A new record yet again: 95,385,000 Americans not in labor force. The army of non-working Americans continues to grow.

- 5 Comment

We continue to live in a country with two very different stories to tell. In one of the stories, we have a country with a very low unemployment rate and a record in the stock market. In the other story we live in a place where 95,385,000 Americans are not in the labor force. This new record was reached in the latest set of data released by the Bureau of Labor and Statistics (BLS). This is a bigger issue than most would like to admit. Many older Americans are drawing substantially from the government and we now have a younger American population working in low wage positions. This is a new record that isn’t something to be proud about.

Another record of those not in the labor force

The number of Americans not in the labor force is troubling when you dig deep into the data. Part of this is being governed by Americans retiring but millions of these people are falling into this category for harder to characterize reasons.

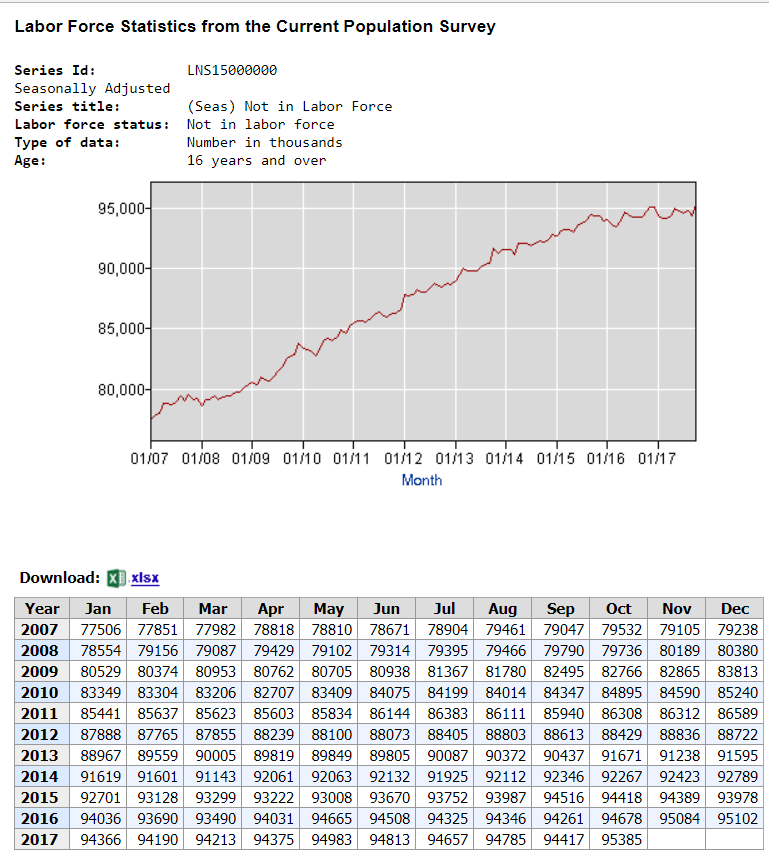

Take a look at the chart:

Source:Â BLS

What is worth noting first is that since 2007 the number of Americans not in the labor force has increased by a stunning 17.8 million. This is an incredible number and most of this increase occurred during a time that we were supposedly in a recovery. This data coincides with the reality that many Americans are too broke to afford a home to purchase.

It is important to have an accurate assessment of those not in the labor force because you can game the unemployment rate by taking those people out. Take a look at this chart:

Now of course it makes sense that we take those out that are retired by their own free will but what about those being forced into retirement to cash in on Social Security since their earnings are so low and they need other income? Most of the elderly depend on Social Security as their primary source of income. Many are now operating under a new retirement model called working until you die. So having an incredibly low unemployment rate with a record number of Americans not in the labor force does call for some deeper scrutiny of the numbers.

We are living in a largely rentier system where productive members of the economy are being squeezed out. The large financial sector is capturing more money from activity that is largely detached from creating new value. This system of siphoning off money is causing some deep problems and has contributed to destroying the American middle class.

In an era of fake news and fake stats, it is important to look beyond the superficial headlines. The vast majority of people simply see the low unemployment rate and assume all is great. Is it great? We are near a generational low in terms of the homeownership rate since Americans can no longer afford homes at current prices. Why? Because inflation is real and the standard of living has been hammered by the debt producing system we operate in.

Pay no attention to the record 95 million Americans that are no longer in the labor force.

![]() If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

5 Comments on this post

Trackbacks

-

Tom said:

How many of those 95 million are like me, who quit working and took up voluntary simplicity lifestyles because it was no longer worth contributing to the police state we live in? I would love to still be contributing to my country’s wealth creation, but not when the taxes go for bombs abroad and constitutional violations at home.

November 11th, 2017 at 12:24 pm -

Rachel said:

When I hear about the low unemployment rates in the media, I know that it’s nothing but lies. The classified sections of newspapers are basically non-existent, jobs posted online appear to be employers wanting to do anything but hire, maybe meet some government criteria or get a pool of fallbacks if current employees quit or are fired. Very large numbers of people who want to work cannot find anything even remotely suited to their skills and abilities or pay needs. It’s a fairly dire situation for large numbers of Americans that will only continue for the foreseeable future. No one and no group is going to do anything that will make a real and sweeping change.

November 12th, 2017 at 3:29 pm -

DearSX said:

I wonder how many of those folks are over 50. The economy is good to certain skilled people right now, but it is scary to think about how that could change too.

November 16th, 2017 at 11:38 am -

Dowless said:

Its all going the way of the tobacco program. The tobacco program is hiring at only 20% of what it was in the 1970s, that equates to a 90% unemployment rate in our own time. The reasons? Outsourcing of production, in sourcing of processed product, and new technology. These same identical forces are affecting everything else in the system, as far as employment opportunity is concerned. I predict the same unemployment figures for every area…70 to 90%. Why doesn’t the government reduce regulations on individuals using their own wealth producing resources to generate goods and services that can be used by the fellow Americans, giving their fellow Americans opportunity? The banks and the corporations want to collectivize/socialise/ communize the system, so that they can own the entire resource base and make complete slaves out of the population base.

December 20th, 2017 at 6:18 pm -

Manny said:

Those numbers from the Labor dept. exclude anyone in the Armed services & retired.

So 40 million retired + 1.5 million in the armed services need to subtracted from the 95,385,000 to get the true number.

January 4th, 2018 at 5:46 am