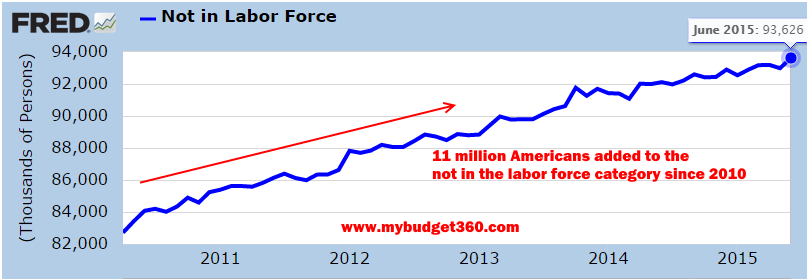

Non-working America soars by 640,000 in one month to new record of 93.6 million. Not in the labor force Americans up 11 million since 2010.

- 1 Comment

It is hard to believe that one out of every three Americans is financially supporting the other two-thirds. The unemployment rate appears much lower than it is because of the odd math behind the labor force. The latest unemployment rate of 5.3 percent sounds great until you realize that last month 640,000 Americans were plopped into the not in the labor force category. 223,000 jobs were added but 640,000 Americans dropped out of the labor force. Take the back of the napkin calculation that 10,000 Americans a day are hitting retirement age (that is roughly 300,000 per month). Assuming all of these older Americans had the means to retire (not likely according to older Americans working) this means 340,000 Americans of working age fell out of the workforce for other reasons than age. Something is going on behind the headline figures and it seems like more people are waking up to the funny math when it comes to employment.

11 million Americans join the not in the labor force category

Even accounting for demographic changes, the not in the labor force category has grown much faster than anticipated. Since 2010 we have seen this category grow by 11 million people. If you are keeping track, the economic recovery started in the summer of 2009, six years ago. So is this really a jobless recovery? Not necessarily but we are certainly not adding enough jobs to keep up with population growth. Most of the jobs we are adding are in the form of low-wage labor jobs.

Just look at how quick the not in the labor force category has grown:

Last month alone we added a whopping 640,000 to this category, nearly three times the amount of jobs added. As more Americans are relying on Social Security as their primary source of retirement income, we need to keep the tax dollars flowing. Yet you have a younger and less affluent population. This is going to put larger strains on the Americans that are actually employed in the labor force.

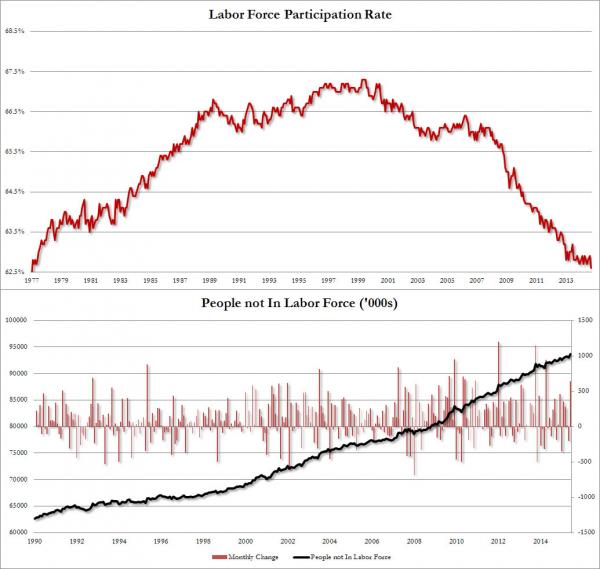

This is also a reason why our participation rate in the employment sector is near generational lows:

The last time the labor force participation rate was this low was back in the late 1970s. Why is this problematic? It would be one thing if all of these people were retirees with planned out portfolios and large nest eggs. Sadly, most are broke and fully relying on Social Security. Many others are on the new retirement plan of working until they die. So much for the financial planning propaganda of long walks on the beach and sipping margaritas until the old ticker gives out.

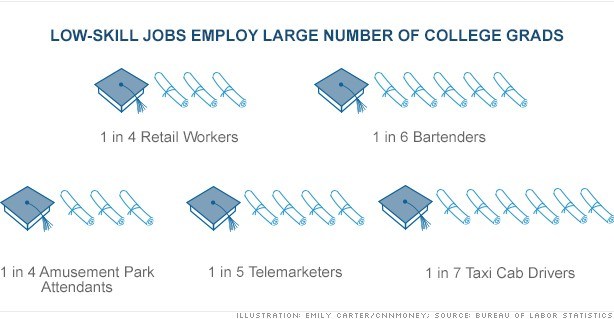

What we have right now is a case of demographic headwinds and a debt fueled economy. Every large purchase now needs to be financed with debt. Student debt is now at a jaw dropping $1.3 trillion. Most jobs that pay a decent living wage require some form of college education. Yet many people choose degrees that have little demand in the marketplace. That is how you end up with well educated and low paid workers:

“1 out of 4 retail and amusement park workers have a college degree. 1 in 6 bartenders has a college degree. And you wonder why so many Americans are having a tough time paying back their college debt. Of course this is for people that are working. Many young Americans are working part-time or not working at all in our massive “not in the labor force†category that is ignored.â€

This is becoming a larger problem for the economy and will likely show up in the 2016 election campaigns. 93.6 million Americans that can work are not working for one reason or another and old age can’t explain all of it away.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Mikki Scott said:

The working sector has reached a tipping point where between inflation and taxes a low income family is better off making less or not working at all and getting government freebies than they are working. Most families receiving assistance still have cell phones, cable TV and many of them can afford more that the working poor.

Who wants to slave away at two or more jobs for the rest of their lives just to keep their heads above water. That’s if you can find a job. I work ten hours a day in a factory. The work is really hard and fast yet they expect you to stay how ever long it takes to get the days orders done. I’m 56 and my body is starting to hurt bad in places. If I make it to 65 I’m going to retire and collect the Social Security that I earned. I don’t need to sip Margaritas on the beach or travel the country. My simple paid off home is the only place I want to be. That and not having to work like a third world slave.

Yes, the American economy is broke along with many other country’s economies. The world can’t keep growing, consuming, and going into debt indefinitely. We have reach the point where the working stiffs are tapped out and there are too many people on the dole. Not to mention America’s corrupt government and banking system are trying to loot every last penny they can from the system before it crashes. This won’t end well for the majority of humanity.

July 5th, 2015 at 5:00 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â