Record 93 million Americans now not in the labor force: The non-working American recovery added 451,000 to the not in the labor force category in December alone.

- 0 Comments

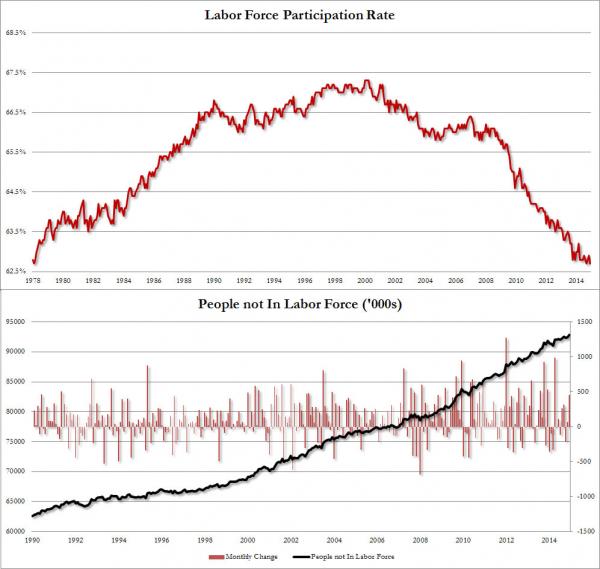

The employment report came out today and what you would take as good news sent the market moving lower. Why? A large number of the jobs added were in retail and food services. The growth in low wage employment caused the overall wage level to dip. But what was more telling and what continues to be ignored by the press is that we now have nearly 93 million Americans in the “not in the labor force†category. In December alone this category surged by 451,000. The market turned sour on a variety of fronts but the labor force participation rate also took a tumble. The spin is that we have many people hitting retirement age and many are going into the sun with large nest eggs. But the reality is, most older Americans are relying on Social Security to keep them one step away from poverty. We just hit a new record for those not in the labor force.

The not in the labor force category

Adding 451,000 people to the not in the labor force category is dramatic. The surge easily sent the total figure into record territory (to be exact, 92.9 million Americans are not in the labor force but given the current rate, we’re probably already at 93 million once we factor in January data). The jump continues to happen in this low wage recovery.

Take a look at this data:

This is not a good trend. The labor force participation rate is now at a generational low. Sure the media spin can discuss the low unemployment rate but the reality is, many Americans are hurting badly even though the stock market continues to flirt with an all-time peak.

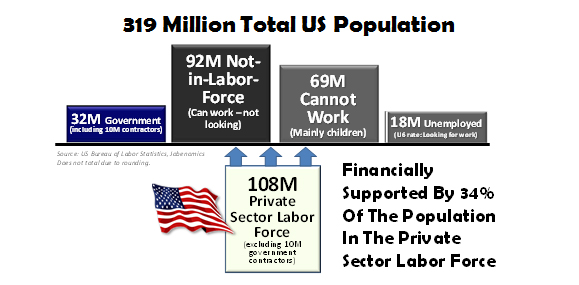

One figure that warrants repeating is that one-third of Americans are supporting two-thirds of Americans:

Those in the private workforce are basically keeping things rolling for the rest. Now in this category of non-workers you have retirees and children but a big number is coming from people that should be working if this was truly some broad based recovery.

93 million is a massive number. The fact that we added close to half-a-million in one month should be very telling. I’m sure you will hear very little about this since the media seems pleased on ignoring this figure. Obviously those with no work and income are not really worth the time in targeting ads.

This data is readily available from governmental sources. So why is this story underreported? I think one of the main reasons is that the narrative of “older people retiring†fits conveniently into this trend. Yet when we look at the actual breakdown, we find a substantial growth of those not in the labor force is coming outside of those retiring. Yet the current groupthink is around the idea that we simply have all these old people entering retirement with loads of cash. That is absolutely not true. Social Security is the main source of income for those entering retirement and a recent analysis found that without Social Security, half of retirees would be on the streets in poverty.

We’ve set another record for those not in the labor force. The growth in this figure nearly doubled the number of jobs added in December. With a good portion of jobs being added in retail and food services, many of those working are merely getting enough to get by. And many have simply dropped out of the labor force.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â