92.4 million Americans not in the labor force: The continuing trend of one-third of Americans supporting the other two-thirds.

- 0 Comments

92.4 million Americans are considered to be “not in the labor force†officially. This number is incredibly high and is a large factor for the drop in the employment participation rate. While many older Americans are winging it when it comes to retirement, one-third of the private workforce is supporting two-thirds of the population. Part of the reason we have so many Americans in the not in the labor force category is partly due to the aging of the country but that only accounts for one portion of the change. A large portion also comes from the unusual jumps in the disability category, a large number going back to high cost college, and many simply dropping out of the market completely. The rate of increase in each of these categories is growing much faster than the rate of growth in the population suggesting something else is going on. The unemployment rate on the surface looks to be much healthier than it is because you are removing millions of Americans from being counted.

Supporting the rest

This isn’t a political statement but a simple math issue. You have one-third of Americans supporting the other two-thirds. This is the highest percentage we have seen in this country. It would have seemed impossible to see 100 million Americans being part of the not in the labor force category but the trend is heading there. Back in 2009 alone we had 82 million Americans not in the labor force. In the span of five years we have added 10 million. So should the trend continue, we will hit 100 million by 2020.

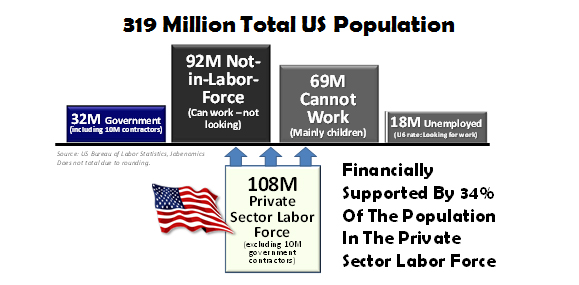

Take a look at the numbers:

Source:Â Jobenomics, BLS

You have 108 million private sector workers out of 319 in the US population. Many of course can’t work because of health reasons or are children. That is obvious. But the rise of these 10 million in the last five years is coming from other categories that speak to a weak underlying economy. These are people that in any other decade would have been working. Sure, there are job openings but many simply do not have the skills for those positions. Also, you have a massive number of new jobs coming in the form of low wage labor.

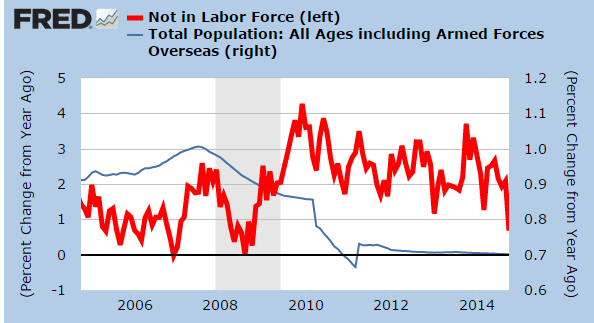

If you look at the growth of the population versus the growth of those not in the labor force you can see the divergence:

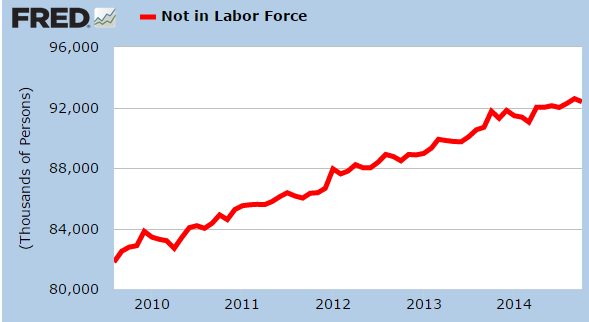

Part of it has to do with the aging of the country but that only accounts for one part of it. The number being added to this category has gone in one straight line even though we are supposed to be in a dramatic recovery that has created a new record in the stock market:

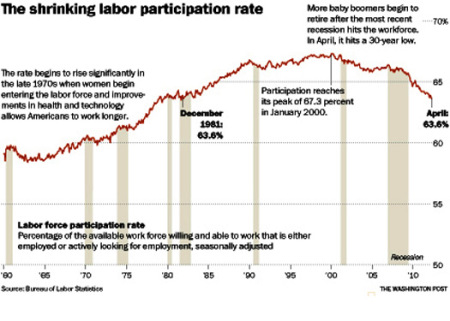

Yet we have fewer people as a percent of the population working. This is a new record for the current generation. Inflation is also hitting while wages are stagnant. So many Americans are seeing a slow erosion to their purchasing power. Take a look at the participation rate:

What does this mean? It simply means more deficit spending and more pressure being put on the backs of those working. With millions of Americans using Social Security as their default pension plan, there will be more focus on making sure this is fully funded. Medicare costs are skyrocketing in conjunction with the cost of healthcare overall. All of these things are interconnected and the rise in the stock market is largely driven by lower wages, slashing benefits, and profits being largely trickled up to a few people. Unfortunately the large majority are not benefitting although lower oil prices will help somewhat. Yet this is a drop in the bucket when you have 92.4 million Americans flat out absent from the labor force.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â