM with no documentation).

Now it should be apparent that a family making $60,000 (close to the median income in the United States) should never be able to buy a $500,000 home. But this happened tens of thousands of times over. What led us down that path?

Issue #1 – Real estate psychology

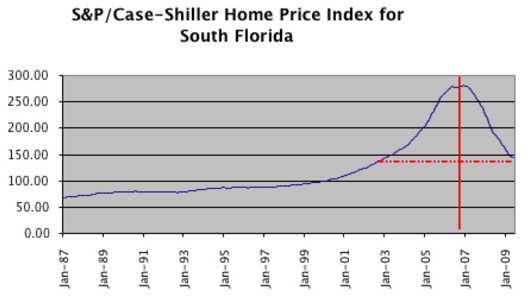

Consider it the perfect storm of savvy marketing, easy Wall Street money, and the belief that everyone should be rich. I remember listening to an audio CD about personal wealth and the front cover of the book stated that it would talk about 10 “investors†and how they made incredible wealth in a short amount of time. The book was pushed as a financial book but it was really a real estate sales piece. Every story was about real estate. In fact, most of the stories were from people in Florida and the book was published in 2006. What has happened to Florida real estate since that time?

Source:Â Palm Beach Post

The market went tumbling down. How leveraged were these people? Just query real estate wealth building books on Amazon and you’ll see hundreds of these books. This literature shifted the psychology of Americans and made it seem so easy that anyone could be a “Rich Dad†and make big money with little effort. The media with shows like Flip this House made it seem glamorous to be a real estate flipper.

Some of the cases presented in these books would go like this:

“So you want to be rich? All you need to do is buy a home with zero down. Let us say you buy a home for $300,000. With current appreciation rates, you’ll be able to sell it in one year for $400,000. A $100,000 profit in one year with nothing down! When will you save this much from working? Rinse repeat and you’ll be a millionaire in no time.â€

In many places including California, Florida, Nevada, and Arizona, this formula worked for 5 to 7 years depending on which market we are looking at. As Pavlov demonstrated through his experiments, this kind of positive reinforcement can have deep changes to psychology.

Yet it was all unsustainable but Wall Street provided the ammunition to make this bigger.

Issue #2 – Zero down payment

The idea of zero down should be offensive to your senses. How can you purchase the biggest item of your life with nothing down? For most of our home buying history in the U.S. a down payment was always needed. A down payment was your initiating passage into buying a home. It was a fire walk that we all had to go through. But Wall Street with 30 to 1 and at times 40 to 1 leverage, decided that average Americans should have this same kind of buying (i.e., gambling) power.

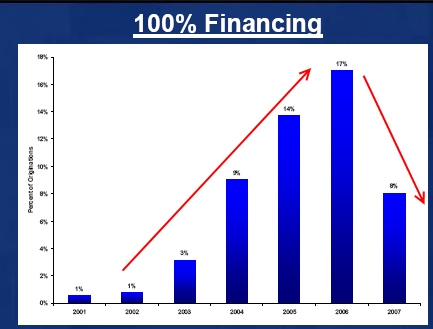

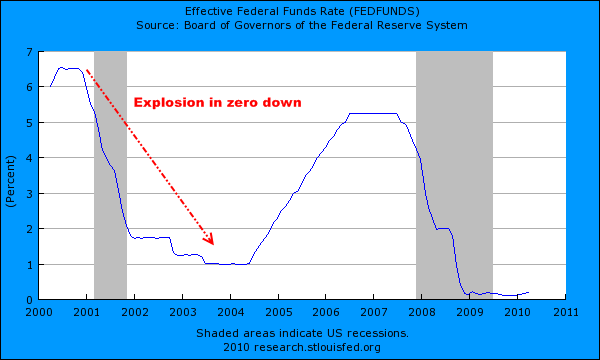

The first that I remember about zero down started in the 1980s infomercial circuit. Now this was usually a very tiny niche market where heavy marketing and self promotion allowed some people to create really creative deals that were nothing down. But this was not mainstream at all. It was a fringe idea relegated to the wee hours of the night. Yet starting in 2001, when Former Fed Chairman Alan Greenspan dropped the Fed funds rate to 1%, the fun all started.

As you can see from the above chart, zero down started spiking about a year after this rate drop. Wall Street did not waste any time pushing this out to market. The apex of zero down occurred in 2006 when a stunning 17% of all mortgage originations were zero down. If we look at the Federal Reserve data, we can see the spark that lit the fire:

The Fed tried to stop this mess in 2005 but their Frankenstein had already been born. Even if the Fed was pulling back Wall Street had no intention of stopping.

Issue #3 – De-centralizing loan origination

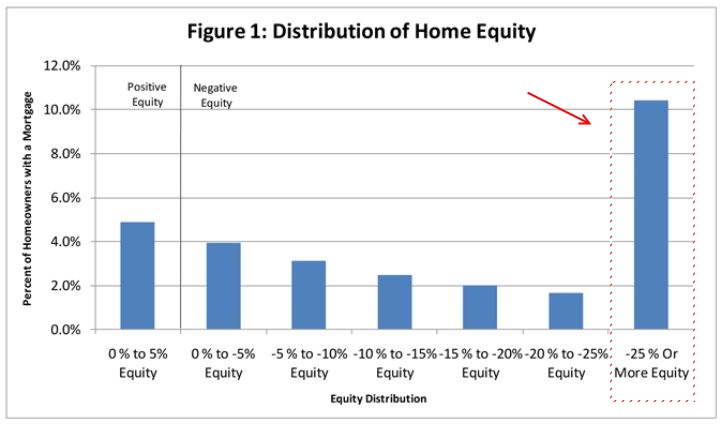

An old adage in real estate is location is everything. So how can a Bear Stearns investor in New York know anything about real estate in Kansas? Or about a shopping mall in Oklahoma? Another problem that occurred was the de-centralization of real estate lending. Banks, mortgage brokers, and a network of lenders were allowed to make loans in their immediate area without being responsible for the quality of the loans they were pushing out. This has now caused massive negative equity situations across the country:

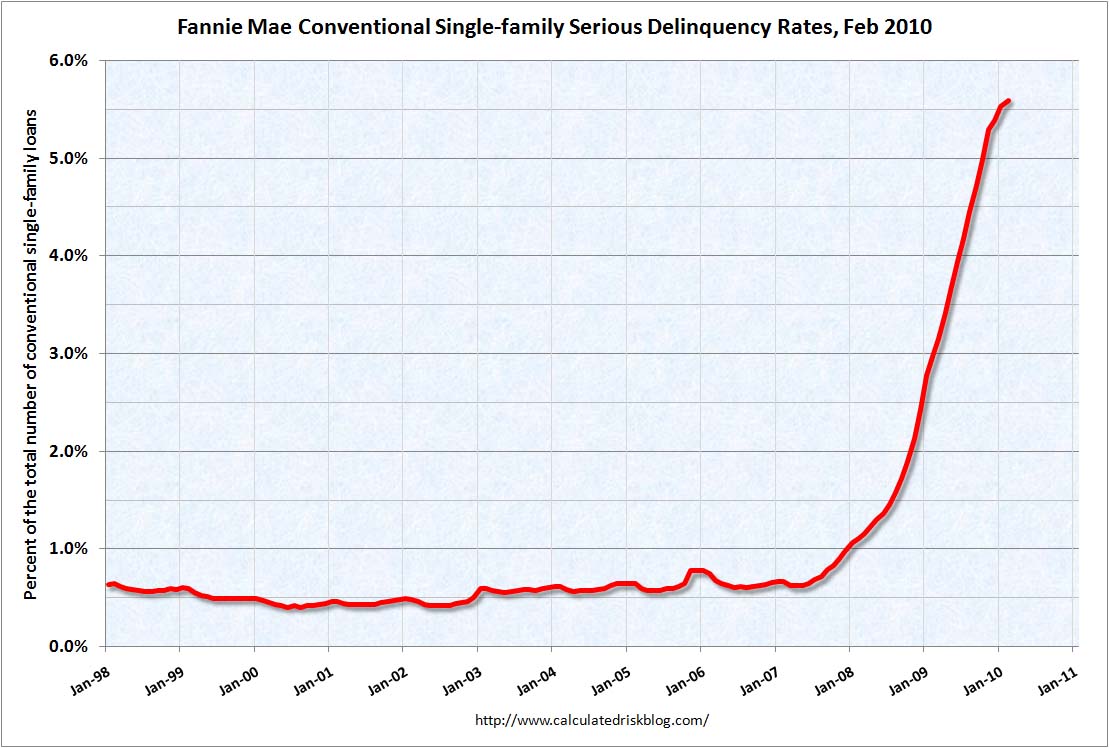

One third of all U.S. mortgages are now underwater. Why has this occurred? Again, removing down payments has taken away any buffer for price declines. A 60 Minutes piece discussed strategic defaults. Strategic defaults are a new phenomenon to this housing market. What happens here is you have a person who is financially able to pay their mortgage but chooses not to do it. In the past, you had a handful of “ruthless defaulters†but it was a tiny fraction. The current estimate is 1 out of every 5 foreclosures is strategic. So why is this now a problem?

When you have no skin in the game, it is easy to walk away. Just look at the option markets. People place bets all the time and the only risk they have is the premium they pay. If the option goes up in value, they sell or exercise and make money. If not like most options, they simply allow it to expire worthless. This is what happened with zero down and low down payment options. There is little incentive for buyers to keep making payments on a severely underwater loan. That should be obvious. But today with FHA insuring nearly 4 out of 10 loans they only require down payment of 3.5%. And with the tax credit that just expired, many were able to buy their home with zero down. The defaults as you would imagine are exploding even today:

Source:Â Calculated Risk

Problems keep growing in these markets and more money is being sunk into the government backed industries. 96.5 percent of all loans being made are government backed. Don’t you think that we should correct course with the above three items. What should we propose then?

-a. At least a 10% down payment from cash savings for future buyers

-b. Lenders are responsible for mortgages in their area. A structure for hybrid markets should be created. In other words, if a loan is good, both the government and the local lender share in the profits. If it is bad, then both will suffer (today only the government bails everything out).

-c. Break up the big Wall Street banks. Home lending contrary to what Wall Street wants you to believe is not that complicated. If incomes are verified and down payments are required, the market will find equilibrium quickly. This hasn’t occurred because Wall Street makes too much money by the current system. They need to go back to a split between investment and retail banking.

The above are merely three main issues to tackle if we want to correct course. Otherwise, we’ll be setting ourselves up for problems again in a few short months. In fact, some areas in California are already witnessing mini bubbles. Do we want to repeat this all over again?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

mdk said:

Limit the amount a person can spend to a % of their income which they have to prove.

May 13th, 2010 at 5:09 am -

CLARENCE SWINNEY said:

1980-1% OWNED 20% TOTAL FINANCIAL WEALTH

1989–36%

2007–43%

10%=70%

20%-93%=30,000,000

80%=120,000,000 workers=shaftingJobs? Heck We are too busy Gambling for Billions on our Casino tables. Roll dem dice.

Three conservatives got 99,000 net new jobs per month in their 20 years of Gambling Casino.

Durn tight wads Carter + Clinton got 222,000 per month over 12 years.Reagan + Bush + Conservatives–20 years Record-

1% get 60% Income Tax Cut

Wall Street Gamblers get 47% Tax Cut

Corporate get Loopholes by zillions

Pay 16% on 35% tax Rate.

Estate big big big Cut for Few Ultra Rich

Rich get Tax Cut with Revenue Sharing Income Tax being transferred to Middle Class Property Tax.Middle Class get da shaft–

biggest tax increase via Payroll Tax Increase

Tax on Social Security Checks

Five Cent Gas Tax

Revenue Sharing off rich Income Taxes now local, state and property taxes.REAGAN + BUSH CREATED A FINANICAL TSUNAMI AND LEFT OBAMA AN ERUPTING FINANCIAL VOLCANO

FACTS UNDENIABLE. POLICIES DID IT. It was Deja Vu of 1920s

Turn dem Gamblers loose– do not interfere they know best.

The 30 Million Rich got the Money the 120,000,000 workers got the Debt for Decades of belt tightening.

Will our grandchildren revolt?Unaffordable Housing-Unaffordable Health Insurance-Unaffordable High Education. ON AND ON AND ON

clarence swinney

old ugly mean honestMay 23rd, 2010 at 11:08 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!