How the Middle Class Slowly Evaporated in the Last 40 Years – Loss of Manufacturing, Bank Deregulation, Hyper Consumption, and Short-term Profit Seeking from Wall Street.

- 19 Comment

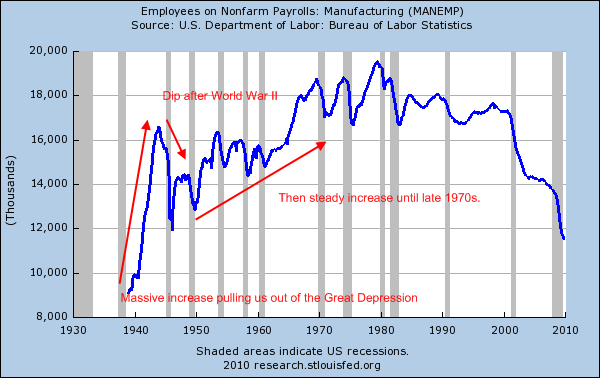

Some like to think that the middle class has always been a fixture of American society. In fact, the rise of a steady and strong middle class didn’t happen until after World War II. Clearly people can’t look at the economically painful Great Depression, which rampaged the nation from 1929 to 1939 as a good time for average Americans? In fact, even a few years after World War II the nation hit a few rough patches with price controls and millions of Americans rushing back into the workforce. But with many of the industrial economies in tatters in Europe and Asia, the U.S. had a well positioned spot for decades of strong growth. But make no mistake by looking at history that we were producing and manufacturing goods for the world. And things seemed to work out well for many Americans even with a robust manufacturing base.

The above chart is extremely telling. There are many reasons and explanations for the Great Depression but World War II clearly got our employment machine going. That is something that we are struggling with today. After all, even with the two wars going on today, much of the warfare doesn’t require heavy machinery like fleets of tanks. What use are thousands of tanks if someone with an improvised explosive can do just as much damage? So simply saying war is what will drag an economy into production is not necessarily true especially in the modern era.

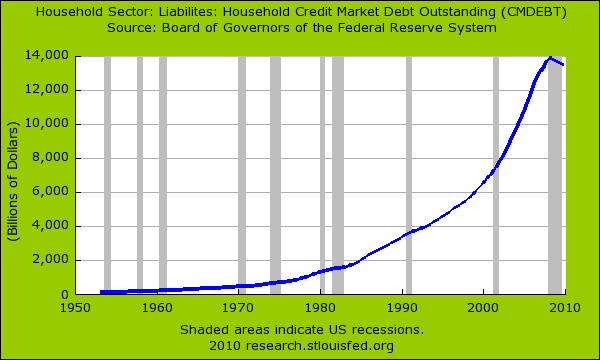

The middle class today has it very different from the same family in the 1950s. Back then, one blue collar income was enough for the purchase of a modest house, a car, and a bit of money for savings without going into massive amounts of debt. That is no longer the case. Even though in the last year debt loads have fallen (because of bankruptcy and millions of foreclosures) American households are still highly over leveraged with debt:

Here is some stunning data for comparison:

1953 Household Debt (mortgages, auto loans, etc):Â Â Â Â Â Â Â Â $106 billion

1953 GDP:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $379 billion

2010 Household Debt:Â Â $13.5 trillion

2009 GDP:Â Â Â Â Â Â Â Â Â Â $13.1 trillion

*Real US GDP (2000 Constant Dollars)

So we went from household debt being 27 percent of GDP to where we are today where household debt is nearly 100 percent of GDP. This is clearly unsupportable and as the chart above shows, we can expect more deleveraging in the years to come. As Stein’s Law will have it “if something cannot go on forever, it will stop.â€

Bank Deregulation (No Enforcement)

Since the 1970s, strong regulations that were in place to keep the banking industry in check have come off letting the wild hyena loose. Those that argue today that we have too much regulation are right but it is weak regulation in agencies that have no power (obviously since this decade was a Wall Street Wild West). Simple regulations like usury or even checking income before making a loan were all removed. So in 50 years, we went from very little debt and high levels of production to massive consumption fueled by easy money. But when things went bust the net was pulled for average Americans while Wall Street racked up trillions in taxpayer money.

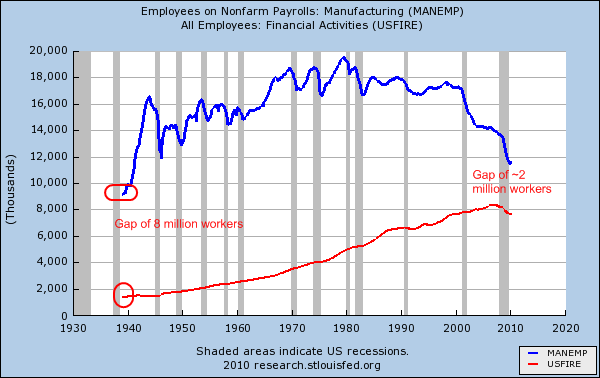

Since you need an army for this kind of fraud, this is what has happened over the decades:

As the manufacturing base slowly drifted away starting in the late 1970s the financial and real estate part of the employment equation exploded. With massive amounts of deregulation, capital flowed to any industry regardless of the long-term implications to the U.S. We are seeing some of those longer term trends now hitting us. At this point, it is like reversing the Queen Mary in the middle of the ocean. This is actually an important debate to have yet few are exploring this at least at the national level. Some use the price point argument. They argue that it is fantastic that we can get cheap goods from other countries. But they usually ignore the cost (see above). In an ideal world, there would be a balance between exports and imports for any country. These are usually your perfect case examples in economics. But right now, if we look at our trade deficit with China for example it is anything but balanced. Is it any wonder the U.S. Treasury walks on a fine line when discussing policies with China?

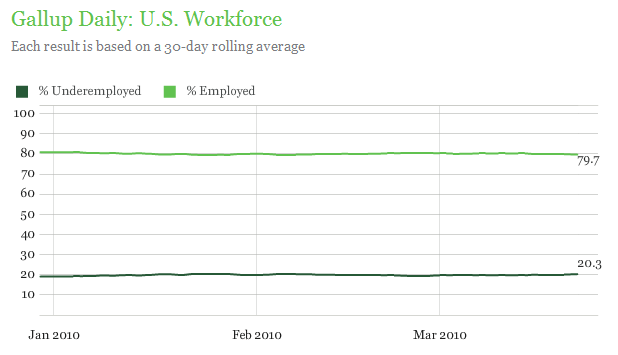

Many multi-national companies are doing well in this recession even though we have an underemployment rate of 20%:

If you would have asked someone if you could envision a 70 percent stock market rally while 20% of Americans were unemployed or underemployed people would have laughed. But that is the new structure we currently have with the corporatacracy running the system especially when it comes to financial reform.

The Short-Term Fix

Think of all the horrible short-term policies that have led us to this mess. What benefit did we get by offering zero down toxic adjustable rate no verification mortgages? The only benefit came from mortgage brokers getting $10,000, $15,000, and even $20,000 commissions by putting Americans into toxic financial time bombs. The other winner was Wall Street who then packaged this waste and sold it off to investors globally but also found its way into the funds of many American pensions and retirement accounts. How did this help our economy? What use did this serve? Or what about the billions in overdraft fees usually pushed on the poorest in our country? The notion that anything can go flies in the face of thousands of years of human history. Wall Street made trillions gambling and making money on short-term instruments that really did not improve the overall economy. In fact, they were parasites that have now created this deep financial mess we are in. And here we are with no serious financial reform over two years into the crisis.

One thing that really isn’t talked about is whether we want to protect the middle class. This is a legitimate debate we should be having and should be priority number one. So far, the banking angle has been that without the enormous bailouts, the middle class would have suffered. This was of course merely fear mongering to make sure the financial structure stayed in place. If we continue on this current path, a Japan like scenario in terms of part-time employment is possible. A population where a third of their workforce is employed part-time yet headline unemployment is at 4 or 5 percent. And this notion that we have no money is absurd because that hasn’t stopped Wall Street from getting $13 trillion in bailout funds. We may not have the money but somehow we were able to funnel that much there way while the middle class is feeling the pinch from every angle.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!19 Comments on this post

Trackbacks

-

Brendon Carr said:

You say the middle class has been destroyed over a period of time you define as “the last 40 years” — i.e., 1970 to 2010. If that’s the time period, one cannot help but note that starting just before 1970, the U.S. government became very active in trying to “fix” America through ever-increasing administrative and judicial intervention in all aspects of our economy and citizens’ personal lives.

Could it be that all the “help” from the government is what’s killing the middle class?

March 24th, 2010 at 12:13 am -

ghpacific said:

I’d like to see a chart correlating the rise of petroleum based products with the rise of the middle class. I’ll bet there is a strong correlation and Peak Oil will also spell Peak Middle Class. I drink your milkshake.

March 24th, 2010 at 9:02 am -

BK said:

The middle class must continue to shrink as global wage arbitrage dictates that we need to produce stuff in this country and working class wages are the only solution.

Global wage arbitrage will continue indefinitely.

Welcome to your world.

March 24th, 2010 at 9:11 am -

Iraqi Dinar Value said:

Brendon,

What help are you talking about? Our absence of universal health care? The thousands of dollars of aid we gave to mega banks to help them through this financial crisis while people lost their homes? Almost every policy over the past 40 years has been about taking money from the middle class and funneling it to the wealthy elite. If you are complaining about social security or medicare, don’t worry, the government ransacked those reserves years ago and left IOUs, so they will go belly up, and the baby boomers will have no health care or money to tide them over in their old age.

One thing I always hear about people when they talk about the housing crisis or debt is they rail about personal responsibility. Oh you lost your house? Why did you take out that huge mortgage. And I agree. If you behave foolishly financially, you should deal with the consequences. The problem is the wealthy elite in this country never do that. They behave foolishly and are rewarded with our tax money.

Interfering with our economic and personal lives, yes, but for their wealthy donors and fat cat friends. Until we realize that those in power only care about their own meal tickets and we have some kind of political upheaval we will continue to see the behaviors we have witnessed recently, and maybe we deserve it. Afterall, American Idol is on, who has time to make sure the banks don’t take over the government…

March 24th, 2010 at 10:45 am -

made in china said:

unless we can curb americans insatiable appetite for chinese crap, u better get used to seeing electrical engineers bagging groceries,computer programmers stocking shelves. anyone out there able to pay a mortgage working at wendys?

March 24th, 2010 at 2:03 pm -

JP Merzetti said:

Every chart that displays what’s happened to the average worker should be accompanied by a chart displaying what the financial “wizards” have siphoned off:

One of my favorite quotes (can’t remember the particular author)

Investment doesn’t create “wealth” anymore (as in research and development, factores, etc)…..instead, it intercepts it.I always imagined some Holden Caulfield character standing in the outfields of Wall Street, with some gigantic fielder’s mitt…..snagging popups of billion-dollar stuffed baseballs….

The basis of any economy is jobs.

March 24th, 2010 at 7:36 pm -

educated professional said:

I have a friend (in the USA) who makes working class wages, and this friend only has debt on a house that is not underwater (not even close.) This friend drives a nice, reliable car – the kind I see other professionals in my field driving. In other words, working class wages are not a bad thing unless you live beyond your means or live in a high cost of living area. This friend is older than me, so at this stage of life I would expect that financial picture.

I am a professional (in the USA) with a graduate level education. I have no debt whatsoever. I am living well within my means. Part of living without debt on my fairly decent income (well above the national average) means that I still do not have the money to buy expensive clothes, the most expensive cell phone with full data package, a new midsize sedan, meals out more than a couple times a week, or purchase a house (using 20% down and still having emergency savings available). If I do not have enough money to do those things, there is no way in HE double hockey sticks that any of my peers making my salary and surviving independently can “afford” all of these things.

Furthermore, I had a much larger head start than many of my peers (first part of gen y) because I went to an affordable state university (got a nice scholarship, worked to pay part of my other costs, lived really cheaply, got a lot of support from my parents, and got a small loan that I paid off within four years of getting my first job.)

So, I say all of that to give you some insight into a few of my opinions and observations.

1. It’s not a bad thing to be a part of the skilled working class. Sometimes I wish I had started with an associate’s degree instead of a bachelor’s. I think there might be a better return on money with selected associates degrees. The only part of the working class I definitely would not want to be in is the unskilled, manual labor category.

2. For generation y, the middle class is nonexistent right now. You either have lots of money or you are broke as a joke, and chances are it’s the latter. In between college costs, car costs and a lifetime of cultivated habits like going out to eat five times a week, most of my peers start their lives in massive debt servitude and this is pretty normal. It also shows that people my age are generally ignorant when it comes to managing personal finances. No surprise here as most of their parents also have crap for brains when it comes to financial matters. This brings me to my next point.

3. The government as administrated by the Baby Boomers plans on spending any wealth gen y might be able to earn in the future and baby boomers feel they are entitled to it. That pisses me off. What happened to setting an example and leaving an inheritance for the younger generation? I will do all I can to clean up the enormous mess that grew out of your greed and ignorance.

March 24th, 2010 at 7:45 pm -

educated professional said:

Also, one more note because I can picture people wondering why I can’t afford those items on a good salary. Part of the reason is that I’m saving for retirement. Yes, I hope to retire someday.

March 24th, 2010 at 8:07 pm -

ReaganMyth said:

Looks like the rate of decline begins in earnest after 1980. Hmmm, maybe Reagan didn’t save America. (Duh!)

March 25th, 2010 at 9:15 am -

KB said:

@educated professional: I completely agree with all your statements (I’m also an early member of Gen Y). I’ve seen many people my age go down the path of part-time jobs/lots of debt/struggling to make it while others get help from their parents to make up the income gap. Those lucky enough to have decent jobs and low/no debt don’t live lives of luxury (if they’re smart) so they can save for retirement and other major life events.

I’m fairly sure the middle class may entirely evaporate for our generation. You will either end up as a member of the low-upper class if you make enough money and have savings or a member of the upper/lower poor class if you don’t. IMHO this amounts to intentional or unintentional generational warfare.

While I can certainly appreciate the wake-up call some are getting about spending habits in this recession, I do not appreciate the lack of decent jobs (with or without a college education), wage stagnation, and price inflation.

I completely agree that we have to bring back skilled labor to this country. Not everyone can or should work in white-collar or information sector jobs. Some will not be happy there and others will most likely never have the skills needed to work in those types of jobs. I think our generation has been sold the assumption that we have to have a college education to get ANY decent job, which means we begin our early earning years already in the hole from student loans. There should be more options for true earning potential besides being forced on the college treadmill.

March 25th, 2010 at 9:53 am -

AndyC said:

Bretton Woods 2

“on August 15, 1971 the United States unilaterally terminated convertibility of the dollar to gold.”

When currencies were no longer backed by a hard asset and governments were able to print money with abandon that is when the trouble started.

You will see this same escalation in every chart you look at from around the world after 1971.

The worlds prosperity since 1971 has been built upon an ever increasing mountain of debt and it has basically been a phantom prosperity because you can only engage in this behavior for as long as you can make interest payments on that debt, we are fast approaching the point where interest on debts globally can no longer be serviced by the people and their governments.

Thats my take anyway

http://en.wikipedia.org/wiki/Bretton_Woods_system#Bretton_Woods_II

March 25th, 2010 at 10:33 am -

Also educated said:

From educated professional: “The government as administrated by the Baby Boomers plans on spending any wealth gen y might be able to earn in the future and baby boomers feel they are entitled to it. That pisses me off. What happened to setting an example and leaving an inheritance for the younger generation?”

Yes, I am one of the so-called Baby Boomers who are ripping off the next generation.

Sure.

I congratulate you for your foresight and abilities, but perhaps you need to view this from a different angle, and with a bit more compassion. My husband and I, both in our 50s now, have worked hard all our lives to earn a living — I was cleaning hotel rooms at 16. I worked my way through college and so did my husband, no handouts from daddy or the government. We both enjoyed full careers in our chosen fields — I in the newspaper industry and he in the airlines.

However, we won’t be retiring happily, or at all. Today, I’m lucky I still have a job in an industry that’s imploding; I have had my wages cut, who knows what’s next. He had the bad fortune to work for a company that went bankrupt, saw his wages slashed and pension totally evaporate. He’s now on disability because stress lead to physical problems including diabetes.

What retirement savings? Lots of my 401K money evaporated, so did his. We both had to use some of it to pay living expenses, but to no avail. (No dedicated pensions anymore, you know, it’s all 401K — invested in the stock market and hedge funds, of course, not much personal control there).

We did not overextend ourselves, nor take on unnecessary debt. I’m now working two part-time jobs (lucky to have them) in addition to my fulltime one. We’ve worked hard to provide for our children — one child is in community college because we can’t afford to send him anywhere else. He works, too. I hope we can at least get him through to some useful degree, perhaps in health care as that’s not going away. We’ve both wanted to leave a legacy of prosperity to them, but that’s not going to happen now.

My point is this: I don’t see where “our greed” did anything to you or anyone else. The “Boomers” I know did what we were suppose to do, grow up, get a degree or training, get a job, raise a family, invest in the future. We had the rug completely pulled out from under us at a time when we were supposed to be thinking of “our golden years” just ahead. You can’t make general statements that “Baby Boomers are greedy” anymore than I can say all “Gen Ys are ignorant and condescending.”

The way I see it, “greed” is the operative word, here. Many people of many generations in key decision making positions inside the financial world and in government had a hand in this mess, for their own benefit and no one else’s. Many decisions and reversals in banking laws and regulations which helped keep the middle class alive, decisions made years ago — a couple of administrations ago — have now borne bitter fruit. They made out like the bandits they are. They aren’t having their houses foreclosed on, like we have. If you want to blame someone, blame them, not those stuck in the middle.

Yes, I’m a “Boomer” and I’m angry, and so are a lot of others. We need to focus that anger on getting our massive problems fixed, not blaming it on one broad generational segment of the population, which, quite frankly, doesn’t deserve it.

March 25th, 2010 at 11:35 am -

Tristan said:

I’m so glad you brought up the fact that almost all our financial woes can be traced to Baby Boomer policies. Baby Boomer excess. Baby Boomer idealogical squabbling (i.e., utterly no bipartisanship). Just the sheer number of them expecting us (everybody who came after—I’m a Gen Xer myself) to support them into their old age. wtf? The math doesn’t just support that.

March 25th, 2010 at 6:26 pm -

Tristan said:

I’m so glad you brought up the fact that almost all our financial woes can be traced to Baby Boomer policies. Baby Boomer excess. Baby Boomer idealogical squabbling (i.e., utterly no bipartisanship). Just the sheer number of them expecting us (everybody who came after—I’m a Gen Xer myself) to support them into their old age. wtf? The math doesn’t just support the sheer outsized proportion of their masses.

March 25th, 2010 at 6:27 pm -

DaveInIowa said:

educated professional,

You just don’t get it and your ‘kind’ don’t and that is the problem.

The core of the middle class has always been the grunt front line factory worker. My Dad working a factory ‘unskilled’ job, bought a home, two cars, raised three boys and took vacations and saved money and wife(mom) did not work. With the exception of possibly an autoworker; find ONE production job that will allow that lifestyle.

The author makes that point very clearly, did you miss that?

The arguement that we all lived beyond our means is bunk. Yes, quite a few did; but the vast majority is in massive debt only trying to provide for our own. Just as previous generations did. We are doing with both hands tied behind our back.

The author used the word parasite to describe the ‘men’ that raped this country,that is too kind.

I read a quote once that makes it clear and extremely frightening:

Remember, these ‘capitalists’ truely believe that every dollar you own is rightfully theirs. They will do any and all neccesary to obtain it.March 26th, 2010 at 6:27 am -

DaveInIowa said:

BTW, educated professional,

good for you…really.

Just to further my case. I live in Iowa; very affordable living compared to the coasts.

I work food production for a MAJOR food conglomerate with billions in sales. Billions. I make 14.00/hr. Multiply that times 2080 full time hours.

Now, is that making a living?

30 years ago my dad made roughly the same.March 26th, 2010 at 6:37 am -

Credit Girl said:

Educated Professional- You make a few great points here and I’ll take the things you’ve said into consideration. The factor that stood out the most to me, however, was the fact that you are living within your means. Simply because you have a decent salary and an education does not make you entitled to the most luxurious cars or high-tech gadgets and I couldn’t agree more.

March 29th, 2010 at 1:44 pm -

JP Merzetti said:

Educated, professional and Otherwise:

– good points all.

Here’s an interesting question. In the heady days of American manufacturing glory (WW2 – 1970) when many Americans eschewed higher education for good factory work, was America any “dumber”?

I think not.

Was it healthier economically, and socially more homogenous? Arguably, yes – on the second point. The first is a no-brainer.I get the impression that a lot of people did not adjust themselves financially to changing conditions, and have lived as if the times were good (or about to get better.)

I still believe that the template set for debt culture runs from the top down. When governments operate on deficits, it normalizes the activity, and consumers think this is state sanctioned behavior.I think the fact of the matter is – if most people had lived within their means throughout this era, the buying and selling of many things wouldn’t have happened. They would have been unaffordable.

What impact would that have had on the economy?

(I’m speculating on a chronic recession perhaps spanning the last 3 decades.)

Of course, in a debt-based economy, you have to have growth in order to keep it healthy. It constantly has to expand, because that’s where the money comes from the pay back the interest on the principle.Living within one’s means is a sensible way to live. The current job market dictates retraction, plain and simple. There’s an awful lot of denial out there. We see the results.

April 2nd, 2010 at 5:49 am -

GenXer said:

Great article! I wish more knew the facts as stated here.

“Also educated” wrote this, “The “Boomers†I know did what we were suppose to do, grow up, get a degree or training, get a job, raise a family, invest in the future.”

As part of the younger generations, I must admit I’ve grown to see exactly this thinking as a problem. For generations we’ve been raised to do exactly what “Also educated” said. I had it beat into me all my younger years, but somehow I just never could handle that. I knew it would be all bad following the “normal” route. I started my own business at age 16, still tried college, but quit and I learned on my own. Biggest mistake I ever made was trying to “fit in” and work at a “job”.

It’s been a rocky road for about 10 years, but I am so much better positioned than the average American because I took a different road and didn’t buy into the “job” mentality, 401K’s and all that crap. I have hardly any debt, and a plethora of marketable skills learned through much trial, error, and long years of experience.

There is no such thing as job security, and what anyone gives you, they can take away. My father taught me that.

It is very sad, though, to see people who were honest, hardworking folks lose their dreams. It just isn’t right. This whole country needs to stop buying the BS.

Everyone should be self-employed!

April 2nd, 2010 at 8:33 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!